-

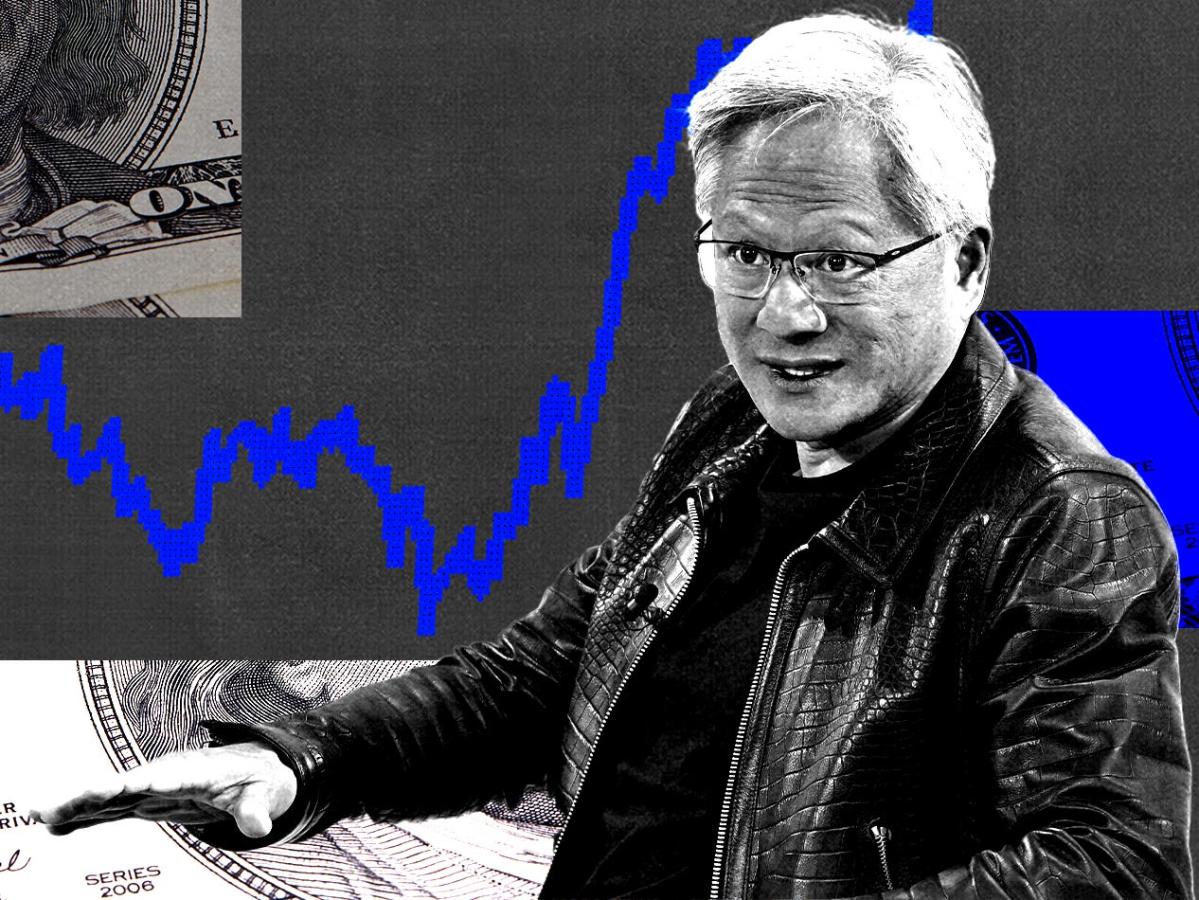

According to strategist Bill Blain, Nvidia stock is giving a sell signal.

-

Blain cites Nvidia’s high valuation and wealthy employees as reasons for quitting.

-

According to him, the rise in the chip maker’s share price marks the culmination of a decades-long market cycle.

According to veteran strategist Bill Blain, Nvidia stock is sending a clear sell signal to investors.

Blain, the founder of Wind Shift Capital and a veteran financial strategist, pointed out in a note Tuesday that Nvidia’s sky-high valuation has made many of its employees very wealthy. He pointed to a recent poll that found that 40% of people working at Nvidia had a net worth between $1 million and $20 million, while 37% had a net worth of more than $20 million.

Blain said that as a result, less than a third of Nvidia’s workforce is experiencing “real day-to-day financial pressure.”

“Do you think that poor neighborhood of Nvidia peons are really going to break their hearts for guys who are already rich and highly motivated to protect their wealth and position? Do they think Nvidia is going to rise another 700%? Will they be happy to remain extremely poor compared to their colleagues and bosses? Or is it more likely that the enormous wealth in the office means that the poorer but still highly motivated staff will think their chances of getting rich are better elsewhere? Blain wrote.

Nvidia’s soaring valuation could also signal a spike in the broader stock market, Blain said. While investors are pricing in ambitious rate cuts in the coming year, policy easing will likely be “limited” by the Fed, he said, adding that he believed 4%-6% interest rates would be the market’s new normal.

“Some people think that lower interest rates, as promised by the Fed later this month, will mean unlimited joy for the markets. (I think it could still be a sell-the-fact moment.)” Blain said. “And many, including myself, believe that a new long-term economic cycle could reverse the last 40 years of reduced inflationary pressures.”

Markets began their current long-term cycle in the 1980s as inflation steadily declined after a difficult period of inflation in the previous decade, Blain said. He suggested markets could enter a new cycle as early as 2025, pointing to inflationary pressures from geopolitical tensions, commodities and the rising U.S. debt balance.

“I’ve just found my best reason to sell Nvidia, confirming that we’re at the top of the market. What could happen next? How about 20 years of rising inflation, rising tariffs, and a global commodity supercycle as countries scramble to secure future strategic resources?” he added.

Other strategists have warned of persistent inflationary pressures despite the slowing of price growth from its 2022 peak. BlackRock strategists have previously predicted that inflation could pick up again, citing the risk of a sharp rise in oil prices and demand outstripping supply in the U.S. economy.

Read the original article on Business Insider