On June 7, S&P Dow Jones Indices announced that cybersecurity company CrowdStrike Holdings (NASDAQ: CRWD) will enter his famous S&P500 index on June 24. It is an announcement that has caught the attention of many investors.

With a market cap of $94 billion at the time of writing, CrowdStrike will be one of the most valuable companies ever added to the S&P 500. Airbnb And Uber Technologies There have been other significant additions with valuations of around $80 billion and $125 billion respectively. While CrowdStrike agrees with these industry leaders, the biggest addition was by far Tesla in 2020, which had a market cap of about $400 billion when news broke of its addition to the S&P 500.

So what can CrowdStrike investors expect next? Here are some insights we can gain by using history as a guide.

The S&P 500 Inclusion Effect

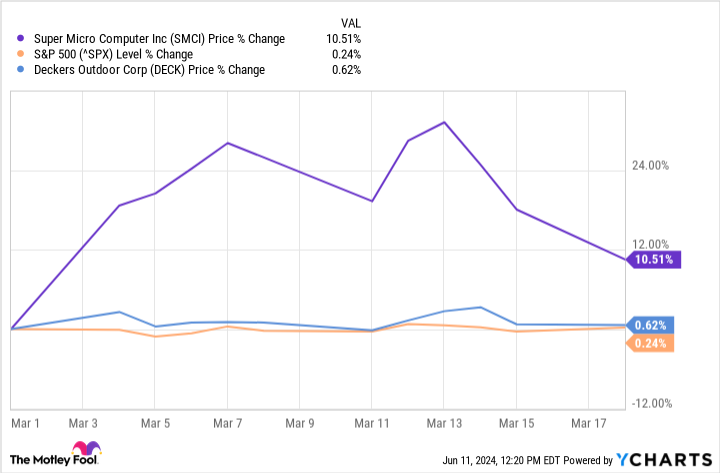

There is an investment theory called the S&P 500 inclusion effect. The theory states that stocks tend to outperform the market average between the announcement and the day they are officially admitted to the index. As an example, Super microcomputer was added to the S&P 500 earlier this year and indeed outperformed between its announcement and its official inclusion.

However, this does not always happen, and any winnings are usually not as great as with Super Micro Computer. For example, Deckers Outside was announced and added at the exact same time as Super Micro Computer. But it wasn’t the same rally as you can see below:

In other words, there’s no guarantee that stocks will get a big boost when they become eligible to join the S&P 500: Super Micro Computer jumped while Deckers barely moved.

Based on a 2021 survey, CrowdStrike stock could fall in the next month or so S&P Global which analyzed more than 25 years of data. According to the study, the average outperformance of stocks between the announcement and official inclusion in the S&P 500 was about 3.5 percentage points. In other words, if the S&P 500 rose 1% in the meantime, the stock added to the index rose about 4.5%.

At the time of writing, CrowdStrike stock is up 11.0% since the announcement, but the S&P 500 is up 1.4%. If the trends from the S&P Global survey hold, CrowdStrike will pull back in the coming weeks.

In addition, S&P Global’s research showed that from the official inclusion of a share in the index until 21 days after inclusion, the median share underperformed the index with 1.7 points.

In other words, based on these historical trends, CrowdStrike stock could continue to lag the S&P 500 from June 24 through mid-July.

Does this mean investors should sell CrowdStrike stock?

Whether you are a trader or a long-term investor, after reading the above your alarm bells may now be ringing. But they should ring for entirely different reasons.

Alarm bells are ringing among traders as they see the potential for CrowdStrike to reverse the recent rally. However, alarm bells should be ringing for investors as they recognize the risks associated with taking action on these short-term fluctuations. Selling based on S&P Global’s research would be unwise.

Will CrowdStrike stock fall in the next month or so? It is possible. But on the other hand, underperformance over a short period of time is always possible. After all, short-term price movements are impossible to predict. That’s why most day traders lose money.

Long-term returns, on the other hand, are generally based on actual business results. And thinking about things this way, investors should be encouraged by the recent news. After all, joining the largest, most profitable U.S. companies in the S&P 500 doesn’t just happen: CrowdStrike is where it’s at after years of strong business performance.

Looking ahead, there is reason to believe CrowdStrike can continue to outperform. The company expects its market opportunity to more than double to $225 billion over the next four years, giving it a long growth trajectory.

CrowdStrike has shown for years that it can grow faster than its competitors by capturing market share. The company continues to expand offerings on its cloud-based platform, which offers significant upsell opportunities. Moreover, it has been shown to be able to do all this profitably.

In other words, CrowdStrike has achieved profitable growth in a growing industry. Since nothing has changed for the company with this latest news, it’s reasonable to expect these trends to continue. Yes, an addition to the S&P 500 could cause some short-term ups and downs in the stock price. However, for long-term investors who rightly focus on the underlying business, nothing has changed.

Should you invest $1,000 in CrowdStrike now?

Consider the following before purchasing shares in CrowdStrike:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Jon Quast has positions at Airbnb. The Motley Fool holds positions in and recommends Airbnb, CrowdStrike, S&P Global, Tesla and Uber Technologies. The Motley Fool has a disclosure policy.

Like Airbnb, Uber, and Super Micro Computer before it, CrowdStrike is joining the S&P 500. Here’s what history says will happen next. was originally published by The Motley Fool