AI market darling Nvidia (NASDAQ: NVDA) has cooled off, down about 15% since its $3.3 trillion market cap peak a few weeks ago. Despite the recent decline, the stock is up more than 100% in the past year. Volatility is normal for any stock that rises that much in a short period of time.

But Nvidia’s current dip isn’t an automatic buying opportunity. Question marks are starting to mount as the company prepares to report second-quarter earnings in a few weeks.

Below are the risks investors should consider before buying stocks today.

Is Nvidia’s market share being undermined?

The race for artificial intelligence (AI) began in early 2023 with the viral arrival of ChatGPT. Nvidia’s GPUs, which can optimize for AI applications using proprietary software, quickly captured a dominant market share. Industry estimates put Nvidia’s AI market share as high as 70% to 95%. TechInsights research estimates that Nvidia will account for 98% of total data center GPU revenue in 2023.

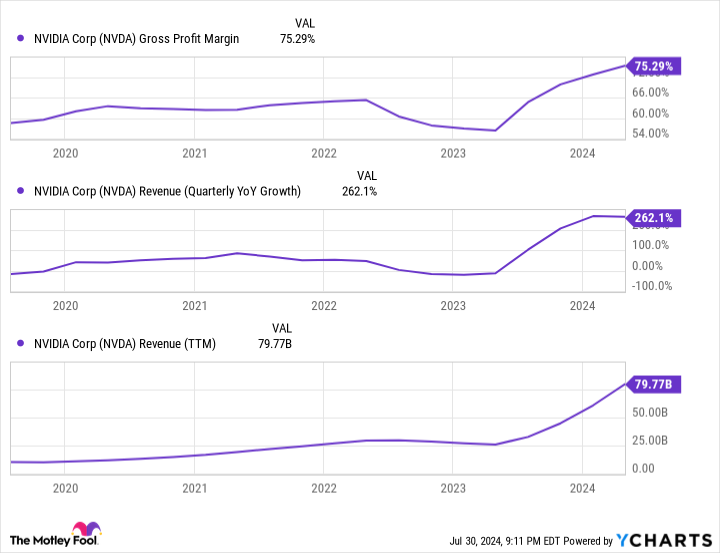

Nvidia’s financials bear that out; revenue growth accelerated to nearly 300%. Tech CEOs like Elon Musk openly complained that they couldn’t get Nvidia’s chips fast enough. Such high demand has also done wonders for Nvidia’s pricing power. Gross profit margins have expanded significantly to over 75%:

But it’s hard to stay on top when everyone is after your crown, and many of these big chip spenders may not be happy being at the mercy of Nvidia. Competitors like Intel And AMD are pushing alternatives forward, and big tech companies like Amazon, AlphabetAnd Meta platforms build custom AI chips.

Alphabet may have dealt the first known blow to Nvidia’s dominance. Apple (NASDAQ: AAPL) Apple Inc. recently announced that it used 2,048 TPU v5p chips from Alphabet to build the AI that will run on iOS devices. For its server AI model, Apple used 8,192 TPU v4 processors, which are tensor processing units (TPUs) built specifically to train AI models. Apple didn’t say it didn’t use Nvidia chips, but it omitted Nvidia from its description of its hardware and software build.

On the way to profit figures with sky-high expectations

Apple’s partnership with Alphabet is important for several reasons.

First, Apple’s AI project is critical, and the company chose Alphabet’s chips despite the perception that Nvidia was the de facto market leader and go-to chip supplier. It’s just one example, but it’s now fair to question whether Nvidia’s AI moat is as wide as initially thought.

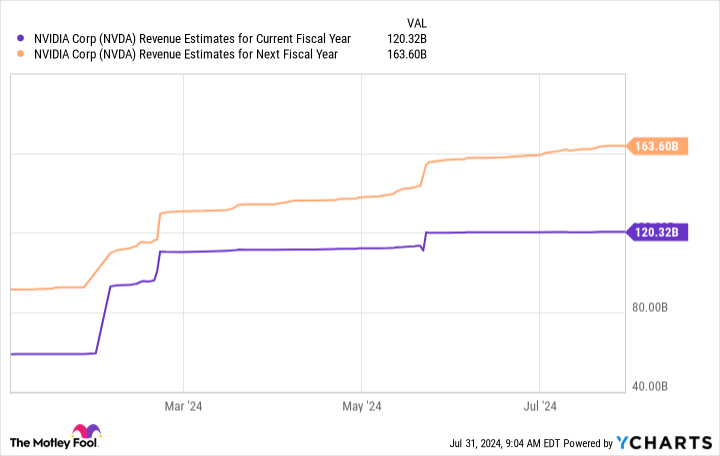

Second, analysts’ revenue estimates remain very optimistic, despite potential competitive pressure. You can see that the estimates for 2024 and 2025 are higher than ever:

Third, real competitive pressure would likely threaten Nvidia’s gross profit margins, which (as you saw in the first chart) have expanded to over 75%. Over the past five years, Nvidia’s gross margins have averaged 63%. Even if Nvidia retains the lion’s share of the AI chip market, it can’t do so at any price. Prices may have to come down to compete.

How should investors approach Nvidia today?

The potential downside to both revenue and gross margins should worry investors. I’m not saying Nvidia can’t or won’t remain the leading AI chip company. But it’s becoming increasingly likely that deep-pocketed competitors could win business. Many of these large tech companies building custom AI chips are currently Nvidia’s largest customers!

Perhaps the broader demand for AI chips is so strong that Nvidia can grow while giving up some market share. The risk is that it can’t, that Nvidia’s AI revenue could spike and then moderate or even decline as other AI chips flood the market. Q2 earnings could be another bumper one. Investors will want to pay close attention to management’s full-year guidance, which should reveal future sales dynamics.

Nvidia could prove volatile as Wall Street mulls these questions. Investors may want to wait until Q2 earnings before aggressively buying shares. At the very least, consider dollar-cost averaging your Nvidia investments. This is a smart way to manage uncertain markets or declining stock prices. By investing a fixed amount at regular intervals, you can lower your average cost per share over time. This method helps you buy more when prices are low, which provides a strategic advantage in volatile markets.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $657,306!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long Jan 2025 $45 calls on Intel and short Aug 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Is Nvidia Stock a Bargain Right Now? was originally published by The Motley Fool