Six U.S. companies have a valuation of at least $1 trillion, and all are in the technology sector. So far, five of them have moved into the $2 trillion club or higher:

-

Microsoft is estimated at $3.3 trillion.

-

Apple is estimated at $3.2 trillion.

-

Nvidia is estimated at $3 trillion.

-

Alphabet is estimated at $2.3 trillion.

-

Amazon (NASDAQ: AMZN) is estimated at $2 trillion.

Amazon is the newest member, having surpassed the $2 trillion mark for the first time last week. The company generates more revenue than any of its peers on the list above, but that hasn’t translated into a higher valuation due to its relatively modest profitability. Amazon’s e-commerce business, for example, operates on razor-thin margins.

But the company is making changes that are delivering substantial bottom-line gains. Combined with its growing presence in artificial intelligence (AI), investors are clearly paying attention. Here’s why $2 trillion likely isn’t the end of the road for Amazon.

Amazon is in the AI era

Amazon was founded as an e-commerce company, and online sales are still its biggest source of revenue. However, investors are focusing heavily on its other businesses, such as streaming, digital advertising, and especially cloud computing. Amazon Web Services (AWS) is the world’s largest cloud platform, and it’s preparing to dominate the three core layers of AI.

At the bottom tier, AWS designed its own chips for both training and inferencing AI models, and they’re becoming increasingly popular because they can be up to 50% cheaper to operate than some of its other infrastructure, which is powered by Nvidia’s industry-leading hardware. What’s more, they help AWS alleviate supply constraints that other data center operators like Oracle (NYSE: ORCL) struggle with.

Large language models (LLMs) are the second layer. The AWS Bedrock platform provides developers with a full portfolio of prebuilt LLMs they can use to accelerate the buildout of customer-facing applications like chatbots and virtual assistants. That portfolio includes a family of LLMs designed by Amazon itself, called Titan, as well as LLMs from leading AI startups like Anthropic.

The application layer is the third, and includes finished AI software that is ready for integration into almost any business. The new virtual assistant Amazon Q is a good example, as it can analyze large amounts of data to identify potential revenue opportunities, and it can also analyze, debug, and write computer code to accelerate software development.

But Amazon’s use of AI extends to its legacy e-commerce business, too. It powers the recommendation engine on amazon.com to show customers products they’re likely to buy, and the company has also developed a suite of AI tools to help sellers create more appealing product pages to drive sales.

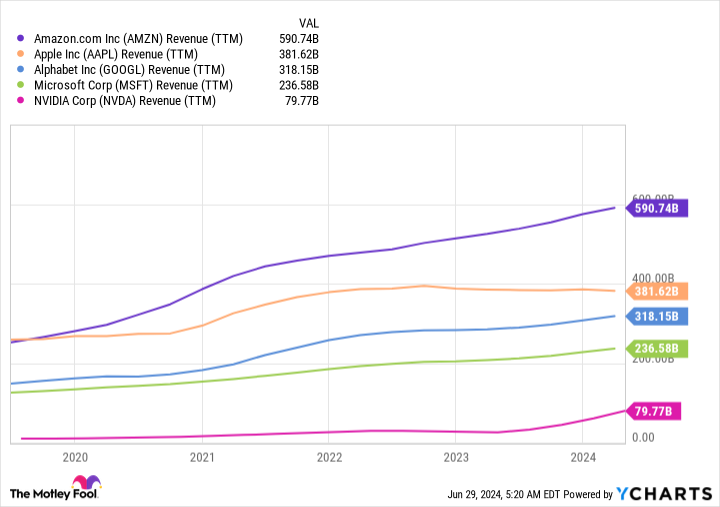

Amazon generates more revenue than any of its competitors

Amazon generated $590 billion in revenue in the past 12 months, far outpacing any competitor in the $2 trillion club:

