Newsflash: The stock market is in trouble. That may seem hard to believe when the stock market is hitting record highs. But beneath the surface I am convinced that trouble is brewing.

For example the S&P500 is up about 15% this year, but about 40% of the components are down this year. In other words, big winners love Nvidia And Broadcom carry the index higher even after taking into account many big losers such as Intel And Lululemon.

However, I am still optimistic about the stock market. Let me explain why.

Reasons for concern

First things first: There are plenty of ominous signs beyond the stock market’s lack of breadth.

Black cats on the floor of the New York Stock Exchange? Ravens circling the Nasdaq? No, the worrying signs I see are economic indicators – and they look more alarming by the day.

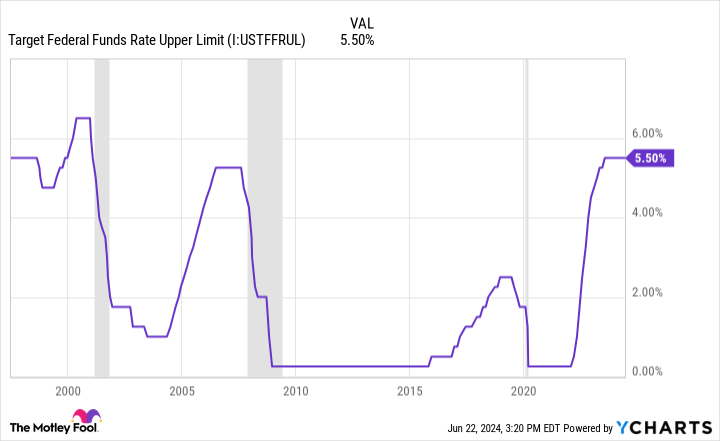

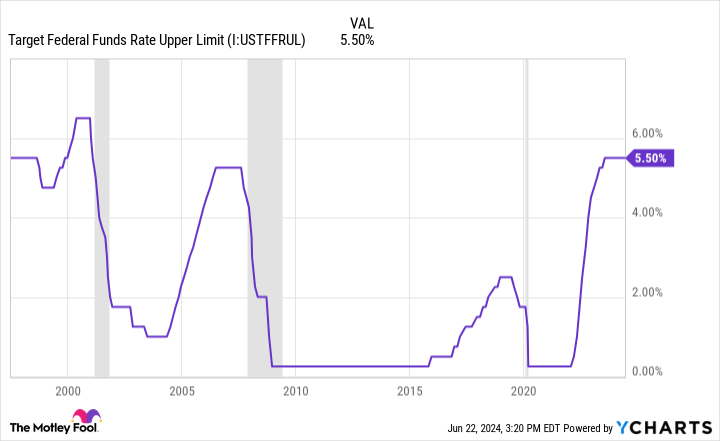

Consider the relationship between interest rates and stock market corrections. Many people think that high interest rates lead to stock market corrections or stock market Crashes.

There is some evidence to support that. But even more than the high interest rates, the corrections in the stock markets seem to be the result first interest rate cut. This is because a rate cut is often seen as a sign that the economy is slowing or contracting, which can lead to a decline in corporate profits and a subsequent decline in stock prices.

While the Fed has yet to start cutting interest rates, it has indicated that it will en route. In addition, several other central banks, including those in Canada and the European Union, have started cutting their benchmark interest rates.

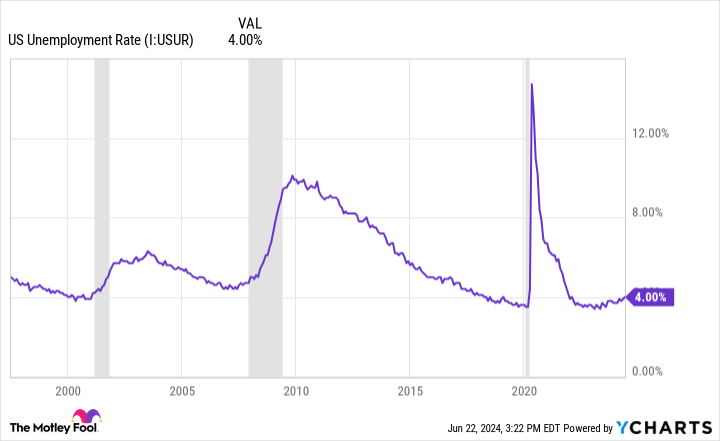

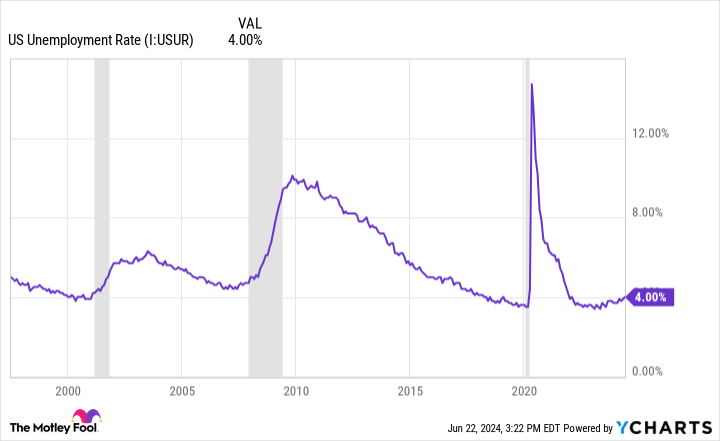

The second alarming sign for the stock market is the unemployment rate. It’s starting to go higher.

