Since the start of 2023, Wall Street has been firing on all cylinders. Over this period of roughly 17.5 months, we have seen mature stocks being driven Dow Jones Industrial Average (DJINDICES: ^DJI) gain of 17%, the benchmark S&P500 (SNPINDEX: ^GSPC) add 42%, and growth is fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) slingshot higher at 69%. More importantly, all three indexes have reached record highs and are firmly established in bull markets.

On paper, Wall Street is doing well. A majority of S&P 500 constituents are beating consensus earnings expectations, and the U.S. economy has remained on track. Despite some historically accurate predictive indicators calling for a US recession in 2023, the economy continues to chug along.

But history also tells us that the stock market rarely moves up in a straight line for long periods of time. While the hype surrounding artificial intelligence (AI) is undeniably boosting stocks, it doesn’t eliminate the possibility that stocks will crash back to Earth at some point in the future.

Although there is no such thing as a foolproof measure when it comes to predicting short-term price movements in the Dow Jones, the S&P 500 and the Nasdaq Composite, certain predictive tools have an uncanny track record when it comes to correlation with major movements in the stock market throughout history. One such valuation indicator, which has 153 years of data under its belt, offers a big clue as to whether or not the stock market will crash.

Are stocks headed for disaster?

Over the past year, I’ve been looking at an assortment of predictive tools that are highly correlated with significant directional changes in Wall Street’s three major stock indexes. These include the US M2 money supply, the ISM Manufacturing New Orders Index, and the Conference Board Leading Economic Index (LEI), to name a few.

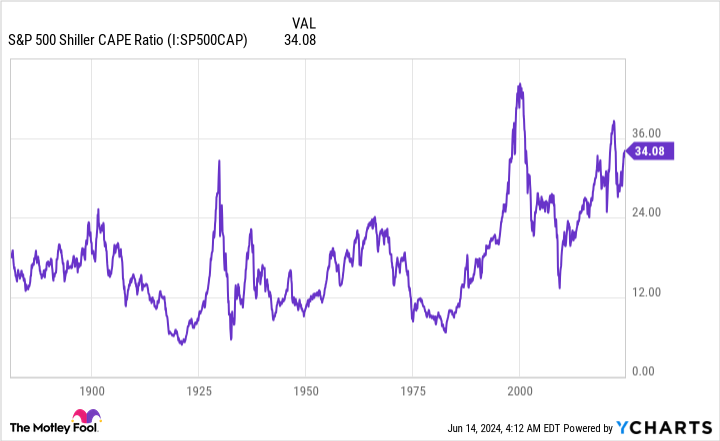

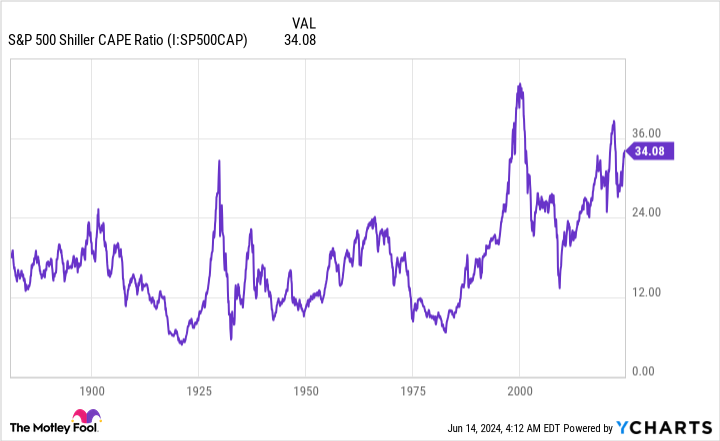

But if there’s one metric that has an extensive track record of foreshadowing big moves on Wall Street above all others, it’s the valuation-driven Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings ratio. profit ratio is called. price-earnings ratio or CAPE ratio.

A traditional price-earnings ratio divides a company’s share price into its earnings per share over the last twelve months. However, the Shiller price-to-earnings ratio of the S&P 500 is based on average inflation-adjusted earnings over previous years. 10 years. Examining a decade of earnings data can help rule out one-off events, such as COVID-19, that could negatively impact the valuation analysis.