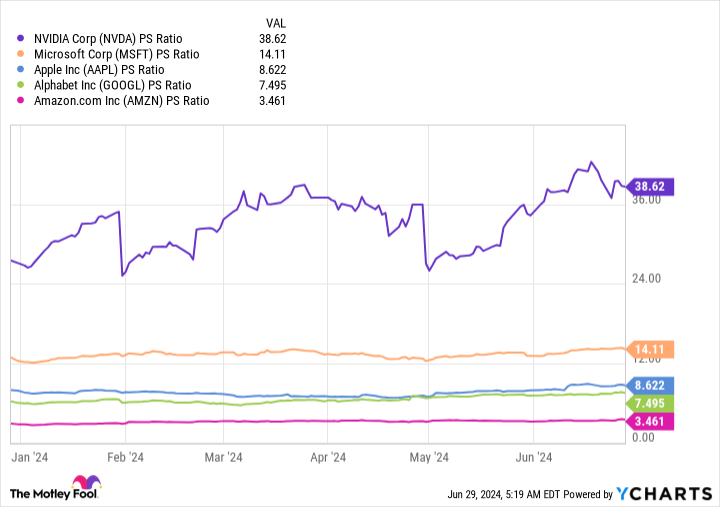

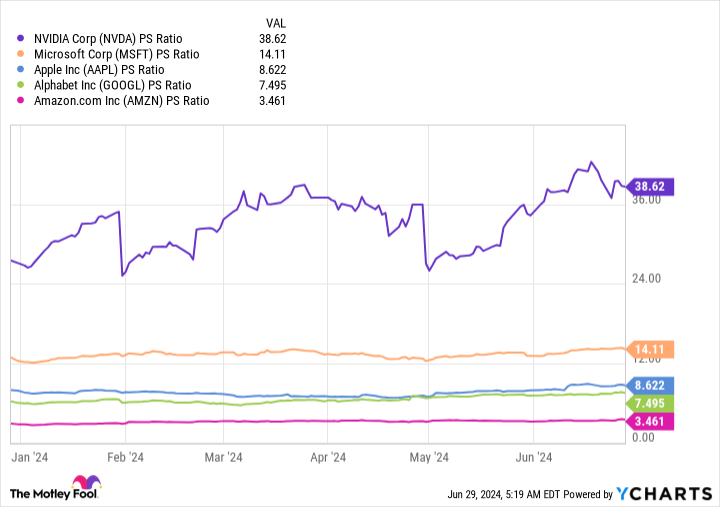

However, Amazon’s price-to-sales ratio (P/S), which is calculated by dividing valuation by sales, is the cheapest of the bunch:

Simply put, investors haven’t given Amazon full credit for both sides of its business. In the recent first quarter of 2024 (ended March 31), the AWS cloud platform contributed 61.5% of the company’s total operating profit, despite representing just 17.5% of total revenue.

The e-commerce segment, on the other hand, has inflated revenues but often generates operating losses because Amazon charges low prices to sell a large volume of products. But the company is working to improve profitability in that segment. Last year, it split its national U.S. fulfillment network into eight regions, allowing certain geographic locations to hold higher inventory levels for the most popular products. That means products travel shorter distances to reach customers, reducing logistics costs.

By the end of 2023, Amazon’s cost to serve (the cost of fulfilling orders) on a per-unit basis globally fell for the first time since 2018. Additionally, nearly 60% of Prime members in Amazon’s 60 largest metropolitan areas received their orders the same day or next day in the first quarter of this year. Amazon CEO Andy Jassy says faster deliveries mean customers are ordering more often and spending more money, which is good for both revenue and profitability.

Strong contributions from both AWS and its e-commerce business helped Amazon’s net income rise to $10.4 billion in Q1 2024, up 225% from the same period last year. That’s a key reason why investors have been flocking to its stock lately.

$2 Trillion Probably Won’t Be the End of the Line for Amazon

Based on Amazon’s $3.57 earnings per share over the past 12 months, the stock is trading at a price-to-earnings (P/E) ratio of 54.1. The average P/E ratio of the other four stocks in the $2 trillion club is 42.9. That’s why Amazon was so late in gaining membership, despite its sky-high revenue (it seems expensive by comparison).

However, improving profitability will pave the way for Amazon shares to rise. Wall Street expects the company to deliver earnings of $5.41 per share in 2025, which puts the stock at a forward price-to-earnings ratio of 35.7. In other words, the stock would need to rise 20% by the end of next year to trade in line with the current average price-to-earnings ratio of the rest of the $2 trillion club.

AI could further fuel Amazon’s bottom line. The company recently invested $4 billion in Anthropic , and as part of the deal, the startup will make AWS its primary cloud provider. The company also pledged to use Amazon’s chips to train its future models, which could entice other leading developers to try them. Finally, it will make those models available on AWS for customers to use, which could help the cloud platform win over customers that might otherwise have chosen competitors like Microsoft Azure.

In summary, investors with at least a two-year time horizon are getting a great deal on Amazon stock today, even though it recently set a new all-time high. But investors with a longer-term outlook could reap greater rewards as AI unlocks more opportunities for the company.

Should You Invest $1,000 in Amazon Now?

Before you buy stock on Amazon, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the unstoppable stock that just joined Nvidia, Microsoft, Apple and Alphabet in surpassing $2 trillion in market cap originally published by The Motley Fool