One of the biggest areas of investment in artificial intelligence (AI) is data centers. Applications in generative AI are driving a new wave of demand for cloud storage, server racks, network infrastructure and more.

While Nvidia is a major provider of data center services, other players are coming forward with formidable solutions. Furthermore, even major tech giants, such as Amazon, are investing significant amounts in building their own data centers. Smart investors understand that there are a multitude of opportunities entering the growing data center world – a market expected to reach nearly $440 billion by 2028, according to Statista.

Stock analyst and media personality Jim Cramer was recently appointed Constellation Energy (NASDAQ: CEG) as a top choice for data center services. While this may seem a bit unusual, Constellation Energy is currently discussing some interesting partnerships and could very well emerge as a big winner from the AI data center boom.

Below, we explore how the company could play a major role in the data center arena and whether now is a good time to pick up some shares.

Data centers consume a lot of energy

Data centers act as storage units for IT architecture and network infrastructure. These buildings house larger server racks filled with hardware such as graphics processing units (GPUs), which are used for accelerated computing.

Although data centers play an integral role in the AI ecosystem, there is one major drawback: data centers use a lot of electricity.

According to the Department of Energy, data centers use between 10 and 50 times more energy than a standard commercial office. This translates to about 2% of total electricity consumption in the US

Research of Goldman Sachs suggests that energy demand in data centers will increase at a compound annual growth rate (CAGR) of 15% through 2030 – reaching approximately 8% of total US energy demand by 2030.

Constellation Energy offers a unique solution

Given that the long-term tailwinds AI is fueling are directly correlated with rising energy consumption – especially electricity – data centers will sooner or later need an alternative solution. Constellation Energy may have the answer.

The company is active in many aspects of the energy sector, including solar energy, wind energy and natural gas. But another solution that Constellation Energy is bringing to the table is nuclear energy. And the best part? Large tech companies are interested.

During Constellation Energy’s most recent earnings call, management hinted that the company is in talks with ‘Magnificent Seven’ members Microsoft And Alphabet about possible cooperation in the field of nuclear-powered data centers.

Additionally, Goldman confirmed the growing interest in nuclear energy, calling it “an attractive generation source for data centers as it is carbon-free and reliable.”

Are Constellation Energy Shares a Buy Now?

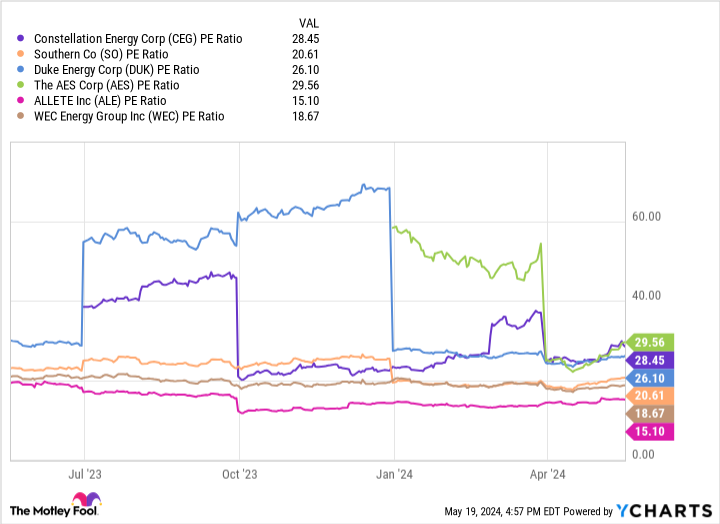

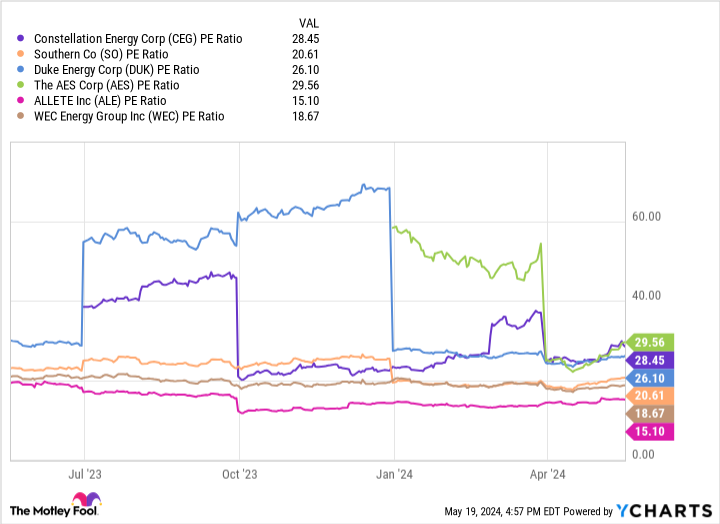

At the time of writing, Constellation Energy was trading at a price-to-earnings (P/E) ratio of 28.4 – well above S&P500‘s P/E of 24.8.

Furthermore, after benchmarking Constellation Energy against other regulated utilities, the company appears to be trading at a premium compared to some of its competitors.

While Constellation Energy may be pricey compared to other utilities, I see the company as an under-the-radar opportunity among AI investments. While there will be obvious investment choices between big tech companies and competitors from the periphery of IT infrastructure, energy stocks should not be forgotten when it comes to AI.

For this reason, Constellation Energy could be seen as a better value compared to many tech stocks whose valuation multiples have risen dramatically over the past year as AI tailwinds have fueled buying activity.

Since nuclear energy is attracting interest from the largest AI companies, I wouldn’t overlook the energy sector in general.

Given Constellation Energy’s relationship with big tech and its capabilities at the intersection of data center services and nuclear energy, I see the stock as an attractive buying opportunity for long-term investors.

Should You Invest $1,000 in Constellation Energy Now?

Consider the following before purchasing shares in Constellation Energy:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Constellation Energy wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions at Alphabet, Amazon, Microsoft and Nvidia. The Motley Fool holds positions in and recommends Alphabet, Amazon, Constellation Energy, Goldman Sachs Group, Microsoft and Nvidia. The Motley Fool recommends Duke Energy and recommends the following options: long January 2026 $395 calls at Microsoft and short January 2026 $405 calls at Microsoft. The Motley Fool has a disclosure policy.

Forget Nvidia: Jim Cramer Says This Company Is About to Make Money From Artificial Intelligence (AI) Data Centers Originally published by The Motley Fool