Energy transfer (NYSE:ET) has a lofty distribution yield of around 8%, which will likely sound quite attractive to most dividend-oriented investors. But don’t jump in yet. You’re probably better off with Partners for business products (NYSE:EPD) and the still very attractive return of 7.2%. Here’s what you need to know.

Energy Transfer and Enterprise have similar businesses

Both Energy Transfer and Enterprise Products Partners are active in the mid-segment of the broader energy sector. Each of these master limited partnerships (MLPs) owns the essential physical assets – such as pipelines, storage and transportation – that help move oil and natural gas from where they are drilled to where they are used. Midstream assets tend to be very reliable money generators.

Essentially, the energy sector would not function without the resources that connect energy producers (the upstream) with the consumers of the raw materials produced (the downstream). Midstream companies generally charge fees for the use of the assets they own, with energy demand outweighing the price of the raw materials flowing through their midstream systems. Even when oil prices are low, oil demand generally remains fairly robust because access to energy and a country’s financial prosperity go hand in hand.

So from an overall perspective, Energy Transfer and Enterprise are very similar companies. But these two MLPs haven’t rewarded investors the same way.

Who else can you count on?

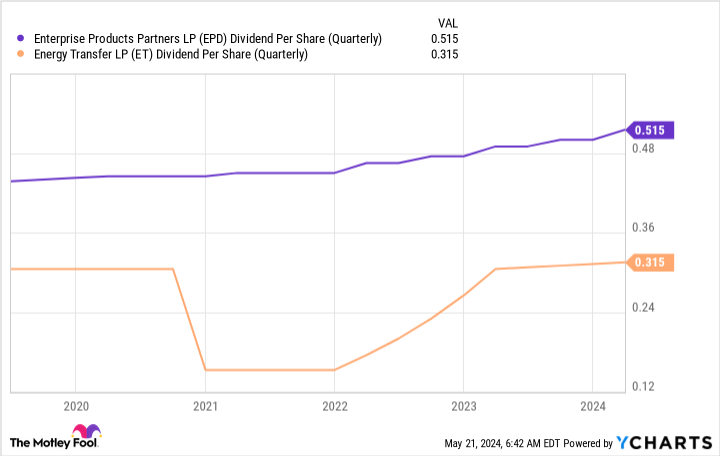

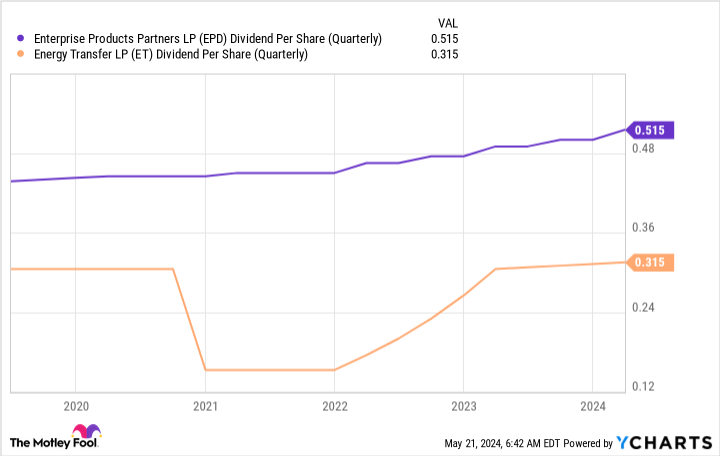

The latest event likely to push investors to buy lower-yielding companies occurred during the coronavirus pandemic. Oil prices fell as countries around the world essentially shut down their economies in an effort to slow the spread of the disease. In short, less energy was needed because less economic activity took place. In light of this and the uncertainty it has caused in the energy sector, Energy Transfer has halved its dividend.

This was a precautionary measure to ensure that the limited partnership could survive in an uncertain future. But any investor who tried to live off the income his portfolio generated would be in trouble. And it could have been just when they needed that income most, as employers in major sectors (particularly retail, a major provider of part-time jobs) were forced to close.

By comparison, Enterprise Products Partners has not scaled back distribution. In fact, it has increased its distribution annually for 25 consecutive years. If dividend consistency is important to you, you’ll clearly prefer Enterprise to Energy Transfer any day of the week.

Letting down investors in a different way

The next concerning issue is unique to Energy Transfer. In 2006 it agreed to buy pear Williams Companies. But the energy sector faced some turbulence, which is quite common in the historically volatile energy sector, and Energy Transfer got cold feet. Management stated that executing the deal would have resulted in a distribution cut, the need to take on a mountain of debt, or both. In its efforts to unwind the deal, it issued convertible securities, with its then-CEO purchasing a large portion of the issue. It’s a bit complicated, but it seems like the convertible would have protected the CEO from the distribution cut if the deal had gone through. That’s not a particularly friendly move for shareholders and it would be understandable if investors started having confidence issues here.

So far, nothing even close to that has happened with Enterprise. If you prefer your investments to be simple and for management teams to put shareholders first, the answer again seems to point toward Enterprise.

A few revenue points aren’t worth the extra baggage

Energy Transfer has a higher return than Enterprise Products Partners, but investors should not let return be the ultimate determining factor for an investment; you have to take the underlying activities into account. If you do that, Energy Transfer probably won’t be the best high-yield energy stock for most investors. If you sacrifice a few percentage points of return and buy Enterprise, you can probably sleep a lot better.

Do you now have to invest € 1,000 in energy transfer?

Consider the following before purchasing shares in Energy Transfer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $635,982!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Is energy transfer the energy share with the highest return for you? was originally published by The Motley Fool