(Bloomberg) — The biggest U.S. tech stocks are not just a bet on innovation but also a potential hedge against inflation, according to some respondents in the latest Bloomberg Markets Live Pulse survey.

Most read from Bloomberg

Gold, the haven of choice for decades, is still seen as the best protection against the risk of rising prices, according to 46% of survey participants. But almost a third said the tech giants would be their first choice for the role.

The answer highlights the dominant role that companies such as Nvidia Corp., Amazon.com Inc. and Meta Platforms Inc. play in the US financial markets as they expand their power over large parts of the economy. That has allowed them to generate stable profits, creating rallies that give investors confidence that they will continue to be a source of solid profits.

U.S. inflation has fallen significantly from 2022’s torrid levels but exceeded economists’ expectations through the first three months of the year and remained stubbornly above the Federal Reserve’s 2% target.

That has meant that price increases have generally become the biggest concern among investors. A majority of survey respondents – 59% of 393 – identified resurgence of inflation as the biggest risk facing financial markets between now and the end of the year. The next reading of the consumer price index is scheduled for next Wednesday and is likely to be around 3.4%.

Nvidia, for example, is up more than six times since inflation first rose above 2% in March 2021. Even Apple Inc., which has had its ups and downs, has outperformed the broader market in that time frame, gaining more than 50% versus the S&P. 500 is about 30%. Still, technology companies, like other growth stocks, are sensitive to changes in inflation and interest rates because their valuations depend largely on future earnings.

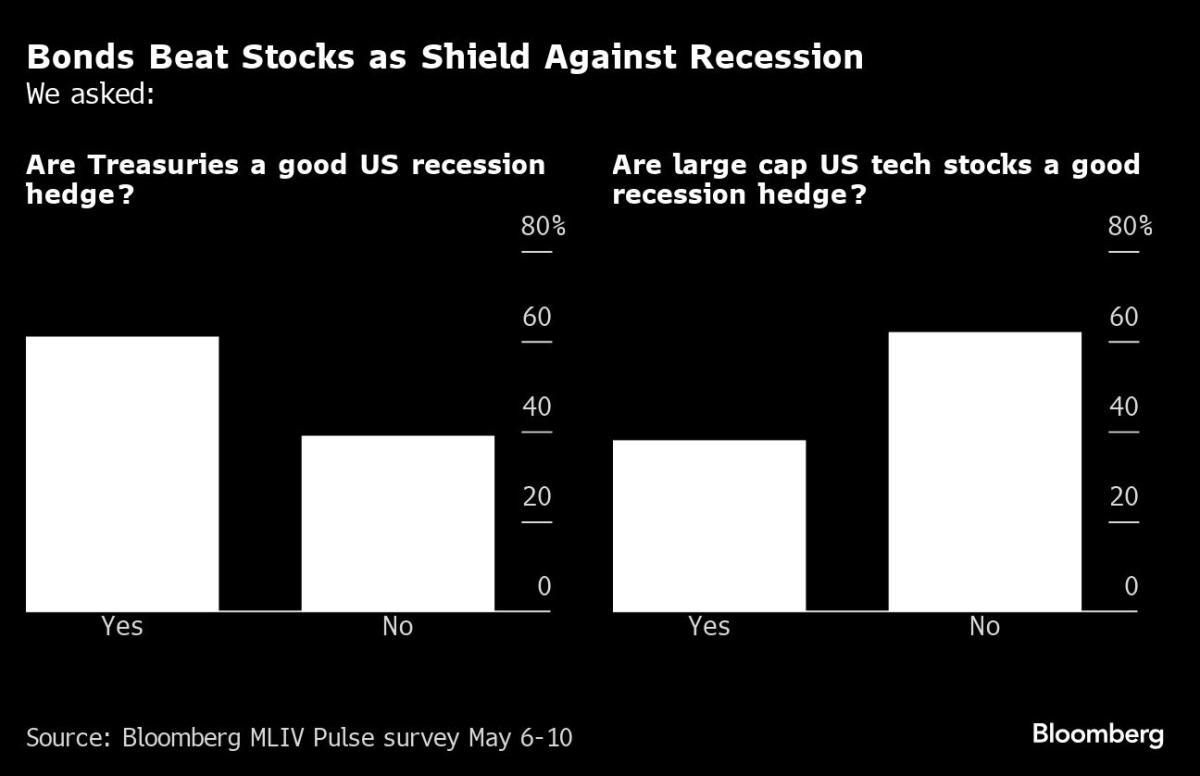

About a quarter of respondents named a recession in the US as the biggest risk for 2024. In that case, government bonds and not shares would provide a better shield, the survey shows.

Read more: We need to talk about recession risk again: MacroScope

The surprising resilience of the economy, despite the Fed’s tighter monetary policy, has kept money flowing into the US, where bond yields are high and corporate profits continue to grow.

The inflow has fueled a renewed rise in the U.S. dollar, which is generally seen as the best currency to weather times of market turmoil.

Nearly three-quarters of respondents said the dollar was the best port currency, with the Swiss franc getting about 23% of the vote and the Japanese yen about six times less. Among respondents from the US and Canada, the dollar received 86% of the votes, while in Europe 43% of participants chose the Swiss currency.

The yen has lost its haven status due to its depreciation against the dollar and Japan’s ultra-loose monetary policy, the survey found. The gaping difference between Japan and US interest rates sent the yen to its lowest level since 1990 earlier this year.

Read more: Gold Rally makes it look more like a hedge than a refuge: Macro View

Gold is up nearly 15% this year, with the People’s Bank of China one of the biggest sources of demand. With the seizure of Russia’s dollar assets in the wake of the war in Ukraine, many countries are looking to diversify away from the dollar, with gold being a natural beneficiary. Only 13% of respondents in the MLIV Pulse survey said the search for geopolitically untethered assets has benefited Bitcoin.

The MLIV Pulse survey is conducted among Bloomberg readers at the terminal and online by Bloomberg’s Markets Live team. Sign up here to receive future surveys.

–With help from Simon White.

Most read from Bloomberg Businessweek

©2024 BloombergLP