Donald Trump and his allies have vowed to dismantle the Inflation Reduction Act if the former president wins back the White House.

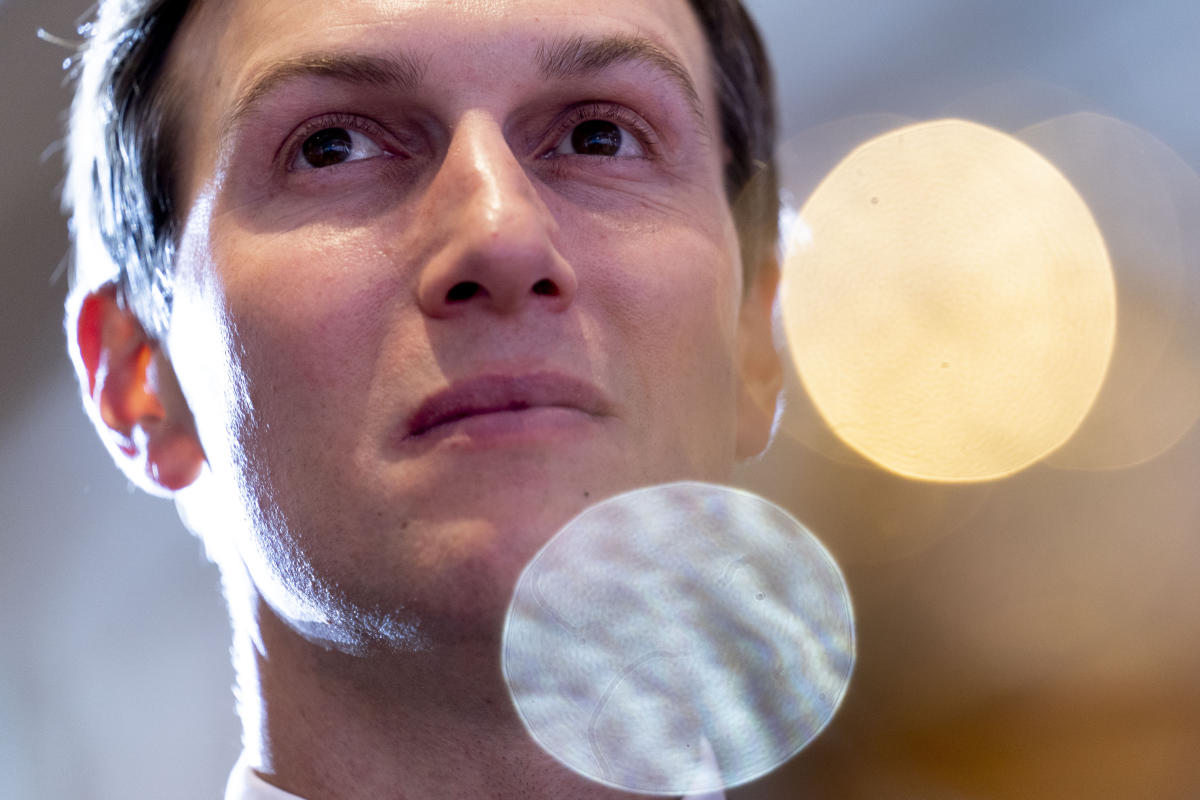

But that could prove costly for Trump’s son-in-law and former White House adviser Jared Kushner, whose investment fund has poured millions into U.S. solar projects.

Kushner’s investment fund, Affinity Partners, gambled on the growth of green energy by investing a lot of money in the Californian solar financing company Mosaic. Its stake in Mosaic is “north of 10 percent” and Affinity has a seat on the company’s board of directors, according to a person who was granted anonymity to speak freely about the company’s portfolio. The total investment is worth more than $100 million, the person said.

Affinity also co-led a $200 million funding round in 2022 for Mosaic, which has provided more than $14 billion in loans to homeowners.

Trump, by contrast, has railed against green energy for years, falsely claiming that wind turbines cause cancer and driving whales “crazy” and warning that electric vehicles could unleash a “carnage” on the auto industry. And while the presumptive Republican nominee has been less vocal on solar energy specifically, he has pledged to cut all spending under the IRA, the 2022 climate law that underpins the country’s clean energy boom. to stop.

“Upon taking office, I will immediately impose a moratorium on all new spending, subsidies and giveaways under Joe Biden’s massive socialist bills, such as the so-called Inflation Reduction Act,” the former president said at a rally in Wisconsin last month. We’re going to save all that money. It doesn’t help you at all.

Neither Affinity nor Mosaic responded to requests for comment on the record.

It’s unclear how much of Kushner’s own personal fortune — if any — may be tied to the solar project. Kushner’s fund has attracted a flood of investment from outside the US, including money from the petro-states Saudi Arabia, Qatar and the United Arab Emirates, according to reporting in The New York Times.