That’s not just bad news for the people who have lost their jobs; it is a sign that the economy is slowing. Moreover, the unemployment rate is rising from its lowest level in decades. This could pose serious problems for the stock market, as prolonged periods of ultra-low unemployment are often followed by deep recessions that hamper corporate profits and lead to steep sell-offs in stock markets.

Finally, the largest segment of the economy – the consumer – is finally showing signs of weakening. For years, strong consumer spending kept the U.S. economy afloat even as high inflation took its toll. However, there are now signs that consumers are crying uncle. Retail sales are slow; some months show year-over-year declines as consumers withdraw from discretionary purchases.

Meanwhile, more and more consumers are not paying off their loans on time. Credit card delinquencies have reached their highest level in more than a decade, and car delinquencies are also increasing. This could prove to be another stumbling block for the stock market, as consumer spending accounts for about 70% of U.S. economic activity.

What’s the plan if the stock market is on the brink of a correction?

While all these signs point to a correction in the stock markets, Investors don’t have to do that panic. Selling would indeed be wrong.

That’s because economic indicators are not perfect. No model, prediction or person can predict the future flawlessly. In fact, trying to time the stock market doesn’t work. As Peter Lynch once said, “Far more money has been lost by investors trying to anticipate corrections than has been lost in all the corrections combined.”

Even if economic indicators perfectly pinpointed when stock market corrections would occur, investors would need to time their return to the stock market correctly.

All this is to say that it is best to remain steady and unmoved through the phases of the economic cycle. Investors who hold their nerve and continue investing in the stock market will not only save themselves enormous stress; they tend to outperform those who try to time the market because they give more time for their investments to grow through the power of compounding.

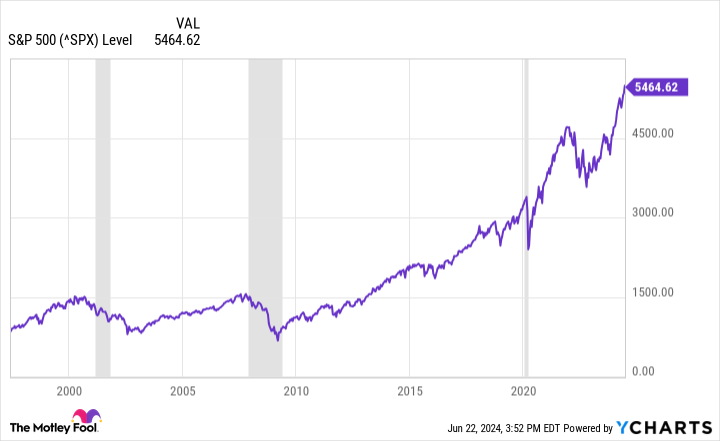

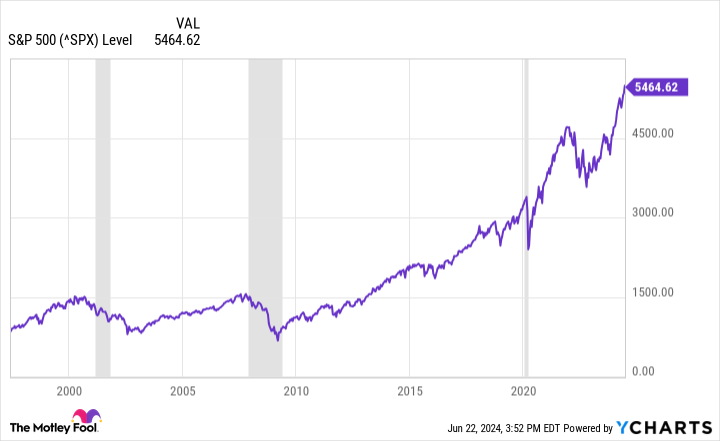

For example, during the 2008 financial crisis, the S&P 500 fell about 50%, but recovered all its losses within four years.

In short: storm clouds may be gathering. But for long-term investors, it all comes with the territory. A stock market correction – or worse – may be coming soon, but it may not. Either way, the best plan is to stick to a steady plan of saving and investing, using the power of compounding to one’s advantage.

Should You Invest $1,000 in the S&P 500 Index Now?

Consider the following before purchasing shares in the S&P 500 Index:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and the S&P 500 Index wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 24, 2024

Jake Lerch has positions at Lululemon Athletica and Nvidia. The Motley Fool has positions in and recommends Lululemon Athletica and Nvidia. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls to Intel and short August 2024 $35 calls to Intel. The Motley Fool has a disclosure policy.

It looks like the stock market is about to drop. This is why I still buy. was originally published by The Motley Fool