Nvidia (NASDAQ: NVDA) will complete a 10-for-1 stock split tomorrow after market close. The split follows a huge price increase. Nvidia returned 205% in the past year and 580% in the past three years, with enthusiasm about artificial intelligence being the main reason for these gains.

What does the split mean for investors? Shareholders receive nine additional shares for each share they own. The stock will begin trading on a split-adjusted basis on Monday, June 10. Importantly, the demerger will not impact the value of the company or change an investor’s interest in the company.

The big question is: what happens after the stock split? Of course, there’s no way to know for sure, but we can make an educated guess by examining Nvidia’s performance after past stock splits.

History says Nvidia stock is headed for a sharp decline

Nvidia has completed five stock splits since its 1999 IPO. After these events, stocks typically fell (often significantly) over the next twelve and twenty-four months, as shown in the chart.

|

Share split date |

Inventory split type |

Return (12 months later) |

Return (24 months later) |

|---|---|---|---|

|

July 20, 2021 |

4-for-1 |

(4%) |

145% |

|

September 11, 2007 |

3-for-2 |

(70%) |

(53%) |

|

April 7, 2006 |

2-for-1 |

1% |

(6%) |

|

September 12, 2001 |

2-for-1 |

(72%) |

(49%) |

|

June 27, 2000 |

2-for-1 |

28% |

(52%) |

|

Average |

(23%) |

(3%) |

Data source: YCharts.

As it turns out, Nvidia shares fell an average of 23% over the twelve-month period following previous stock splits, and the shares were still down an average of 3% after 24 months. In other words, history says Nvidia is headed for a steep, long-term decline.

But there’s a big asterisk in this statement: four of the past five stock splits occurred just before a recession. Specifically, the U.S. economy was in a recession from March 2001 through November 2001, and from December 2007 through June 2009. This economic downturn caused bear markets that had devastating effects on the stock market, so Nvidia naturally got dragged down.

Importantly, even though shares initially fell, investors still did exceptionally well if they bought shares when any of the previous stock splits occurred. The diagram provides details.

|

Share split date |

Inventory split type |

Return (since the stock split) |

|---|---|---|

|

July 20, 2021 |

4-for-1 |

527% |

|

September 11, 2007 |

3-for-2 |

14.580% |

|

April 7, 2006 |

2-for-1 |

24.840% |

|

September 12, 2001 |

2-for-1 |

40.100% |

|

June 27, 2000 |

2-for-1 |

42,650% |

Data source: YCharts.

Going forward, Nvidia’s performance depends primarily on its ability to grow revenue and profits, and investors have good reason to be optimistic.

Nvidia is the market leader in artificial intelligence chips

The bull case for Nvidia builds on its critical position in the artificial intelligence (AI) economy. Nvidia graphics processing units (GPUs) are the standard-bearer of accelerated computing, a discipline that combines specialized hardware and software to accelerate demanding data center workloads such as AI applications. Indeed, the Wall Street Journal recently reported that “Nvidia’s chips are the foundation for all of the most advanced AI systems, giving the company a market share estimated at more than 80%.”

Its dominance in the GPU market has allowed Nvidia to expand into adjacent data center product categories, including central processing units (CPUs) and networking equipment, as well as subscription software and cloud services. CEO Jensen Huang sees this evolution as an important competitive advantage. “We are literally building the entire data center,” he told analysts. “This deep knowledge across the data center scale is fundamentally what sets us apart today.”

