One of the most important dates in modern history is November 30, 2022, the day OpenAI released ChatGPT to the public. It didn’t take long for people around the world to become enamored with the potential of generative artificial intelligence (AI).

Perhaps no company has benefited as much from the AI revolution as the semiconductor and data center specialist Nvidia (NASDAQ: NVDA)Since ChatGPT’s commercial launch about two years ago, Nvidia shares have risen more than 700%.

Nvidia has dominated the high-performance computing market, largely through its industry-leading graphics processing units (GPU). However, three trends evident in the company’s latest earnings report have me concerned that the euphoric bubble surrounding Nvidia is about to burst.

1. Sales and profit growth are slowing

Nvidia reports revenue in five different categories, but the vast majority of its sales now come from its data center business. Within the data center category, Nvidia divides its revenue into two further subcategories: compute and networking.

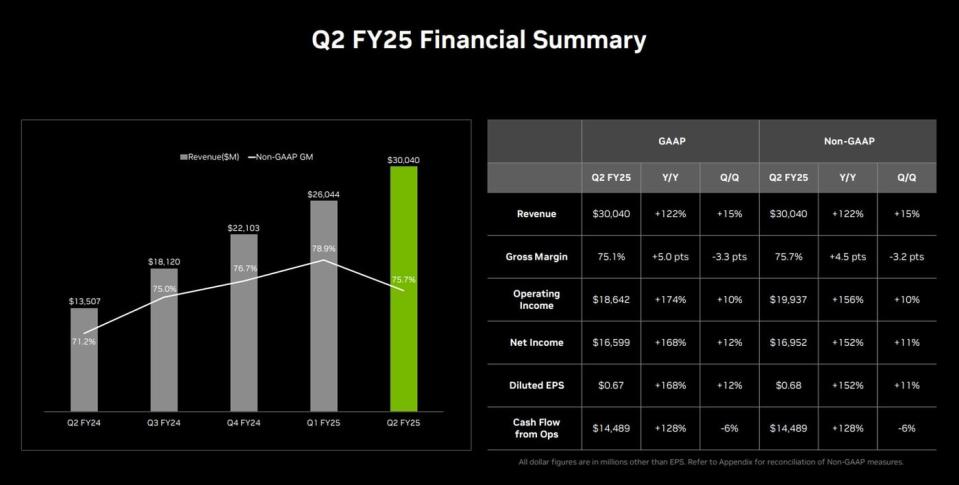

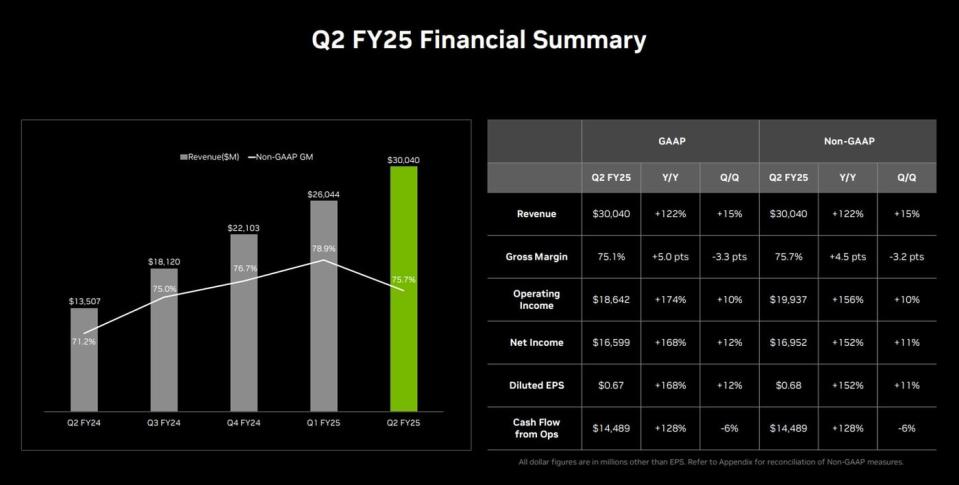

Over the past two years, compute and networking sales have been off the charts, consistently growing in the triple-digit percentage range as demand for Nvidia’s GPUs has remained robust. A few weeks ago, Nvidia reported results for the second quarter of its fiscal year 2025, which ended on July 28. The company’s total quarterly revenue of $30 billion set a new record, as did its total data center revenue of $26.3 billion.

While these numbers may make Nvidia seem unstoppable, the underlying trends suggest otherwise. The table below shows Nvidia’s annual and sequential growth rates for total revenue and data center revenue over the past five quarters.

|

Metric |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|---|---|---|---|---|---|

|

Total revenue growth (YoY) |

101% |

206% |

265% |

262% |

122% |

|

Total revenue growth (QoQ) |

88% |

34% |

22% |

18% |

15% |

|

Data center revenue growth (annual) |

171% |

279% |

409% |

427% |

154% |

|

Data center revenue growth (quarter-on-quarter) |

141% |

41% |

27% |

23% |

16% |

Data source: Nvidia. YOY = year-on-year. QoQ = quarter-on-quarter.

It’s hard to criticize a company that’s growing as fast as Nvidia. What worries me isn’t its ability to create demand, but the pace at which that demand is being created. Sales in the data center industry — and by extension Nvidia’s entire sales base — are starting to show signs of slowing. Some of this can be attributed to the cyclicality of the semiconductor industry in general, while some of the sales trends can be attributed to ongoing bottlenecks in Nvidia’s supply chain.

Still, I’m a little wary of a slowing sales pace. Plus, further analysis suggests that where Nvidia’s growth is coming from could be an even bigger problem.

2. The concentration of customers is becoming more and more apparent

Looking at the top numbers alone doesn’t help much in determining the health of a company. A more useful metric to analyze is customer concentration. This reflects how diversified a company’s sales base is.

While Nvidia sells its GPUs all over the world, an analysis of the company’s financial statements suggests the business has become highly concentrated. In the second quarter of fiscal 2025, nearly half of Nvidia’s $30 billion in revenue came from just four customers. This level of concentration isn’t exactly new, and I see increased competition as a major reason Nvidia’s sales slowdown could be further exacerbated.

While Nvidia faces direct competition from Advanced micro devicesthe company is also beginning to experience increased competition from lateral sources such as Microsoft, Tesla, Meta platformsAnd Amazon.

Many of these “Magnificent Seven” companies are big buyers of Nvidia’s technology. However, based on comments from executives at these various mega-caps, many of these companies are looking to reduce their reliance on Nvidia and actually design their own chips that directly compete with the technology.

Even as that competition starts to take shape, I think Nvidia will have little trouble finding new buyers. But with increased competition comes another problem: a loss of pricing power. As more AI-capable GPUs become widely available — potentially to the point where they become commodity hardware — it’s likely that Nvidia won’t be able to command such high prices for its chips.

This dynamic brings me to my final and most important concern about Nvidia’s prospects.

3. The most important metric: gross margin

With its existing pricing power, Nvidia has consistently delivered strong margins. However, the company’s latest earnings report revealed a notable decline in gross margin.

I wouldn’t worry too much about a slowing margin profile in a single quarter, but the larger implications of this are hard to ignore.

If margins continue to deteriorate against a backdrop of increasing competition, Nvidia’s profits could be significantly affected. Free cash flow and profitability would begin to shrink, leaving it with less capacity to invest in research and development, marketing and other areas of innovation or growth strategies.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $730,103!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Nvidia’s bubble about to burst? 3 numbers that make me think it might. was originally published by The Motley Fool