(Bloomberg) — Nvidia Corp. missed investor expectations with its latest results on Wednesday, disappointing guidance and amid news of production problems with its much-vaunted Blackwell chips.

Most read from Bloomberg

Follow the news and analysis from Nvidia’s earnings report in our live blog.

The company’s quarterly report — the most anticipated part of the tech industry’s earnings season — met or beat analysts’ estimates on nearly every metric. But Nvidia investors have grown accustomed to standout quarters, and its latest numbers didn’t qualify.

What’s more, Nvidia’s next big cash cow — its new Blackwell processor lineup — has proven harder to produce than expected. That news contributed to a stock drop of as much as 8.4% in late trading after the results were released. Shares had more than doubled this year through Wednesday’s close, after gaining 239% through 2023.

“It was a battle against high and unsustainable expectations,” Bloomberg Intelligence analysts Kunjan Sobhani and Oscar Hernandez Tejada said in a note.

Third-quarter revenue will be about $32.5 billion, the company said. While analysts on average had predicted $31.9 billion, estimates ranged as high as $37.9 billion.

The disappointing outlook threatens to derail an AI frenzy that has transformed Nvidia into the world’s second-most valuable company. The chipmaker has been the main beneficiary of a race to upgrade data centers to handle AI software, and its sales forecasts have become a barometer for that spending boom.

Before the announcement, there were concerns that Nvidia was having problems with its new Blackwell design. The company acknowledged that there were production issues and said it was making changes to improve production yields—the number of working chips that come out of its factories. At the same time, the company said it expects to generate “several billion dollars” in revenue from the product in the fourth quarter.

“The anticipation for Blackwell is incredible,” CEO Jensen Huang said in a statement.

