High dividend yielding stocks offer two main advantages. They provide regular cash flow through dividend payments and, when dividends are consistently reinvested, have often outperformed the S&P 500 for longer periods.

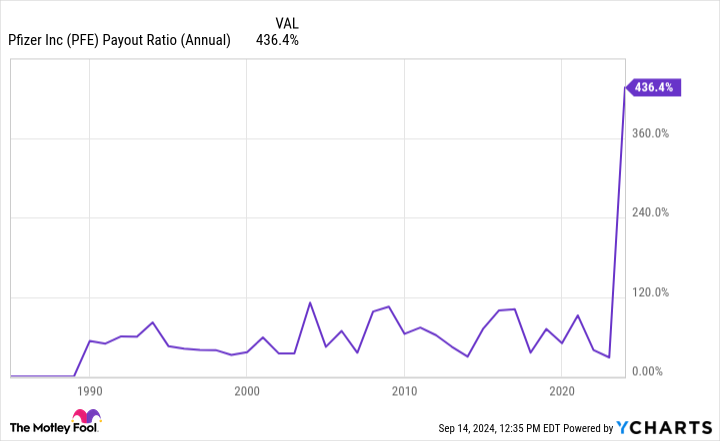

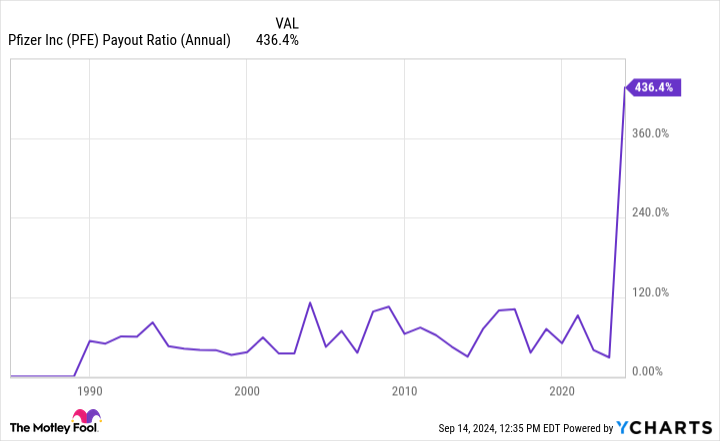

However, high yields do deserve a critical look. They are often the result of falling stock prices or overly generous payout policies. The payout ratio, which measures the percentage of earnings paid out as dividends, is a critical metric. Ratios exceeding 75% can indicate unsustainability, potentially leading to dividend cuts and subsequent stock price declines.

Pharmaceutical giant Pfizer (NYSE: PFE) stands out in this context. The company currently offers a whopping dividend yield of 5.7% – the highest of any major drugmaker and one of the highest in the entire healthcare sector. However, Pfizer’s 436% payout ratio raises significant sustainability concerns.

Is Pfizer’s High Dividend Worth the Risk? Let’s dig deeper to find out.

A pharmaceutical powerhouse facing challenges

Pfizer is a global pharmaceutical giant with an impressive portfolio of more than 350 marketed drugs, 113 experimental candidates in clinical trials, and a presence in more than 200 countries. Despite this dominant position, the company’s stock price has recently fallen 52% from a three-year high.

This significant decline is largely due to the decline in sales of Pfizer’s once-thriving COVID-19 franchise. However, amid this significant challenge, Pfizer’s current valuation could present an interesting opportunity for both bargain hunters and yield-seeking investors.

Digging into the details, Pfizer shares are now trading at just 9.6 times expected 2026 earnings, a notable discount in the typically premium-laden pharmaceutical sector. This attractive valuation, combined with the stock’s high dividend yield and solid market position, creates an attractive value proposition for investors with a long-term horizon.

Concerns about dividend sustainability

Pfizer’s 5.7% dividend yield is attractive, but raises significant sustainability concerns. The company’s payout ratio has skyrocketed to 436%, well above the 75% threshold that typically signals potential dividend instability. Not only is this ratio alarmingly high in absolute terms, it also stands out as the highest among Pfizer’s big pharma and blue-chip biotech peers.

Context is key, however. The pharmaceutical industry often experiences periods of elevated payout ratios due to its capital-intensive nature and limited patent protection for branded drugs. These factors can lead to temporary spikes in this metric. The average payout ratio among Pfizer’s peer group is 141% — already quite high, but still dwarfed by Pfizer’s 436%.

Wall Street reacted decidedly negatively to these figures. Pfizer shares are down 14% in the past 12 months, reflecting investor skepticism about Pfizer’s ability to maintain current dividend levels. This negative sentiment persists despite Pfizer’s strong commercial performance in the first half of the year, including several successful launches of new medicines.

Management’s position and outlook

During Pfizer’s Q2 2024 earnings conference call, management reaffirmed its commitment to maintaining and growing the dividend as a top priority. This stance is supported by a 15-year streak of consecutive dividend increases and no cuts since the $68 billion acquisition of Wyeth in 2009.

To reinforce this commitment, Pfizer has implemented a cost-savings plan that targets $4 billion in net savings by year-end. This initiative is aimed at improving free cash flows and supporting near-term dividend sustainability.

Looking ahead, Pfizer’s pipeline includes several potential blockbuster cancer drugs, most notably vepdegestrant for breast cancer and sigvotatug vedotin for lung cancer. If successful in clinical trials, these drugs could generate more than $1 billion in annual sales.

Successful launches of these drugs could significantly boost Pfizer’s revenue growth and earnings power in the second half of the decade. This improved financial performance could bring the company’s payout ratio closer to its historical average of around 50%.

The verdict: a calculated risk worth considering

While nothing is guaranteed in investing, the market’s pessimistic view of Pfizer’s near-term prospects may be overblown. Management’s steadfast commitment to dividend growth, cost-cutting measures and a promising pipeline of drugs suggest the potential for a turnaround.

Pfizer’s shares are also currently trading at a significant discount to many of its big pharma peers, potentially offering a margin of safety for investors buying at current levels. While the elevated payout ratio is a concern, the company’s strong market position, diverse product portfolio, and proven innovation engine provide some reassurance that this situation will ultimately prove to be temporary.

Given these factors, Pfizer appears to be an interesting option for investors seeking high-yield opportunities. However, as with all high-yield stocks, monitoring the company’s financial health and dividend coverage will remain key.

Should You Invest $1,000 in Pfizer Now?

Before you buy Pfizer stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $729,857!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

George Budwell has positions in Pfizer. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Is Pfizer’s 5.7% Dividend Yield Worth the Risk? was originally published by The Motley Fool