It appears that analysts have reported new growth Nvidia‘S (NASDAQ: NVDA) Stock almost every week for more than a year. Experts have said more than once that the company’s shares are overvalued. And yet the stock price continues to rise.

Nvidia shares are up 174% over the past year, up 122% year to date, and are up again this month. The company’s shares are up 25% in the past 30 days, thanks to another profit boost and continued dominance in AI. So you might be wondering: Is it still worth investing in Nvidia, and does it have much to offer new investors?

Past profits and the company’s position in technology suggest that Nvidia stock remains an attractive long-term option for those in it. Technology stocks are known for delivering significant profits for patient investors, and Nvidia holds one of the most powerful positions in the sector.

This is why Nvidia remains a screaming buy even after its stock prices just exploded.

Growth catalysts across the technology sector

Nvidia has created scores of bullish investors since last year, thanks almost entirely to its growing role in artificial intelligence (AI). A boom in the market has sent demand for graphics processing units (GPUs) soaring, with Nvidia perfectly positioned to immediately start supplying its chips to companies across the market.

As a result, the company’s quarterly revenue has increased 93% since last year, while operating income and free cash flow have increased 149% and 281%, respectively.

While Nvidia has tremendous growth potential in AI and will likely benefit from market tailwinds for years to come, it’s also crucial to consider the company’s other positions in technology. Demand for chips is rising across the industry as virtual/augmented reality, autonomous vehicles, video games, cloud computing and more require more powerful hardware to take their products to the next level. Consequently, Nvidia has growth catalysts in multiple technical areas.

In the first quarter of 2025 (ending April 2024), Nvidia’s revenues rose 262% year over year, while operating income rose 690%. The company’s AI-focused data center segment was responsible for most of that growth, with revenue increasing 427%.

However, Nvidia’s gaming segment, which includes revenue from consumer GPU sales and custom chips for consoles, reported a solid 18% increase in revenue. Meanwhile, the professional visualization and automotive divisions delivered revenue growth of 45% and 11%.

The video game market alone was valued at $217 billion by 2022 and is expected to grow at a compound annual growth rate of 12% until at least the end of the decade. Furthermore, Nvidia sees enormous potential in the automotive sector in the coming years as self-driving technology continues to develop. CFO Colette Kress calls it a potential billion-dollar business for Nvidia.

Nvidia’s business appears to be evolving as the entire technology market evolves, suggesting that its stock prices are far from reaching their ceiling.

Nvidia is a better value than AMD according to several metrics

Throughout Nvidia’s meteoric rise, analysts have often compared the company to its biggest competitor, Advanced micro devices. The fellow chipmaker has the second-largest market share in GPUs (after Nvidia) and is also expanding in AI, albeit with a late start compared to Nvidia. As a result, AMD stock enjoyed some sympathy for Nvidia’s growth, rising 33% since last June.

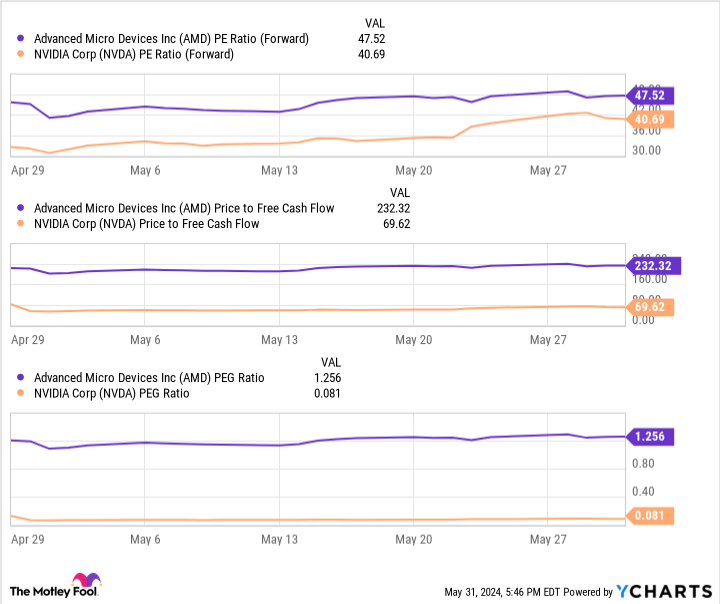

While some analysts have said that AMD could be a better stock to invest in AI, the chart below shows that Nvidia stock offers significantly more value.

This chart compares the valuations of Nvidia and AMD using forward price-to-earnings ratios, price-to-free cash flow, and price-to-earnings-growth metrics. They all compare a company’s stock price to a financial benchmark, making them useful ways to determine a stock’s value. For any statistic, the lower the number, the better the value.

As a result, Nvidia is a bargain compared to AMD, despite delivering significantly more share growth over the past year. Meanwhile, the company’s lead in AI has given it a dominant position that will be challenging for competitors to overcome, with its stock a potentially more reliable option.

Given its diverse business model and technology growth catalysts, Nvidia is a crying buy for long-term investors.

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s stock price just exploded. Time to buy? was originally published by The Motley Fool