Can you become a millionaire by investing? Energy transfer (NYSE:ET) stock? Absolute. Over the long term, stocks have proven to be a great investment. And given the company’s unique asset base, this performance is likely to be repeated in the coming years.

There’s just one catch: If you don’t invest in this stock in some way, you may lose your chance to reach the $1 million mark.

One way Energy Transfer stock can make you a millionaire

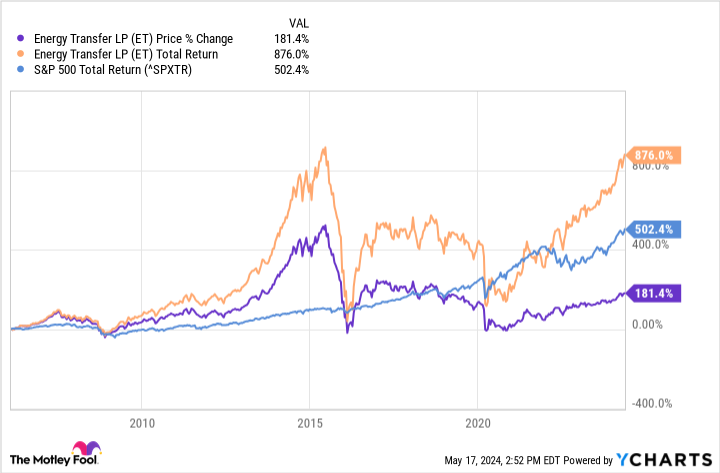

Since 2006, Energy Transfer’s share price has risen only 187%. The S&P500meanwhile delivered a total return of 489%. On the surface, Energy Transfer has not proven to be a great long-term investment. But that’s why it’s crucial to look at a stock’s total return, not just its share price movement. Total return takes into account actions that can affect shareholder profits (such as dividends and spin-offs), but are not necessarily accurately reflected in the stock price.

Energy Transfer, for its part, has been a prolific dividend payer. The current dividend yield is around 8%. These large dividends are not included in the stock price movement. In fact, they tend to depress the share price given the reduction in cash on the balance sheet.

When dividends are included in Energy Transfer’s total returns, shares have returned 882% to shareholders since 2006. That’s almost double the total return of the S&P 500 over that period. These types of returns can help ordinary investors become millionaires. It would still take decades of consistent saving, but by investing in these types of stocks you can earn returns that turn a few thousand dollars a year into a sizable retirement nest egg. Don’t forget to keep and reinvest your dividends.

The only remaining question is: will Energy Transfer stock remain a winner in the long term?

Can you still rely on Energy Transfer shares?

Energy Transfer stock has proven its ability to generate long-term returns that can make you a millionaire. But are Energy Transfer shares still a good option today? Absolute. That’s because this company has a sustainable, structural advantage when it comes to generating profits.

At its core, Energy Transfer is considered a midstream energy company. This means that it is not involved in the production of fossil fuels, but in their transportation, refining and storage. About 90% of the company’s revenues are fee-based, meaning it makes money based on the volume of services provided, rather than the underlying price of the fossil fuel in question. The facilities are expensive to build and difficult to replicate. And because it provides necessary services to oil and gas producers in a way that insulates the company from commodity price fluctuations, Energy Transfer can pay a reliable dividend to shareholders.

Please note that Energy Transfer is not completely isolated from the commodity markets. In 2020, it was forced to cut its dividend due to pandemic uncertainty. However, this reduction proved conservative and about a year later the payout returned to its previous level.

“Overall,” concludes Fool writer Geoffrey Seiler, “Energy Transfer is well positioned to perform stably across commodity cycles as it is involved in primarily fee-based businesses that are diversified across product types.” And because the company’s infrastructure spans more than twenty U.S. states, Energy Transfer also has the unique ability to capitalize on price differentials in local and regional markets.

Because Energy Transfer is completely dependent on long-term demand for fossil fuels, it is important to include this stock in a broad basket of investments, diversified across other sectors and end markets. But if you want to build a portfolio that can generate significant recurring income over the long term, Energy Transfer shares remain a good choice.

Please note that this requires its own long-term investment plan. These types of stocks require consistent savings over long periods of time to produce the magic of compound interest.

Do you now have to invest € 1,000 in energy transfer?

Consider the following before purchasing shares in Energy Transfer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Energy Transfer Stock a Millionaire Maker? was originally published by The Motley Fool