The most popular stocks on Wall Street, Nvidia (NASDAQ: NVDA), will implement a stock split on June 7. The next trading day, June 10, Nvidia’s stock price is cut by one-tenth, increasing the number of shares tenfold. After that date, the stock will trade for around $100 instead of $1,000.

While stock splits excite investors, there are much better reasons to buy Nvidia stock than just the stock split. I’ve come up with three good reasons, but many more could have been mentioned.

1. Nvidia is still growing at a rapid pace

Nvidia’s incredible performance since the start of 2023 (the stock is up about 650%) is directly related to the artificial intelligence (AI) race. Nvidia’s main products are graphics processing units (GPUs), which are incredibly useful in processing AI models because they can compute in parallel. Because Nvidia’s GPUs are the best in their class, they quickly became the top choice for anyone looking to dramatically increase their AI computing power.

This directly translated into stunning revenue growth for a company of Nvidia’s size. In the first quarter of fiscal year 2025 (ending April 28), Nvidia’s revenue rose 262% year over year. While that’s a staggering figure, this will likely be the last quarter with such a high growth rate. Now Nvidia is starting to suffer stronger year-over-year comparisons, so this growth rate will likely slow.

Instead, investors can also look at the quarterly growth rate. For the first quarter this figure was 18%, which is still a rapid growth rate. Management expects second-quarter revenue of $28 billion, indicating approximately 8% quarter-over-quarter growth. While this is a slight delay, management may be adjusting its expectations. The fourth quarter of fiscal 2024 saw first-quarter sales of $24 billion, indicating quarterly growth of 9%. And it beat that projection handily.

The consequences of missing guidance far outweigh those of exceeding projections, so management has nothing to gain from issuing less aggressive guidance. Investors should keep this in mind as there are virtually no signs of Nvidia’s growth slowing down.

2. New products can trigger an upgrade cycle

Nvidia’s H100 is the industry standard in data center GPUs. While this remains a top choice, Nvidia’s H200 is the latest and greatest in technology.

Compared to the H100 GPU, these large language models run up to twice as fast as the H100. Additionally, the H200 is also more efficient, using approximately half the energy as the H100 when using a comparable AI model.

Energy input costs are a huge operating expense for data centers, and upgrading to H200s can provide potential cost savings for many of the largest players in the space.

While the H100 GPU is already an industry leader, Nvidia’s H200 appears to be an upgrade in almost every aspect. This could lead to an upgrade cycle that will see demand for Nvidia’s GPUs continue to boom for years to come.

Nvidia also plans to launch its new Blackwell architecture and most powerful chip ever later this year – another tailwind for Nvidia stock.

3. The shares are not as expensive as investors might think

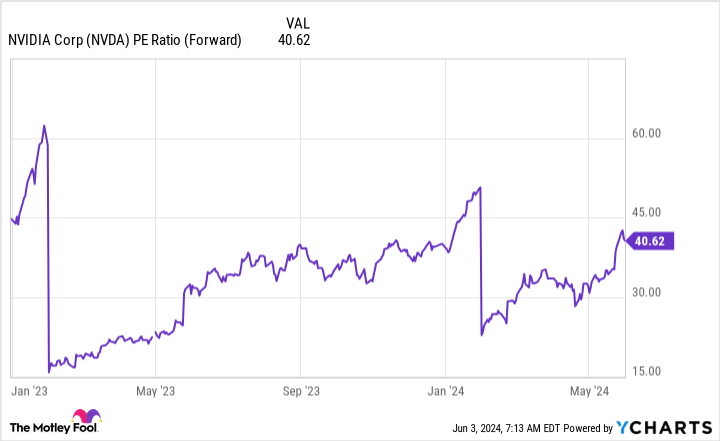

Thanks to Nvidia’s incredible rise, its shares have become quite expensive due to the high expectations built into them. Therefore, using the traditional price-to-earnings (P/E) ratio isn’t all that useful when assessing Nvidia stock. The stock market is a forward-looking machine, so investors should use a metric that measures future earnings, such as the forward price-to-earnings (P/E) ratio.

At 41 times forward earnings, Nvidia is not a cheap stock by any means.

However, if you compare it to other major tech companies, it doesn’t look that bad. Although Nvidia is more expensive, the price is still in a range similar to Nvidia Amazon (39 times future earnings) and Microsoft (35 times future earnings).

They’re both great companies, but Nvidia’s advantages far outweigh the other two. So if you’re looking for a stock with a higher ceiling than Amazon and Microsoft, Nvidia is a good choice.

While many investors are excited about the stock split because it will make the stock more accessible to investors without access to fractional shares and options traders, these are much better reasons to own the stock.

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool holds positions in and recommends Amazon, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 Reasons to Buy Nvidia Stock (Hint: It’s Not the Stock Split) was originally published by The Motley Fool