But as lead investor in Mosaic, Affinity would have taken the highest stake in the company during the funding round – and would be positioned to receive the highest reward if the company succeeds. Mosaic provides loans for solar energy projects and sustainable home improvements.

Axios first reported in 2022 on Affinity’s decision to take a stake in Mosaic, a deal later confirmed by The New York Times and The Wall Street Journal, among others.

It’s telling that both Kushner and some fossil fuel companies are entering the clean energy market, says Andrew Rosenberg, who was a senior official at the National Oceanic and Atmospheric Administration during the Clinton administration.

The sector is growing and profitable, he said. But he said he doesn’t expect Kushner — or Trump — to publicly praise clean energy as a viable path to business success.

“The truth is, this is a good thing for them, it’s a good thing for their wallets, it’s a good thing for the country — in terms of jobs — and it’s a climate imperative,” Rosenberg said. “Instead of telling people they’re doing all these things, they make backroom deals and say, ‘How can I just take all the money and run?'”

Kushner’s investment came as lawmakers reached a final deal on the Inflation Reduction Act. The final law, which President Joe Biden signed in August 2022, was estimated to include about $370 billion in tax breaks and clean energy incentives, leading to a boom in solar and wind energy projects. More recent estimates from the Joint Committee on Taxation say tax credits could ultimately double that amount.

Since the law was passed, Mosaic’s clean energy loans have nearly doubled.

That means Kushner’s investment fund risks losing money if Trump is elected and cuts off government support for the clean energy sector.

Trump has promised to be a “dictator” on his first day in office to boost fossil fuels. He has also called the IRA the “largest tax hike in history,” and his allies and former government officials have laid out a detailed plan to repeal the clean energy law.

It’s unclear whether Trump wants to go after the solar tax breaks, which have been a boon to Mosaic.

But Mosaic is a fan of the climate law. The company joined Rewiring America to raise public awareness about the IRA – and touts its work as an essential tool for fighting climate change.

“We know that, like a Mosaic, we must all come together to achieve our vision: 100% clean energy for all,” the company’s website says.

Kushner’s growing portfolio

Solar energy is in a blooming cycle.

The Inflation Reduction Act has spurred $13 billion in private investment in about 80 factories or expanded solar energy production facilities, according to the White House. The Solar Energy Industries Association reported that solar energy accounted for more than half of all new electricity generation capacity last year, a 51 percent increase from when the IRA went into effect. The solar industry now employs more than 250,000 Americans.

During his campaign, Trump has made scant mention of solar energy in recent months, even as conservative and fossil fuel advocacy groups expect him to strip the clean energy sector of government support.

Trump’s allies in the conservative movement, including former administration officials, see a second Trump term as an opportunity to expand fossil fuels.

More than a hundred conservative groups have joined the Heritage Foundation to create Project 2025, a blueprint for a second Trump administration with detailed plans to roll back the IRA. It also calls for eliminating renewable energy offices within the Department of Energy and other parts of the federal government that support the clean energy industry.

Tom Pyle, a Project 2025 staffer and member of Trump’s Department of Energy transition team, said the former president is not as opposed to solar energy as he is to wind energy projects.

But he also said Kushner’s company’s investment did not appear to be large enough to influence Trump’s approach to clean energy.

“It doesn’t feel like a whole lot of money to me when he says, ‘Oh God, I better be nice to solar now,’” Pyle said.

Kushner’s Affinity is funded almost entirely by foreign investors, according to the company’s most recent filing with the Securities and Exchange Commission in March. In addition to Mosaic, the fund has invested in an Israeli car leasing company, a German fitness equipment company and the operator of the Burger King brand in Brazil.

Most of Affinity’s money, or $2 billion, comes from Saudi Arabia’s government fund, while Qatar and the United Arab Emirates each contributed $200 million, according to The New York Times.

Kusher developed relationships with those countries while working for Trump in the White House. And as his investments grow, so do concerns about conflicts of interest.

“Following the laws and regulations is something we always do,” Kushner told The New York Times in April. “Perception, as I learned from my time in politics, is important. But I have no control over what everyone will write or say about me.”

Noah Bookbinder, chairman of Citizens for Ethics and Responsibility in Washington, said Kushner has shown little concern for avoiding conflicts of interest because he “seemed to potentially leverage the work he did in the White House into investments.”

“In a kind of common sense way, it seems like a clear conflict of interest,” he said. “He has significant financial interests in several industries and with several countries, and he has a father-in-law who – from past experience he is close and influential – makes policy statements that could influence what the United States does in the future . and that could drive decisions that other countries or companies are making now.”