Shares of CFS health (NYSE: CVS) have fallen sharply this month after investors were unimpressed by the healthcare giant’s latest earnings figures. The sell-off has been so extreme that not only is CVS trading near its 52-week low, but its shares are now at levels they haven’t been since 2020. It appears that the stock is trading at a large discount, and with the large drop in the stock the dividend now yields 4.8%, which is much higher than normal.

Is the sell-off justified and is CVS Health in trouble? Or is this an overreaction by the markets and have healthcare stocks become an incredible bargain?

Major disappointment with earnings after the recent decline

On May 1, CVS Health reported first-quarter earnings results. Things looked good on the top line, with CVS reporting revenue of $88.4 million for the three-month period ending March 31. That represented an annual increase of 4%.

The bigger problems were rising costs. Not only were insurance costs higher than expected, but profits were also disappointing and expectations for the year were lowered. Collectively, these factors gave bearish investors plenty of reason to sell the stock.

One key metric of concern was the medical payout ratio, which tells investors how much a company pays out in medical claims versus the premiums it collects. The higher the ratio, the higher the share of costs, meaning the operations were less profitable. For CVS’s health insurance business, the ratio was 90.4%, compared to 84.6% a year ago. The company attributed this increase to increased Medicare utilization over the period, an additional day in 2024, and a decline in Medicare Advantage star ratings.

Then there was the problem of CFS guidance. The company previously forecast diluted earnings per share (EPS) to be $7.06 or higher. Now, however, the company has adjusted that to $5.64. CVS says this is based on the assumption that “utilization pressure” in the healthcare industry will continue throughout the year.

CVS stock is cheap, but is it a value trap?

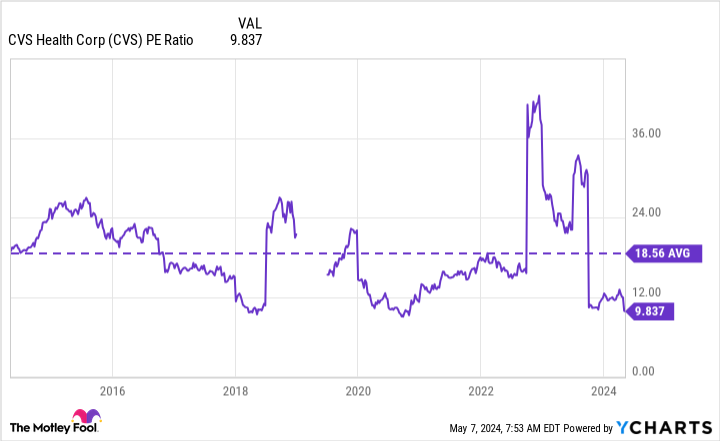

CVS shares trade at less than 10 times the company’s earnings. And that’s well below the average for stocks over the past decade.

At first glance, the stock looks like a deal. Another positive is that while CVS has lowered its expectations for 2024, the dividend should still be safe. CVS will pay its shareholders $2.66 in dividends over the course of a full year, which is still well below the $5.64 in EPS (or higher) the company expects to earn this year.

This is not an unusual area in healthcare. Earlier this year, health insurer shares United Health fell as it also faced rising medical costs. CVS is in a similar situation today, with investors spooked by big increases in costs.

But occupancy rates can change, and while the company’s medical payout ratio was high this quarter, that doesn’t mean it can decline and improve over time. Investors may have been a bit callous in dumping an already cheap stock in CVS. But there are often disappointing quarterly performances And a sharp downward revision of the guidelines could be a recipe for disaster.

Should you invest in CVS Health today?

I don’t think CVS Health stock is a value trap. The company simply appears to have underestimated occupancy rates and costs. There is nothing fundamentally wrong with the company that would indicate that investors are taking significant risks by purchasing CVS stock.

While it’s a bit of a contrarian choice right now given all the bearish trends, I think CVS has the potential to be an undervalued buy in the long run. The stock’s low valuation gives investors a healthy margin of safety if things don’t go as planned and CVS takes longer to turn things around and improve margins. But with a broad and growing healthcare industry, CVS is still a good long-term investment.

It will take some patience, but I’m confident this is a stock that can generate great returns for investors given the low levels it’s trading at today.

Should You Invest $1,000 in CVS Health Now?

Before you buy shares in CVS Health, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and CVS Health wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 6, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends CVS Health and UnitedHealth Group. The Motley Fool has a disclosure policy.

Is CVS Health Stock a Buy After Falling to a Multi-Year Low? was originally published by The Motley Fool