Nvidia (NASDAQ: NVDA) stocks have literally lifted the stock market. Since January 2023, the stock has risen 740% on the enthusiasm for artificial intelligence. The S&P 500 44% return in the same period. In other words, Nvidia was responsible for about a fifth of the S&P 500’s gains over the past 18 months.

Nvidia reset its soaring stock price with a 10-for-1 stock split in June, its second split in three years. Shares have traded sideways since then, but Wall Street remains bullish. Nvidia has an average price target of $136 per share, which represents an 11% upside from the current price of $122 per share.

The highest price target comes from Rosenblatt’s Hans Mosesmann, who thinks Nvidia will rise 64% to $200 per share by June 2025. The lowest price target comes from DA Davidson’s Gil Luria, who thinks Nvidia will fall 26% to $90 per share over the same period.

Read on for more information.

Nvidia has a significant competitive advantage in its ecosystem of supporting software

Nvidia’s graphics processing units (GPUs) excel at accelerating complex data center workloads like artificial intelligence (AI). The company consistently sets performance records on MLPerf benchmarks and objective tests for AI technologies, and it has over 80% market share in AI chips. But Nvidia’s true formidability comes from its ability to cement its dominance in AI chips with an ever-expanding ecosystem of supporting software.

Nvidia introduced the CUDA programming model in 2006, a software layer that allowed its GPUs (originally designed for computer graphics) to function as general-purpose data center processors. “Millions of lines of code have been written for CUDA over the years, making it easier to develop new AI applications using Nvidia’s chips,” according to The Wall Street Journal.

More recently, Nvidia introduced AI Enterprise, a suite of pre-trained models and software tools that streamline the development and deployment of AI applications across a wide range of use cases. For example, the AI Enterprise suite includes frameworks for recommender systems, logistics route optimization, conversational assistants, cybersecurity threat detection, and autonomous robots.

Rosenblatt analyst Hans Mosesmann sees that as a key competitive advantage. “The real story is in the software that complements all the hardware goodness,” Mosesmann recently told clients. “We expect this software aspect to grow significantly in terms of the overall sales mix over the next decade.”

On the other hand, analyst Gil Luria of DA Davidson is concerned that Nvidia is making most of its revenue from Amazon, Alphabet, MicrosoftAnd Tesla. Those four companies are developing their own AI chips to replace Nvidia GPUs. Luria thinks competition will be problematic, saying, “As we look beyond the next four to six quarters, we think a decline in demand for Nvidia computing is inevitable.”

Both analysts make valid points, but Mosesmann’s argument seems to trump Luria’s concerns. Rivals are indeed building custom AI chips, but history suggests they’ll need a similar software ecosystem to truly displace Nvidia. Alphabet, for example, has been using custom AI chips called Tensor Processing Units (TPUs) for nearly a decade. But Nvidia GPUs remain the gold standard.

Indeed, Toshiya Hari at Goldman Sachs isn’t worried about competition. “We believe Nvidia will remain the de facto industry standard for the foreseeable future, given its competitive advantage that spans both hardware and software capabilities,” he wrote in a note to customers. “Nvidia’s annual introduction of new products and platforms sets a pace of innovation that keeps the company at the forefront of the industry.”

