The S&P 500 index yields a meager 1.2% today. The average utility, using Utilities Select SPDR ETF as a proxy, yields 3%. Dominion Energy‘S (NYSE: D) dividend yield is a much more robust 4.7%. That will likely catch the attention of most income-oriented investors. But before you jump on board, you’ll want to understand a few caveats that come with owning Dominion Energy.

What does Dominion Energy do?

Dominion Energy is a fairly simply regulated electric utility today, but it wasn’t always that way. At one point, it owned oil and natural gas production assets, pipelines, and natural gas utilities. The company has spent the last few decades downsizing its business to become simpler and less risky.

The most recent change came in 2023, when the company announced plans to sell three regulated natural gas utilities to Enbridge (NYSE: ENB)The last of the three sales is likely to close in the third quarter of 2024. After that, Dominion expects to grow earnings at a strong 5% to 7% rate through 2029. That’s an attractive growth rate for a utility. The growth will be driven by a $43 billion capital investment plan that notably includes a massive offshore wind development project.

If you’re an income investor looking for a high-yield utility to add to your portfolio, Dominion Energy is definitely worth a closer look. But there are a few additional things to consider before you buy.

Dominion is not the best dividend stock

Before Dominion decided to sell the utility’s natural gas business, it agreed to sell its pipeline business to Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in 2020. That was a very large sale, which significantly reduced the company’s cash flow and forced a dividend cut. After that cut, management said it would resume dividend growth, which it did for a year. And then Dominion announced it was reviewing its business with the intent to overhaul it — again.

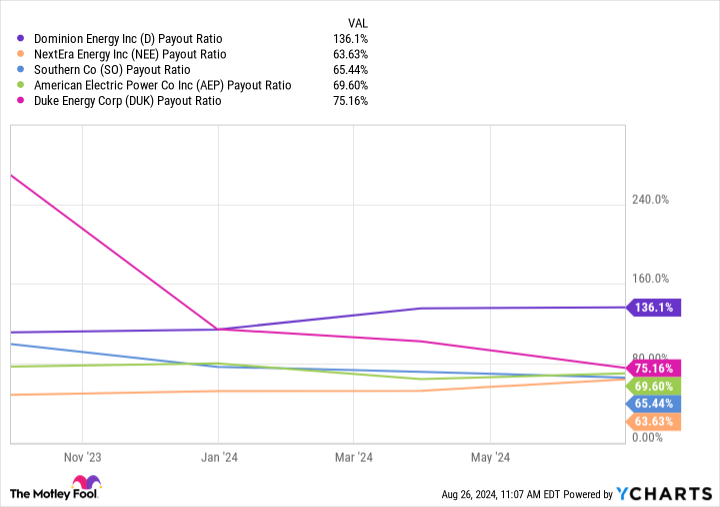

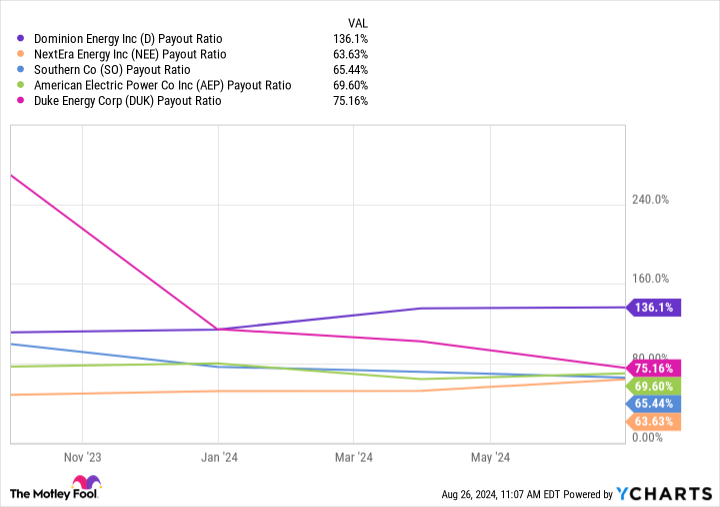

Management has repeatedly stated that the current dividend is safe, but now that the review is complete — which included the sale of the natural gas utility business, among other things — the company is focused on reducing debt and improving its payout ratio. In other words, until Dominion’s balance sheet is stronger and its payout ratio is in line with its peers, there will be no dividend increases here.

It could take a few years for dividend growth to pick up again, and it should be noted that the payout ratio will likely have to dip below 70% before a dividend increase is considered. So buying now will give you a higher yield, but you won’t see dividend growth. If you don’t like that tradeoff, you won’t want to own Dominion Energy until dividend growth picks up again.

All in all, Dominion is something of a special-situation investment. It’s not really a turnaround, as the company is actually doing quite well and has an exciting business future. It operates in one of the most desirable data center locations in the world. But the corporate overhaul is still a real issue to consider, as it puts the company behind its peers in a way that will scare off many dividend-focused investors.

Dominion is for contrarians with a long investment horizon

If you’re looking at Dominion for its above-average dividend yield, make sure you understand what comes with that yield — namely, continued corporate overhaul and a lack of dividend growth. That’s not going to be acceptable to many dividend investors, and understandably so.

But if you think decades from now, Dominion might still be a good option, especially if you’re in a position to reinvest dividends now. Assuming the company successfully lowers its payout ratio, by the time you want to use the dividend to pay for your living expenses, the dividend could be growing again. And you’ll have compounded that hefty return in the meantime, significantly increasing your position in the stock.

Should You Invest $1,000 in Dominion Energy Now?

Before you buy Dominion Energy stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Dominion Energy wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $792,725!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Reuben Gregg Brewer has positions in Dominion Energy and Enbridge. The Motley Fool has positions in and recommends Berkshire Hathaway and Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Is Dominion Energy the Best High Yield Dividend Stock for You? was originally published by The Motley Fool