Key Points

-

Nvidia stock was on track for one of its best weeks of the year on Friday, recovering from a two-week slump that wiped more than 20% off the advanced chipmaker’s market value.

-

Nvidia’s stock price has been in turmoil in recent weeks as enthusiasm for AI waned on Wall Street and quarterly results fell short of high expectations.

-

Demand for AI and the Nvidia chips that make it possible is expected to remain strong, according to analysts, with the vast majority still bullish on the stock despite its recent loss of momentum.

-

Bernstein analysts reiterated in a note earlier this week that Nvidia is one of their top picks for semiconductors, calling it “the best way to play AI.”

Nvidia (NVDA) stock was on track for one of its best weeks of the year on Friday, recouping most of its losses from the previous weeks, as investors heeded analyst recommendations and bought the dip.

Shares of Nvidia were little changed Friday afternoon, sending its stock up nearly 16% for the week, the second major rally in a volatile month for the chipmaker’s stock.

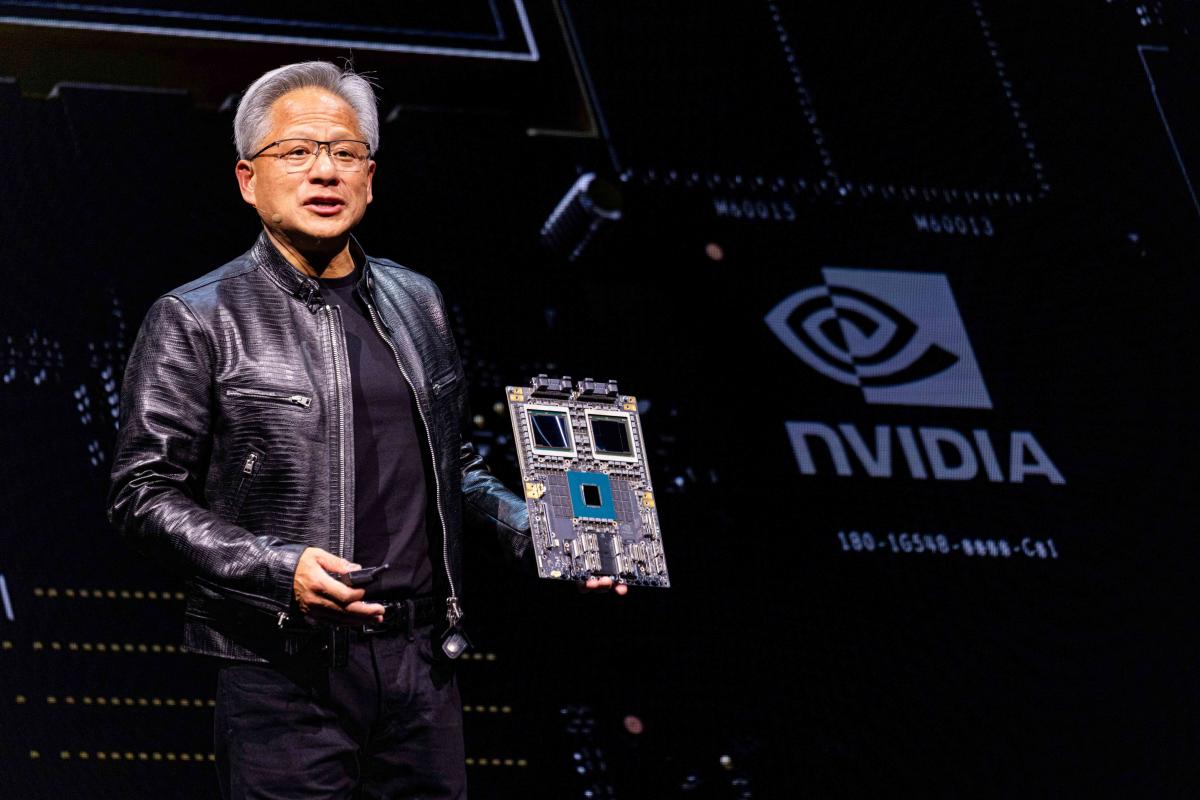

Shares rose earlier this week after CEO Jensen Huang, speaking at a Goldman Sachs conference, called demand for Nvidia’s products “incredible” and touted the size of the company’s market opportunity.

“Generative AI is not just a tool. It’s a skill,” Huang told Goldman Sachs CEO David Solomon at the event. “And that’s why people think AI is going to go beyond the $1 trillion in data centers and IT and into the world of skills.”

Nvidia’s rally came after its stock fell more than 20% in the previous two weeks as Wall Street optimism about all things AI waned and its quarterly report, despite beating official estimates, fell short of investors’ high expectations.

Yet the unrest appeared to have more to do with market sentiment than the strength of the chipmaker’s business.

Reports that Nvidia’s next-generation Blackwell system would be delayed due to a design flaw contributed to a sharp sell-off in early August. As far as analysts can tell, however, delays are unlikely to have much of an impact on quarterly sales.

That’s partly because demand for Nvidia’s chips is so high that customers are taking whatever they can get.

Cloud hyperscalers Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOG; GOOGL) each said in their most recent earnings reports that they would continue to increase their spending on AI infrastructure — a significant portion of which will go to Nvidia chips — throughout this year and next as they build out their AI capabilities. Tesla (TSLA) CEO Elon Musk estimated that the electric vehicle maker would spend between $3 billion and $4 billion on Nvidia’s chips this year, representing a whopping 40% of its total AI spending.

What Analysts Think About Nvidia Stock

The huge demand is a big reason analysts still have Nvidia at the top of their buy lists, despite the stock’s recent loss of momentum. Bernstein analysts reiterated in a note earlier this week that Nvidia was one of their top semiconductor picks, calling it “the best way to play AI.”

“Yes, the numbers are so good (and moving so high, so fast) that investors are concerned about sustainability,” the analysts wrote. “But,” with margins likely to improve next year as Blackwell’s sales grow, “now is clearly not the time to worry.”

Analysts at Bank of America Securities sounded a similar note late last week when they argued that Nvidia’s share price pullback presented an “enhanced buying opportunity.”

Of the 63 Nvidia analysts tracked by FactSet Research, 50 gave the stock a Buy, the highest possible rating. Only four analysts gave the stock a Neutral rating, and none advised investors to sell it.

Read the original article on Investopedia.