After a great start to the year, Supermicrocomputer‘S (NASDAQ: SMCI) stock chart has undergone a sharp reversal over the past six months. It has lost almost 60% of its value from its peak, and recent developments appear to have further eroded investor confidence in the company.

First, the company’s fiscal 2024 fourth-quarter results released on August 6 fell short of Wall Street expectations, and management’s guidance was disappointing. Second, short-seller Hindenburg Research published a report alleging accounting irregularities at Supermicro. Then, Supermicro’s management announced it would delay the filing of its annual report, adding to the negative press.

These factors explain why Wall Street analysts have been downgrading the stock recently. But with shares of the server and storage systems maker now trading at an attractive 22 times trailing earnings and 13 times forward earnings, opportunistic investors may be tempted to buy Supermicro. Should they, given recent developments?

Addressing the elephant in the room

Investors should keep in mind that Hindenburg is a short seller and has a financial interest in seeing Supermicro’s stock price decline. In that context, we can’t be sure that Hindenburg’s accusations are valid, especially given that the short seller has a history of being wrong. That said, Supermicro was charged with accounting violations by the Securities and Exchange Commission (SEC) in August 2020, when it was found that the company had prematurely recognized revenue and understated its expenses over a three-year period.

However, the company has since made a remarkable recovery, posting stellar profits in recent years thanks to the emergence of a new catalyst in the form of artificial intelligence (AI). Revenue for fiscal 2024 more than doubled to $14.9 billion from $7.1 billion the previous year. Non-GAAP earnings jumped to $22.09 per share, from $11.81 per share in fiscal 2023.

In response to the delay in Supermicro’s annual filing, management clarified that “we do not expect any material changes to our financial results for the fourth quarter or fiscal year 2024.” It added that the company looks forward to a “historic” 2025 with “record order intake, a strong and growing order backlog with design wins, and leading market positions in a number of areas.”

Supermicro says the recent developments will not impact its production capabilities and that it is on track to meet demand for its AI server solutions. It’s worth noting that Supermicro expects its fiscal 2025 revenue to be between $26 billion and $30 billion. That would be another year of notable growth from the $14.9 billion in fiscal 2024.

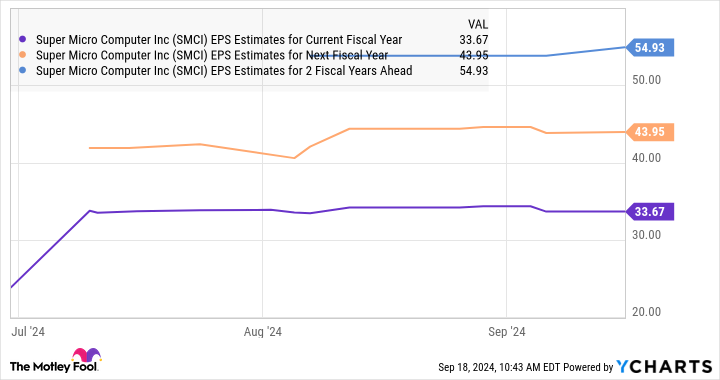

While the company is facing margin challenges due to increased investments it is making to expand capacity to meet strong demand for its liquid-cooled server solutions, management is confident that it will be back in normal margin ranges by the end of the fiscal year. Analyst consensus estimates also indicate that Supermicro’s earnings are on track to grow at an incredible pace in the current fiscal year, followed by healthy jumps over the next few years.

What should investors do?

The delay in Supermicro’s annual filing led JPMorgan to downgrade the stock from overweight to neutral and lower the price target from $950 to $500. Even Barclays downgraded the stock from overweight to equal weight, citing margin pressures facing Supermicro and filing delays. However, JPMorgan’s downgrade was not a result of the Hindenburg report, nor a reflection of its ability to become compliant, but rather because of the near-term uncertainty surrounding the company and the lack of a compelling case to buy the stock.

So, risk-averse investors would be wise to wait for more clarity before buying this AI stock. However, those with a higher risk appetite who want to add a fast-growing company to their portfolio may want to consider buying Supermicro now. It appears poised to sustain its impressive growth over the long term thanks to the company’s huge opportunity in the AI server market.

Analysts expect Supermicro to grow its earnings at an annual rate of 62% over the next five years. If the company can overcome its current problems, it could prove to be a solid investment, given the valuation it is currently trading at.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy Super Micro Computer stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $710,860!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

Is Super Micro Computer Stock a Buy Right Now? was originally published by The Motley Fool