Wall Street has high expectations for Nvidia’s revenue and profit growth

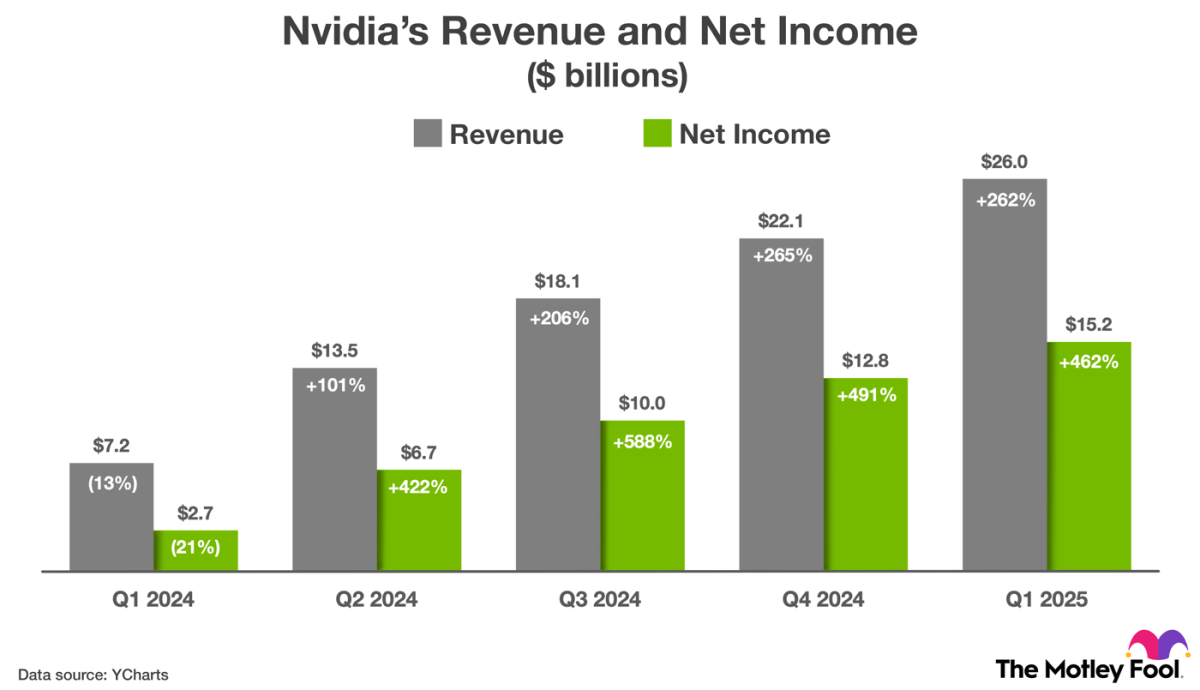

Nvidia reported exceptional financial results for the first quarter of fiscal year 2025 (ended April 28, 2024). Revenue increased 262% to $26 billion and non-GAAP net income increased 462% to $15.2 billion. CEO Jensen Huang said the growth was “fueled by strong and accelerating demand for generative AI training and inference” solutions.

What makes Nvidia’s first quarter performance so impressive is that it comes on top of the triple-digit growth it achieved in the previous three quarters, as shown in the chart below.

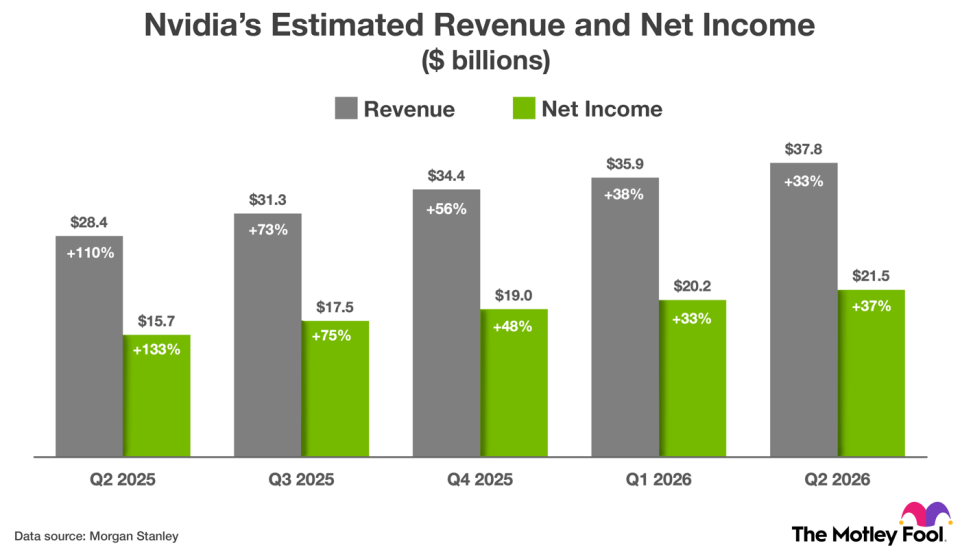

Looking ahead, Wall Street analysts have high expectations for Nvidia. The chart below shows consensus revenue and non-GAAP net income estimates for the next five quarters.

Nvidia shares are trading at an acceptable valuation compared to Wall Street’s earnings estimates

I mentioned earlier that Nvidia shares have risen 740% since the beginning of January 2023. After that price increase, investors might assume that Nvidia is exorbitantly valued. But the stock currently trades at 72 times earnings, a discount to the three-year average of 87 times earnings and the five-year average of 80 times earnings.

What’s more, Wall Street expects Nvidia to grow earnings per share by 33% per year over the next three to five years. That makes the current valuation bearable. Investors shouldn’t fool themselves into thinking the stock is cheap. But Nvidia remains one of the best ways for patient investors to expose their portfolios to AI, a market that’s expected to grow 36% per year through 2030.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $751,670!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Goldman Sachs Group, Microsoft, Nvidia and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Completed Its 10-For-1 Stock Split In June. Here’s How High AI Stock Could Go, According To Wall Street was originally published by The Motley Fool