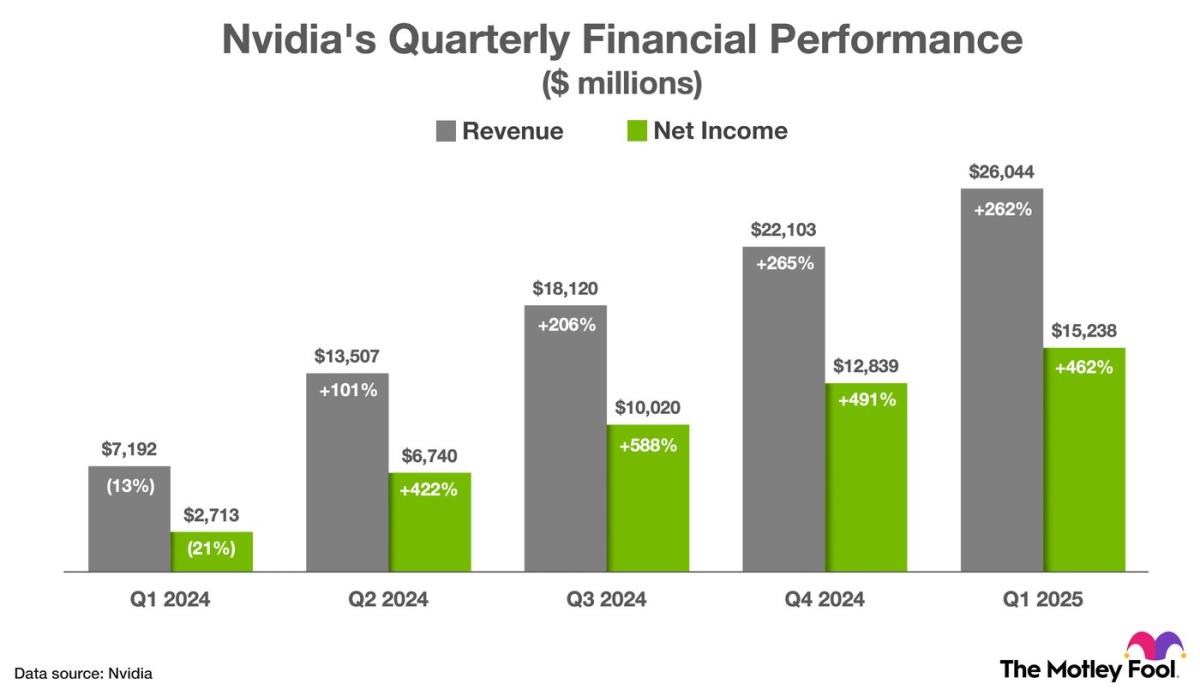

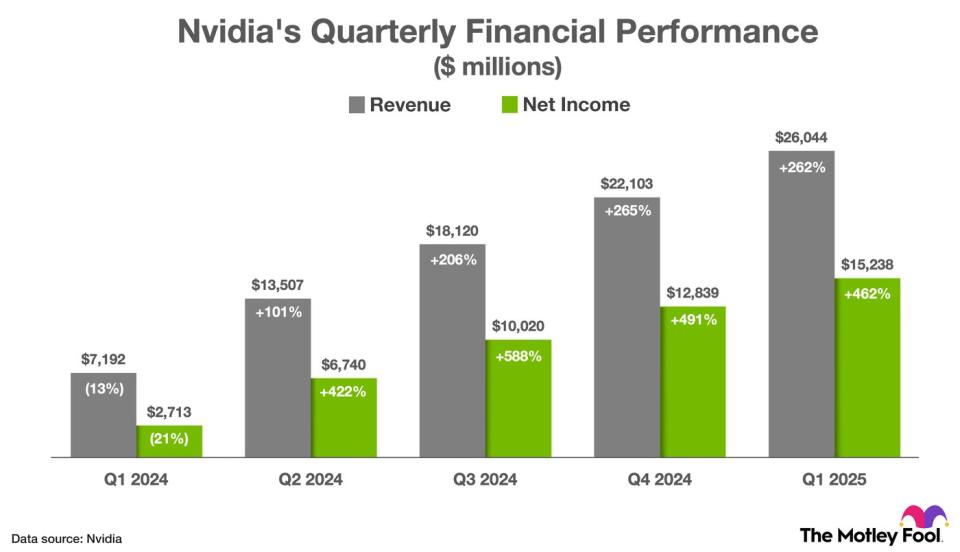

Nvidia has put together a series of really impressive financial reports, as shown in the chart. That trend continued in the first quarter. Revenue rose 262% to $26 billion thanks to strong data center revenue growth, driven by demand for AI products. Meanwhile, gross margin rose 12 percentage points and non-GAAP (generally accepted accounting principles) net income rose 462% to $15.2 billion.

Going forward, Nvidia will inevitably lose momentum at some point, but the company will have a powerful tailwind in the coming years. According to Grand View Research, spending on artificial intelligence hardware, software and services will increase 36.6% annually through 2030.

Somewhat surprisingly, Nvidia shares are trading at a discount to their historical valuation

Some investors may worry that Nvidia is overvalued, as its shares have tripled in the past year. But profits have actually grown faster. Remember, non-GAAP net income rose 462% in the first quarter. This means that the price-earnings ratio has fallen.

Furthermore, Wall Street expects Nvidia to grow earnings per share 38% annually over the next three to five years, and the stock currently trades at 70 times earnings. That gives a PEG ratio of 1.8, a significant discount to the three-year average of 3.2. In short, Nvidia stock is trading at a cheaper-than-average valuation despite its phenomenal share price appreciation over the past year.

I close with a quote from Morgan Stanley analyst Joseph Moore: “The bottom line is that we think the background warrants exposure to AI, even under extreme enthusiasm – and Nvidia remains the clearest way to get that exposure.”

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Trevor Jennevine has positions at Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia will execute its 10-for-1 stock split tomorrow. History says artificial intelligence (AI) stocks will do this next (hint: it might shock you). was originally published by The Motley Fool