June is a popular month for stock splits. Two recent high-profile ones were Amazon And Shopifyboth in June 2022. June’s two latest stock splits are Nvidiawhich split its shares 10 to 1 last week, and Chipotle Mexican Grillwhich will be split at 50-for-1 on June 26.

When a company splits its stock, it implies that it has grown tremendously and that management expects even more growth. A high price tag can be a barrier to entry for some investors, or at the very least can seem intimidating to investors who don’t have four figures to invest. A lower price per share could seem more attractive.

Stock splits get a lot of attention, and stock prices usually rise after the announcement. They often jump after the split as well, making them even more attractive. With high stock prices and rising graphs, Costco Wholesale (NASDAQ: COST) And MercadoLibre (NASDAQ: MELI) could be next.

Costco: The Resilient Membership Model

Costco operates a paid membership model that generates high sales growth and large profits. It’s a win-win for the company and its members: Costco gets a recurring revenue stream with its fees, as well as reliable traffic and volume, and customers get the lowest prices on their favorite products.

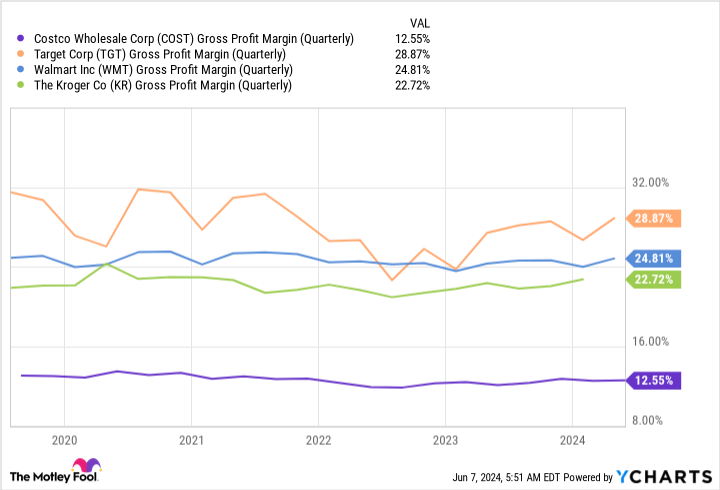

Companies often tout growing gross margins, which are typically the basis for increasing profits. Costco, on the other hand, isn’t trying to get its gross margins high; the company has very low gross margins. It doesn’t raise prices to send more money to the bottom line. Instead, it marks products to cover associated costs and relies on high volume for sales increases. Fees make up the majority of net revenue.

Consider the margin compared to Walmart, GoalAnd Kroger.

It is a unique and powerful model that has led to strong performance and incredible shareholder value over time.

Investors don’t have to worry about lingering opportunities. Costco operates just 879 total warehouses, 606 of which are in the US. It’s not even in every state yet and is just getting started in many international regions, including China.

It also plans to increase membership fees at some point. It’s already past the average period when the rate usually increases, which is about every five years.

Management believes the company is currently performing quite well without this, and it would put additional pressure on the already stressed consumer base. The company focuses on creating value for shoppers and shareholders, which will build consumer loyalty and trickle down from sales to profits.

Investors are so excited about Costco stock that its valuation recently reached record highs. Costco hasn’t split its stock in nearly 25 years, but with shares rising with no sign of stopping, it could be a new tool in management’s arsenal. Management is committed to creating shareholder value, and a stock split would meet that goal.

MercadoLibre: Incredible horizontal opportunities

MercadoLibre is an e-commerce giant based in Latin America. It offers similar opportunities as Amazon did when it was in its early stages.

The company’s shares have already delivered incredible profits to investors – up 5,500% since its IPO – and are trading at a quadruple-figure price. The stock has never been split, but as it continues to show high growth with plenty of opportunity to sustain it, it could be on management’s radar.

MercadoLibre’s main activity is e-commerce, and that segment is experiencing very strong sales growth. Gross merchandise volume (GMV) increased 71% year over year (currency neutral) in the first quarter of 2024, and the company continues to refine its process to become more efficient and capture greater market share.

That results in a flywheel effect: as MercadoLibre’s e-commerce service improves, more customers rely on it for more of their needs, increasing economies of scale. MercadoLibre serves a large population with a low e-commerce penetration rate but a high e-commerce growth rate, implying that this company has a long growth trajectory.

MercadoLibre’s newer fintech business is growing even faster. Total payment volume increased by 86% in the first quarter compared to last year. The company has expanded this segment from a digital payments app to a financial services app with credit cards and other products and is opening its first full-service digital bank in Mexico.

MercadoLibre is an excellent company with many possibilities. As the price continues to rise, management may decide it is time for a split.

Buy them for the long term

There is some evidence that stock split stocks post gains after their split, but the correlation may be more about the company’s excellent performance than the split itself. If you decide to buy a stock that is splitting or could split soon, do so because of the excellent long-term performance and opportunity that typically comes with a great stock split.

Should You Invest $1,000 in Costco Wholesale Now?

Consider the following before buying shares in Costco Wholesale:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil holds positions in MercadoLibre. The Motley Fool holds positions in and recommends Amazon, Chipotle Mexican Grill, Costco Wholesale, MercadoLibre, Nvidia, Shopify, Target, and Walmart. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.

Nvidia and Chipotle split their shares. Could these two companies be next? was originally published by The Motley Fool