As of the closing bell on June 13, the S&P 500’s Shiller P/E stood at 35.38. Tested back to early 1871, this represents one of the highest values ever seen during a bull market rally. It’s also more than double the average value of 17.13 over the past 153 years – although easy access to public data (thanks, Internet!) and a period of historically low interest rates have fueled risk-taking and earnings growth multiples. have certainly encouraged in recent years. 30 years.

However, the fact that the Shiller price-to-earnings ratio is more than twice the historical average is not the biggest concern. Rather, it’s what followed every example of the S&P 500’s Shiller P/E hitting 30 during a bull market rally:

-

August 1929-September 1929: Immediately before the Great Depression broke out in America, the Shiller price-earnings ratio reached 30 for the first time. The Dow Jones would then lose 89% of its value before reaching its bottom.

-

June 1997-August 2001: During the dot-com bubble, the S&P 500’s Shiller P/E reached its all-time high above 44. This was followed by the S&P 500 losing 49% of its value and the Nasdaq losing more than 75% Composite relative to its peak.

-

September 2017-November 2018: A 20% fourth-quarter decline in the S&P 500 followed yet another example of an extended rally, pushing Shiller price-to-earnings north of 30.

-

December 2019-February 2020: In the months leading up to the COVID-19 crash, the Shiller P/E surpassed 30. The S&P 500 would lose 34% of its value in 33 calendar days during the 2020 COVID-19 crash.

-

August 2020-May 2022: During the first week of January 2022, the Shiller price-to-earnings ratio topped 40 for the second time in its proven history. During the 2022 bear market, the S&P 500 would lose up to 28% of its value, with the Nasdaq hit even harder become.

-

November 2023-current: As noted, the Shiller P/E is currently above 35, as of the closing bell on June 13, 2024.

The Shiller price-to-earnings ratio has exceeded 30 six times in 153 years, and the five previous instances all involved pullbacks in the S&P 500, Dow or Nasdaq Composite, ranging from 20% to a whopping 89%. Based on what history has told us about extended valuations, a meaningful decline – and perhaps even a short-lived ‘crash’ – could follow.

Keep in mind that the Shiller P/E is not a timing tool. As you will note from the dot-com bubble, stocks remained exceptionally expensive for more than four years. The stock market’s current trajectory may persist for weeks, months, or years before it reverses, as history suggests it will.

History is a two-sided coin that strongly favors the long-term optimist

The prospect of a bear market or stock market crash is probably not something you want to hear with the Nasdaq Composite, the S&P 500 and the Dow Jones Industrial Average in full rally mode. But the good news I have to offer is that history is non-linear and largely belongs to optimistic investors who put their money to work with a long horizon in mind.

Frankly, nothing we as investors do, say or think can prevent economic recessions or occasional downturns (corrections, bear markets or crashes) in the stock market. These declines are a natural part of the economic cycle and long-term investments.

However, there is a clear difference between periods of growth for the US economy and contractions. Since the end of World War II in September 1945, nine of the twelve U.S. recessions have resolved in less than twelve months. Of the remaining three, none lasted longer than 18 months.

On the other side of this disproportionate coin, most economic expansions have been sustained for many years. Two periods of growth since the end of World War II even exceeded the ten-year mark. If you’re an investor, betting that the U.S. economy will grow over time has been absolutely the right move.

We also see the same differences between bear and bull markets on Wall Street.

A year ago, researchers at Bespoke Investment Group published a dataset on X, the social media platform formerly known as Twitter, that examined the calendar length of every bear and bull market in the S&P 500 since the Great Depression began in September. 1929. This analysis included 27 separate bear and bull markets, as you can see in the post.

While the average bear market for the S&P 500 has lasted roughly 9.5 months (286 calendar days), the typical bull market has lasted 1,011 calendar days, or about 3.5 times as long. Furthermore, 13 bull markets have lasted longer than the longest bear market in the past 94 years.

In the short term, the price movements of the Dow Jones, the S&P 500 and the Nasdaq Composite will always be somewhat unpredictable. While a crash is a possibility, given what history tells us about stock market valuations, it is crystal clear from the historical data on stock market returns and economic growth that being an optimist and investing for the long term is a winning formula.

Don’t miss this second chance at a potentially lucrative opportunity

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, then you have $20,685!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $40,151!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $360,991!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

See 3 “Double Down” Stocks »

*Stock Advisor returns June 10, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is the stock market going to crash? 153 years of valuation history carries a lot of weight and provides a big clue. was originally published by The Motley Fool