AI chip leader Nvidia will be embarrassed by its wealth in the coming years, and shareholders will be rewarded, technology analysts have predicted.

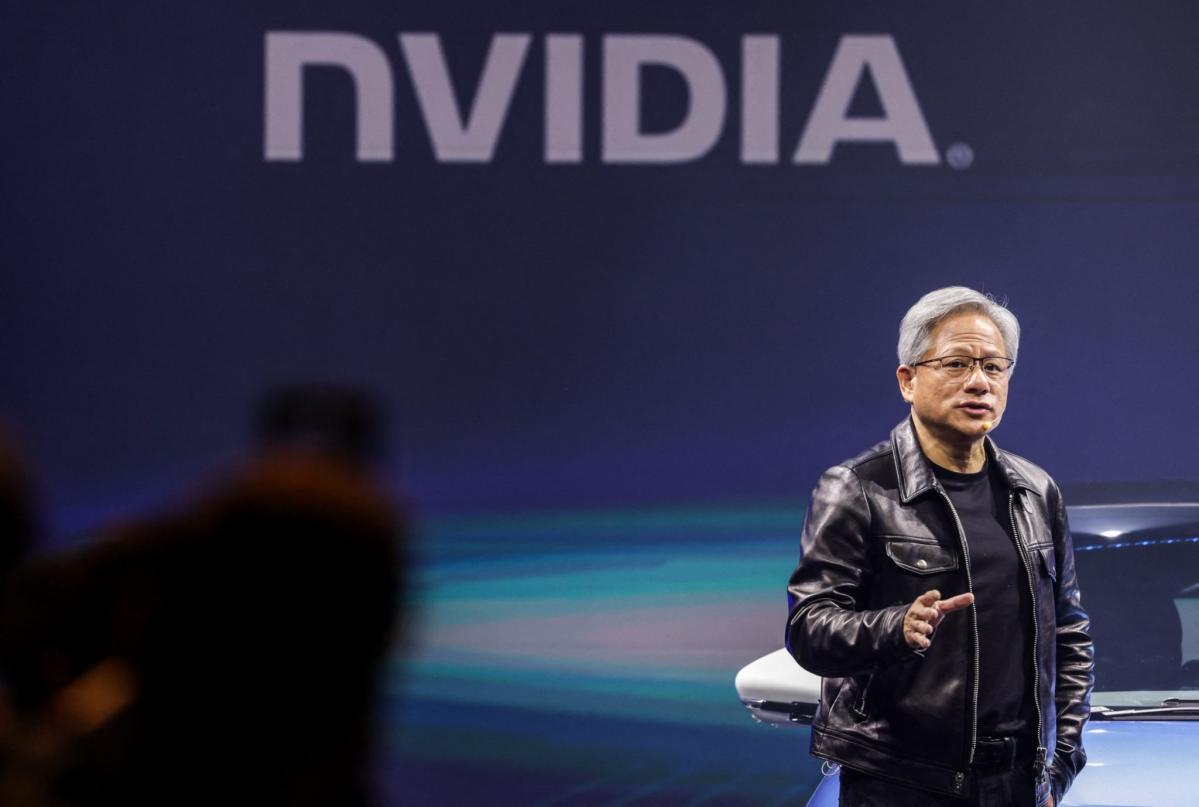

Ben Reitzes, managing director and head of technology research at Melius Research, told CNBC on Wednesday that Jensen Huang’s Nvidia has mastered a “full stack” approach with its hardware and software, giving it a significant advantage in AI.

“What they did was build a computer language and an ecosystem that allows you to monetize AI, and it’s clear they’re very good at it,” he said.

Reitzes has a $160 price target on Nvidia stock, implying a 30% upside from Friday’s closing price. Despite an ongoing sell-off that began earlier this month, shares are up 150% so far this year, after more than tripling in 2023. Of the Magnificent 7 stocks he covers, Nvidia has the most upside, he added to.

Another major advantage Nvidia has over rivals is its annual cadence of innovating new products, Reitzes said. That means developers and customers know where Nvidia is going and can budget for upgrades accordingly.

“And they’re running 150 miles an hour when everyone else is running 100 miles an hour. It’s going to be hard to catch these guys,” he said.

Given Nvidia’s lead in the booming AI space, Melius Research expects the company to generate $270 billion in cash over the next three years, potentially paving the way for massive shareholder returns.

Management may not be eager to tout the possibility of stock buybacks because they are often associated with older companies, Reitzes said. But he says it is clear.

“Nobody’s talking about it, and if you do the model that we do, it’s a money-spinner,” he said. “And there’s nothing they can do. This government isn’t going to allow them to buy anything big. They can’t invest that much in R&D. That’s just not possible. So we have to get it as shareholders.”

Certainly, Nvidia has returned capital to shareholders. In August, it announced a $25 billion buyback program. And last month, Nvidia increased its quarterly dividend by 150% from $0.04 per share to $0.10, which equates to $0.01 per share after the split.

Nvidia declined to comment on the possibility of further share buybacks.

Reitzes, for his part, was quick to point out that any future buybacks would not imply that Nvidia has stopped growing. “It’s not an insult to buy back shares when you have nothing else to do.”

Nvidia’s recent financials show that its cash-generating ability is increasing. In the fiscal year ended in January, Nvidia’s net cash from operations rose to $28.1 billion from $5.6 billion in the previous year.

And in the first quarter ended April, net cash from operating activities was $15.3 billion – more than half of last year’s total.

Meanwhile, Huang told investors last week that Nvidia will remain the gold standard for AI training chips, amid concerns that rivals could chip away at its market share.

The rollout of Nvidia’s Blackwell system later this year will only strengthen that lead, he said Wednesday at the company’s annual shareholders meeting.

“The Blackwell architecture platform will probably be the most successful product in our history and even in the history of computing,” Huang said.

This story originally ran on Fortune.com