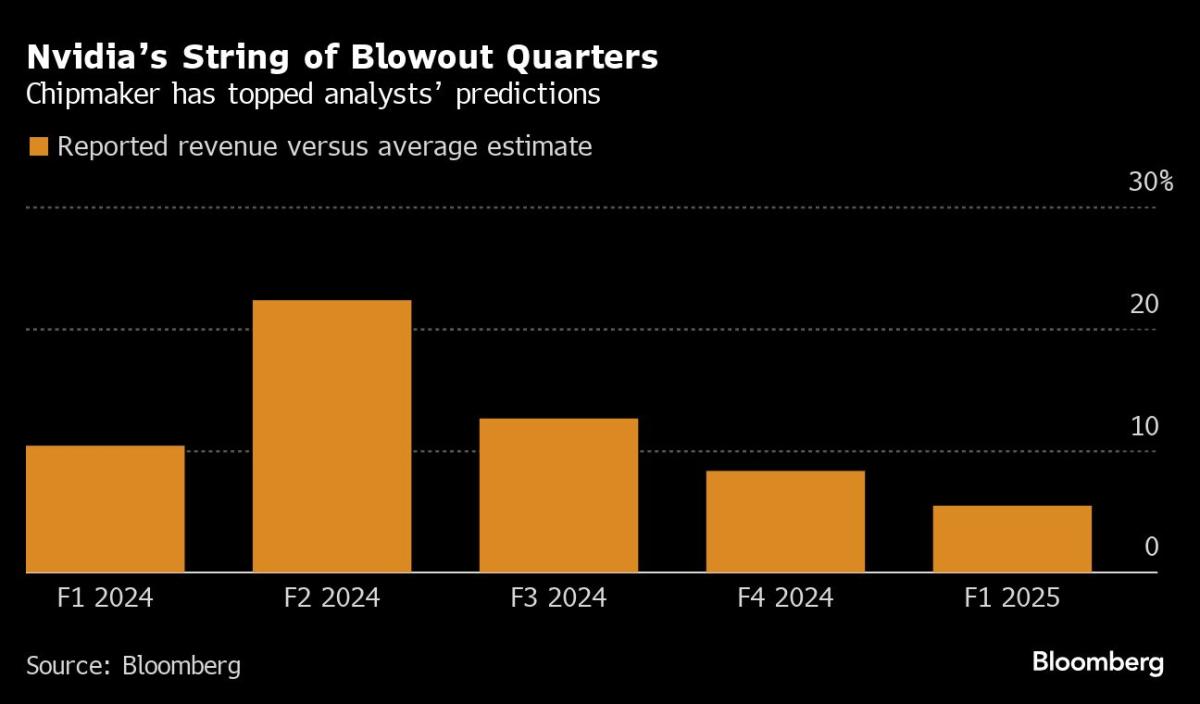

Nvidia is coming off a string of quarters that beat Wall Street expectations — even as analysts continued to raise estimates. But the amount of upside has been declining.

Most of Nvidia’s growth is also coming from a small group of customers. About 40% of Nvidia’s revenue comes from large data center operators — companies like Alphabet Inc.’s Google and Meta Platforms Inc. — that are pouring tens of billions of dollars into AI infrastructure.

While Meta and others have increased their capital expenditure budgets this earnings season, there are concerns that the amount of infrastructure being built will exceed current requirements, which could lead to a bubble. But Nvidia’s Huang has insisted that this is just the beginning of a new era for technology and the economy.

Expectations were high. Nvidia is the best-performing stock in the S&P 500 Index this year, outperforming all other semiconductor companies. With a market cap of more than $3 trillion, Nvidia is worth about as much as the next 10 largest chip companies combined.

Nvidia made its name selling video game cards, but is now best known for so-called AI accelerators. These chips, derived from its graphics processors, are used to develop artificial intelligence software by bombarding it with information.

The process, known as training, makes AI models better at recognizing and responding to real-world input. Nvidia’s components are also used in systems that then execute the software, a phase known as inference, and help power services like OpenAI’s ChatGPT.

Last quarter’s results beat Wall Street expectations, and the Santa Clara, Calif.-based company’s board approved an additional $50 billion in share buybacks.

Nvidia’s revenue more than doubled to $30 billion in its fiscal second quarter, which ended July 28. Excluding certain items, earnings were 68 cents a share. Analysts had forecast revenue of about $28.9 billion and earnings of 64 cents a share.

Nvidia gained a lead over other chipmakers because its technology was a good fit for the needs of AI. But rivals are trying to catch up. Advanced Micro Devices Inc. is now its biggest competitor, with Intel Corp. — once the world’s largest chipmaker — lagging far behind. Their combined market share is only about 5% of Nvidia’s total revenue.

Nvidia’s data center division — now by far its biggest revenue generator — generated $26.3 billion in revenue in the most recent quarter. Gaming chips brought in $2.9 billion. Analysts had called for $25.1 billion for the data center unit and $2.79 billion for gaming.

Blackwell is expected to generate a new wave of growth as it rolls out in the coming months. Analysts have downplayed concerns about delays, noting that the company still has huge demand for its current-gen products. That could help Nvidia weather any delays without a major financial hit.

In describing the challenges with Blackwell, Nvidia said it had to change a mask manufacturing step to improve yield. A mask is the template used to burn the circuit pattern into materials deposited on a wafer of silicon.

According to Nvidia, Blackwell’s production will be scaled up in the fourth quarter and continue into the next fiscal year.

During a post-results conference call, analysts wanted more details about how much revenue the new Blackwell chips would generate and when. Huang and Chief Financial Officer Colette Kress stuck to their promise of billions of dollars in fourth-quarter revenue and declined to elaborate.

The price continued to fall as the call continued and no responses were given.

In typical style, Huang made high-level predictions about the future of the computer industry, arguing that it will take a trillion dollars worth of equipment to replace aging equipment in the world’s data centers. That replacement process is just beginning, he said.

According to him, AI is taking over computer search and helping companies speed up their business processes. Moreover, it is necessary for countries to secure data.

“It affects how every layer of computing is done,” Huang said.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP