Bristol Myers Squibb (NYSE: BMY) pays investors an attractive dividend, which yields an incredibly high rate of 5.5%. That is almost four times the S&P500 average 1.4%. At such a high rate, an investment of about $18,200 would be enough to generate $1,000 in annual dividends from the stock.

However, as is the case with many high-yield stocks, Bristol Myers’ dividend comes with some risk. The company’s growth has been a concern for investors, and lately its financial results haven’t been great. Below I will look at the safety of the dividend and whether investors can rely on it.

The company recently posted a big loss

On April 25, Bristol Myers announced its most recent quarterly results. While revenue was decent (the healthcare company’s revenue grew 5% year over year to $11.9 billion), operating income was problematic.

The company suffered a loss that looked a lot like its revenue, except it was negative. Bristol Myers’ loss was $11.9 billion and was primarily the result of acquired ongoing research and development costs resulting from the acquisition of Karuna Therapeutics and a collaboration with SystImmune.

But even excluding these one-time costs, the company’s pre-tax profits would still have been $1.4 billion – significantly less than $2.8 billion a year ago. Rising costs and minimal growth pose a problem for Bristol Myers, as many of the drugmaker’s top drugs, including Eliquis, Revlimid and Opdivo, are likely to see revenues decline due to increasing competition.

Does Bristol Myers generate enough profit to support its dividend?

Bristol Myers currently pays $0.60 per share in quarterly dividends. To comfortably support the payout, it would need to generate earnings per share (EPS) above $2.40. This year, the company expects diluted earnings per share to be around $0.40 to $0.70. But without the impact of recent acquisitions, earnings per share would have been much higher – at least $7.10.

Acquisitions can often hinder a company’s results, but they are not persistent long-term problems. So Bristol Myers’ low expectations may not be all that alarming. In the long term, acquisitions of healthcare companies can strengthen growth prospects and ultimately strengthen financial positions.

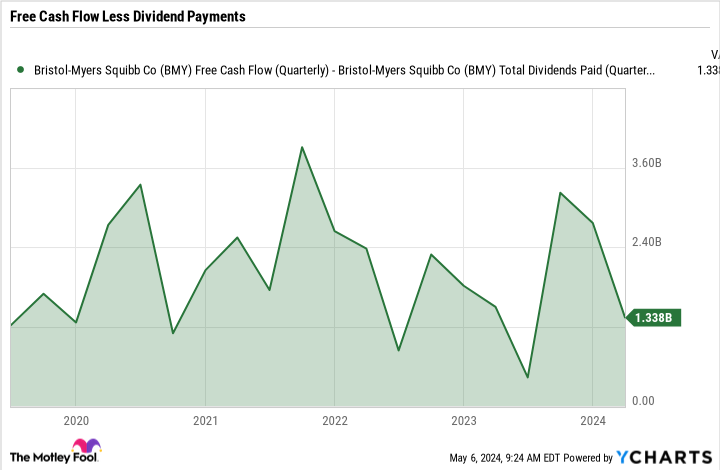

Another way to assess the safety of the dividend is to look at the company’s free cash flow (FCF). Last quarter, Bristol Myers paid out $1.2 billion in cash dividends. Free cash flow during that period totaled $2.6 billion, leaving room for the company to not only pay its dividend but also invest in its growth and its long-term debt, which totals just under $50 billion dollar amounts to be paid off.

The company hasn’t had any trouble generating enough free cash recently to support its dividend. The next chart shows quarterly free cash flow minus dividend payments, which often exceeded $1 billion.

Should you invest in Bristol Myers stock?

Bristol Myers’ dividend appears safe, despite what may have seemed like a troubling first-quarter result. Investors should not expect a dividend cut in the near future.

In the long term there is a bit more risk. The company’s debt load could be a concern as it is a price Bristol Myers must pay to strengthen its pipeline and asset portfolio. Depending on how well the company can grow its business and pay down its debt in the future, I wouldn’t rule out the possibility that the company could reduce its payouts to improve its balance sheet. But right now it’s probably not at that stage.

Bristol Myers can be a good dividend stock to own, provided you’re okay with taking some risk. The stock is trading at multi-year lows and could prove to be a bargain.

Should you invest $1,000 in Bristol Myers Squibb now?

Before you buy shares in Bristol Myers Squibb, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Bristol Myers Squibb wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 6, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool holds and recommends Bristol Myers Squibb. The Motley Fool has a disclosure policy.

Is Bristol Myers’ dividend in danger? was originally published by The Motley Fool