It’s no secret that Intel (NASDAQ: INTC) is struggling. The stock has fallen more than 60% so far this year and was the worst performer in the Dow Jones Industrial Average this year.

The company was once the world’s largest chipmaker, dominating the personal computer (PC) market. That helped it become one of the first two technology companies to join the famed Dow Jones Industrial Average, along with Microsoft back in the late 1990s. However, the paths of the Wintel duo have diverged greatly over the past decade.

Microsoft is a leader in artificial intelligence (AI) that has expanded into other industries such as cloud computing, while Intel is in danger of losing its grip on the PC market to more advanced Arm-based chips made by competitors.

In addition, Broadcom just dealt a major blow to its contract manufacturing business, which it launched in 2021 to help turn the company around. After testing Intel’s latest manufacturing technology, the chipmaker concluded it wasn’t viable for large-scale production.

Nvidia is the logical replacement

Now that Intel is reeling, rumors are swirling that its days on the Dow Jones Index are numbered. The logical replacement would be Nvidia (NASDAQ: NVDA)which is now the world’s largest chipmaker. As its revenue has grown, the company has become a symbol of the AI boom.

Demand for its graphics processing units (GPUs) is currently insatiable as technology companies rush to build the data center infrastructure needed to power AI. Meanwhile, its chips have become the backbone of the AI buildout, with the company expected to have more than 80% market share in the GPU space.

The company’s lead in the space comes not just from the technological prowess of its chips, but also from the wide moat it’s been able to carve out through its CUDA software platform. Developed long before AI became the next big thing, the software was the standard by which programmers learned to program GPUs, giving it the massive advantage it has today.

Meanwhile, on top of CUDA, Nvidia has also been building a number of microservices, libraries, tools, and technologies, called CUDA-X, to extend its software leadership. It recently introduced a number of new libraries for a variety of purposes, from data processing to gene sequencing to vector databases.

While Nvidia is now synonymous with its GPUs used in data centers to build AI infrastructure, the company is no one-trick pony. It also gained a major networking platform when it acquired Mellanox in 2020. The company now has three networking platforms, and its networking revenue doubled last year. While its data center customers are its biggest, the company also sells its products into a number of industries, including gaming, cryptocurrency mining and automotive.

If the Dow Jones wants to keep a semiconductor company in the index as a replacement for Intel, Nvidia is a good choice. Unlike the S&P, which is a market cap-weighted index, the Dow is a price-weighted index, so Nvidia’s recent stock split could help it get into the index, since it was a bit too expensive to begin with.

The Dow doesn’t have hard and fast rules for inclusion in the index. The criteria are that “a stock is generally only added if the company has an excellent reputation, shows continued growth, and is attractive to a large number of investors.” The company must also be headquartered and incorporated in the U.S. Nvidia meets all of those requirements.

The Dow Committee, which consists of two representatives from The Wall Street Journal and three of S&P Worldwidewill ultimately determine which companies are included and which are removed. If the committee believes AI is going to be a big part of the U.S. economy, then Nvidia is the obvious choice to add.

Is Buying Nvidia Stock a Good Idea?

Ultimately, adding Nvidia to the Dow probably won’t impact the stock’s long-term performance. However, it would be a great recognition and could give it a boost in the short term.

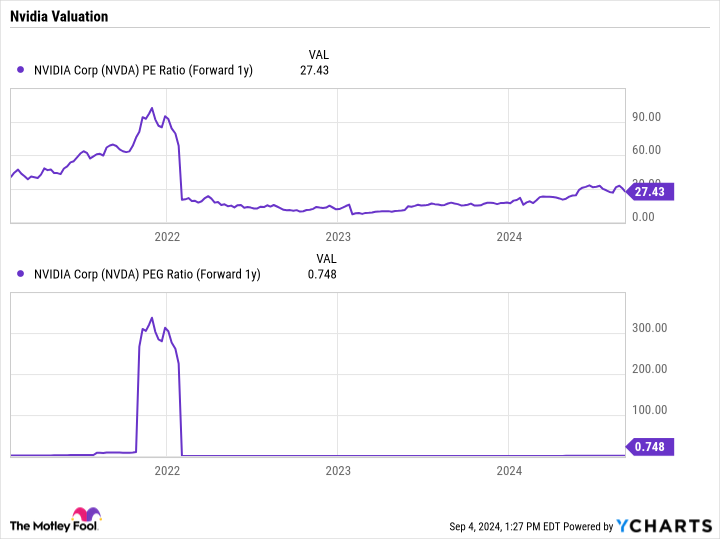

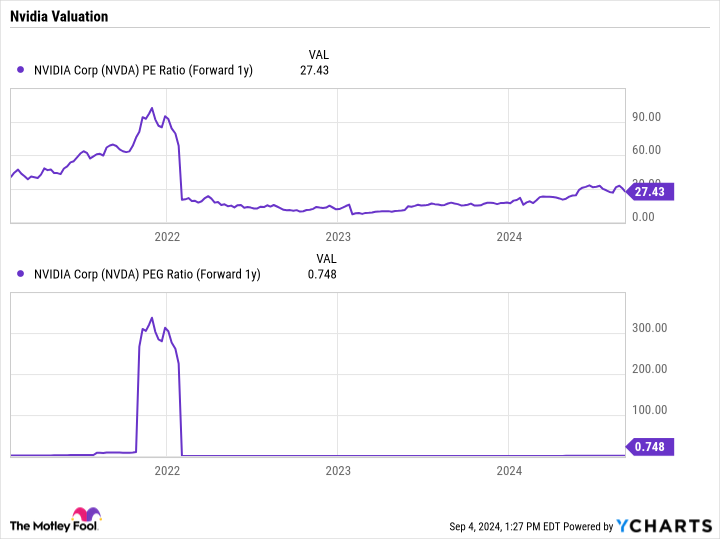

Regardless, Nvidia appears to be a solid buy over the long term given its growth prospects and wide moat. Plus, with the recent sell-off in tech stocks, the stock is also cheap, with a forward price-to-earnings (P/E) ratio of about 27.4 and a price/earnings-to-growth (PEG) ratio of just under 0.75.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $630,099!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft, Nvidia and S&P Global. The Motley Fool recommends Broadcom and Intel and recommends the following options: long Jan 2026 $395 calls on Microsoft, short Jan 2026 $405 calls on Microsoft and short Nov 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: Nvidia Will Replace Intel in the Dow Jones Index was originally published by The Motley Fool