Software stocks had a terrible time in May. The majority of last month’s worst-performing stocks were software vendors. This is notable considering that these high-growth stocks rarely go on sale.

But it’s not just the high-flying software stocks that have struggled. Some biotech companies also struggled in May. If you’re looking for growth all-stars at a discount, the two stocks below are for you.

This growth stock performed the worst on the Nasdaq last month

For years, MongoDB (NASDAQ: MDB) is one of the market’s favorite growth tech stocks. But like any fast-growing stock, the path forward hasn’t always been smooth sailing. Last month, for example, stocks lost about 35% of their value. That sent MongoDB shares down nearly 20% this year — a rare occurrence.

MongoDB is difficult to understand for newcomers. But at its heart it’s a database company, hence the ‘DB’ in the name. The company specializes in a particular open source infrastructure called NoSQL, which is more scalable than previous options.

Daniel Foelber, a contributor to Fool.com, explains: “MongoDB became more popular thanks to the rise of cloud computing – which made data storage cheaper. Cheaper storage costs and easier access to the cloud make it more affordable to use a NoSQL program in instead of a complex but more precise application.”

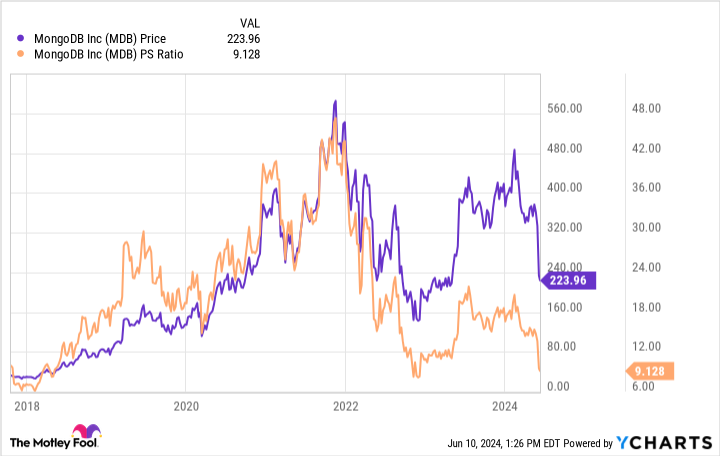

At the beginning of May, MongoDB shares were priced at about fifteen times their revenue. Currently they are valued at less than 10 times sales. As with most growth stock volatility, the decline was due to fears of a slowdown in sales growth. The company beat expectations for the first quarter, but management’s expectations for the coming quarters were relatively weak.

Executives did point out that there were a number of one-off items – such as the recognition of several multi-year contracts in 2024 – that are not expected to happen again in 2025, creating an artificially high base from which to compare growth rates. But with the stock trading at a lofty 15 times earnings, there wasn’t much room for error.

Analysts expect growth to pick up again in 2026, but this year could be difficult for MongoDB as the market digests the high valuation in the face of weakening results.

Could this biotech company triple in value?

Exact Sciences (NASDAQ: EXAS) is another growth stock that stumbled last month. The shares lost about 23% of their value in May. They almost lost last year half of their value. What is happening?

Exact Sciences specializes in the early detection of cancer. In 2014, it launched Cologuard, the first stool DNA test for colorectal cancer. The company has other products in the pipeline, including tests for esophageal, breast and liver cancer, but Cologuard remains the largest financial contributor today.

The company hopes to launch a new, more reliable form of Cologuard in 2025, but fears of a slowdown in sales growth have dragged down the share price.

Still, Exact Sciences maintained its full-year sales guidance, with investors expecting between $2.81 billion and $2.85 billion in revenue this year. And famous investors like Cathie Wood still maintain a position in the stock, despite some selling.

If Exact Sciences can find success with the relaunch of Cologuard next year, and bring forward some of its solutions for other indications, the May sell-off could prove an attractive buying opportunity for patient investors. The last time a selloff occurred so suddenly, shares nearly tripled in value after hitting a low of about three times sales — about where the stock trades today.

Should You Invest $1,000 in MongoDB Now?

Before you buy shares in MongoDB, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and MongoDB wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,886!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends MongoDB. The Motley Fool recommends Physical Sciences. The Motley Fool has a disclosure policy.

Is It Time to Buy May’s Worst Performing Nasdaq Stocks? was originally published by The Motley Fool