Shares of Super microcomputer (NASDAQ:SMCI) have been on a rollercoaster ride so far this year. The AI server maker’s shares gained more than 300% in less than three months in early 2024, but have fallen 29% since hitting a record high in the first half of March.

But now, Supermicro stock appears to be gaining momentum again, as it rose more than 12% on June 13. This increase was driven by the latest earnings reports from major artificial intelligence (AI) players such as Broadcom And Oracle. While Broadcom raised its forecast for AI chip sales for the current fiscal year, Oracle pointed out that it is building more cloud computing capacity to meet the huge demand it is seeing.

These developments are a good sign for Supermicro, whose AI servers are used to mount chips used for training and deploy AI models in data centers. However, the stock’s latest surge means it will almost triple by 2024. So is it too late for investors to buy Supermicro stock? Let’s find out.

Supermicro is not expensive despite its impressive increase

Supermicro shares currently trade at 4.3 times sales. That’s lower than the average of 7.8 for the US technology sector, suggesting the stock is undervalued. A key reason why Supermicro’s price-to-sales ratio is attractive right now is the fact that Supermicro’s share price gains have been supported by excellent sales growth for the company.

More specifically, Supermicro’s revenue tripled year over year to $3.85 billion in the third quarter of 2024. Additionally, the company has raised its fiscal 2024 revenue guidance to $14.9 billion, up from the previous guidance of $14.5 billion (both figures are in the middle of their respective ranges). The updated guidance means Supermicro’s revenue is on track to more than double from the previous fiscal year.

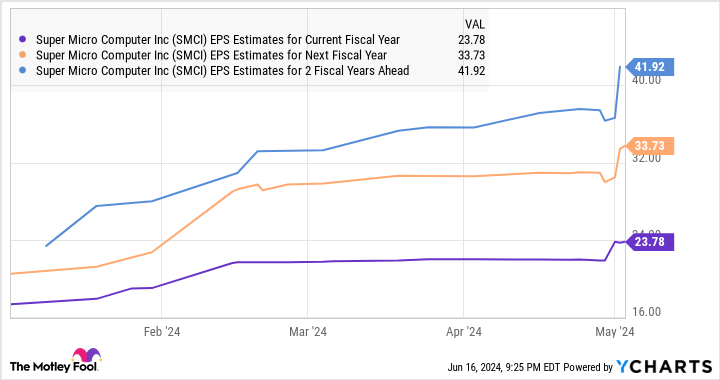

Furthermore, the company’s solid revenue growth also translates into healthy earnings improvement. Operating income quadrupled from the previous quarter to $6.65 per share. The company currently has an earnings multiple of 43, a slight discount to the US technology sector’s average price-to-earnings (P/E) ratio of 45. However, the forward earnings multiple of 21 indicates that net growth is expected to increase. to take off.

Another multiple that tells us that Supermicro is attractively valued is its price-to-earnings-growth ratio. The PEG ratio takes into account a company’s potential earnings growth. As a rule of thumb, a PEG ratio of less than 1 means a stock is undervalued based on the potential growth it is expected to deliver, and that is exactly the case for Supermicro:

That’s not surprising, considering Supermicro’s revenues are expected to grow 62% annually over the next five years, driven by massive spending on AI servers.

Increased spending on AI infrastructure will be a big catalyst

The latest earnings reports from Oracle and Broadcom tell us that AI infrastructure spending is growing at an impressive pace. Oracle, for example, is “working as quickly as we can to build out cloud capacity given the enormous size of our backlog and pipeline.” Broadcom, on the other hand, pointed out that hyperscale cloud computing providers are “accelerating their investments” to improve the performance of their data centers.

This is why the AI server market is expected to grow from a size of $31 billion in 2023 to a whopping $430 billion by 2033. That’s a compound annual growth rate (CAGR) of 30%. Supermicro is growing faster than the AI server market overall, indicating it is the company of choice for data center operators to deploy AI servers.

Supermicro’s strategy to quickly bring cost-efficient server solutions to market for popular AI chips from leading chip manufacturers appears to be playing a key role in gaining a larger share of the AI server market. Furthermore, the company’s focus on quickly adding more manufacturing capacity means it can make a bigger dent in this area.

All of this suggests that Supermicro stock can continue to climb higher in the long term. AI stock has an average 12-month price target of $1,030 per share among 20 analysts covering the stock, which represents a 22% upside from current levels.

Investors who haven’t yet bought this high-flying stock should still consider doing so – it’s not too late.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy shares in Super Micro Computer, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Oracle. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Is Super Micro Computer Stock a Buy Now? was originally published by The Motley Fool