Since the start of 2023, no trend has driven Wall Street’s major stock indexes to new heights more than the rise of artificial intelligence (AI).

The appeal of AI is the ability of software and systems to learn over the long term without human intervention. This gives AI-driven software and systems the ability to become more efficient at their tasks and potentially evolve to learn new skills. With an addressable market spanning most sectors and industries, PwC analysts believe AI could add a staggering $15.7 trillion to the global economy by 2030.

While dozens of companies have benefited from the AI revolution, none have been as successful as the semiconductor giant. Nvidia (NASDAQ: NVDA).

Nvidia is leading the next supposed leap forward in enterprise innovation

In a short time, Nvidia’s H100 graphics processing unit (GPU) became the go-to chip used by enterprises to run generative AI solutions and train large language models (LLMs). With demand now outstripping supply, Nvidia has had no trouble significantly raising the price of its H100 GPUs to between $30,000 and $40,000 per chip, or roughly two to three times what major rivals charge for their AI data center hardware.

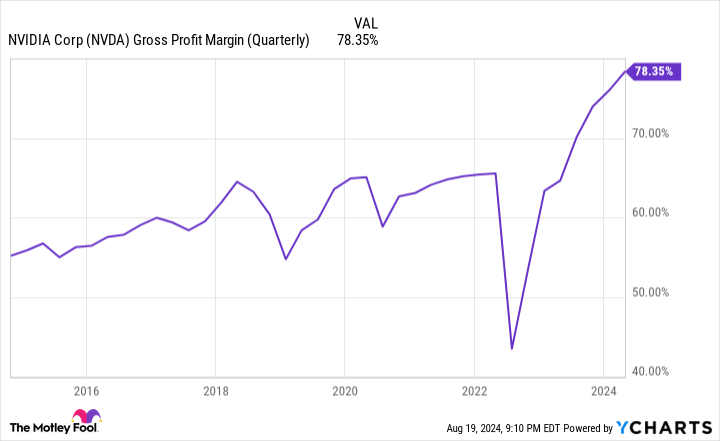

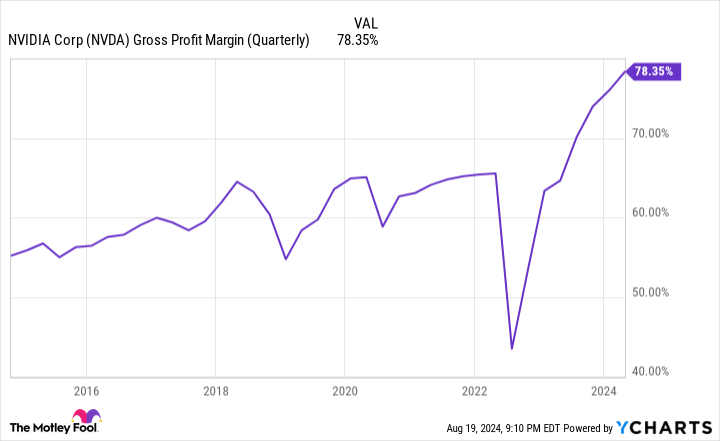

The beauty of higher price points is that they’ve directly benefited Nvidia’s bottom line. Over the past five reported fiscal quarters ending April 28, 2024, the company’s adjusted gross margin has expanded nearly 14 percentage points to 78.35%.

Nvidia hasn’t been shy about investing in the future, either. Its next-generation Blackwell platform, due to ship next year, will accelerate computing in six areas, including quantum computing and generative AI, and be more power efficient than its predecessor. Meanwhile, CEO Jensen Huang briefly previewed the company’s brand-new Rubin GPU architecture in June, which will run on a different processor (known as Vera) and debut in 2026.

The final piece of the puzzle that has helped Nvidia grow its market cap by more than $2.8 trillion as of early 2023 is its CUDA platform. This is the software platform that developers use to build LLMs, and it works hand-in-hand with the company’s industry-leading hardware to keep enterprise customers loyal to its solutions ecosystem.

While it’s a seemingly perfect operational platform, Wall Street will likely learn on August 28 just how imperfect Nvidia and AI as a technology in general are.

This All-Important Number From Nvidia Could Herald the Burst of the AI Bubble

Next Wednesday, August 28, Wall Street’s AI darling will report its second fiscal quarter results.

Over the past five quarters, Nvidia has done nothing short of shattering even the loftiest analyst expectations. A combination of strong enterprise demand for its AI GPUs, exceptional pricing power, and limited competition has allowed the company to build a lead that any tech company would envy.

But the headline revenue and earnings numbers won’t tell the whole story on August 28. Even if revenue and earnings top analyst consensus, another key number could signal the end of the AI euphoria. I’m talking about Nvidia’s adjusted gross margin. Nvidia’s “adjusted” gross margin excludes the impact of stock-based compensation, acquisition-related costs, and a few other charges.

Following the release of Nvidia’s fiscal first-quarter results, Huang and his team provided an adjusted gross margin forecast for the fiscal second quarter of 75.5% (+/- 50 basis points). This guidance implies a decline of 235 to 335 basis points from the first quarter.

While an expected median decline of 285 basis points in adjusted gross margin may sound like much ado about nothing given Nvidia’s approximately 1,370 basis points of growth in adjusted gross margin over the previous five quarters, it’s the reasons behind this forecast decline that really concern us.

It’s unlikely that Nvidia’s computing advantages can save the company from the inevitable

While demand for Nvidia’s H100 GPU is undeniably strong, it’s the company’s pricing power that’s done most of the heavy lifting. Revenue growth has far outpaced cost of revenue growth, suggesting that pricing power, fueled by the continued scarcity of AI GPUs, is the company’s primary driver.

The problem for Nvidia is that it’s not the only show. Advanced micro devices (NASDAQ: AMD) AMD is ramping up production of its MI300X AI GPUs, which are on average 50% to 75% cheaper than Nvidia’s H100. AMD also hasn’t suffered from the same problems with early-stage chip manufacturing suppliers that Nvidia has.

Additionally, Nvidia’s four largest customers by net revenue are — Microsoft, Meta platforms (NASDAQ: META), AmazonAnd Alphabet — are all developing AI GPUs in-house for their data centers. Even with these in-house chips designed for complementary roles, they’re ultimately cheaper and more accessible than Nvidia’s hardware. These companies represent about 40% of Nvidia’s revenue, and they all say they’ll be less dependent on Wall Street’s AI darling going forward.

To make matters worse, just over two weeks ago, reports emerged that Nvidia’s beloved Blackwell chip would be delayed “at least three months” due to design flaws and supplier constraints. Nvidia’s inability to meet enterprise demand opens the door for AMD, Samsungand Huawei to steal market share.

Nvidia’s biggest gross margin growth has come as AI GPUs are in extreme short supply. But as new chips hit the market and the company’s own top customers fill up their valuable data center “real estate” with in-house chips, Nvidia will inevitably find its pristine pricing power eroding. The company’s median forecast of a 285 basis point sequential quarterly decline in adjusted gross margin is evidence that the AI euphoria is waning.

If the AI bubble bursts, no company will likely be hit harder than Nvidia

Looking beyond Nvidia’s August 28 report, we see that history is throwing a spanner in the works for the AI revolution.

Since the advent of the Internet three decades ago, there has not been a single innovation, technology, or buzzy trend with a massive addressable market that has avoided an early bubble-bursting event. Without exception, investors consistently overestimate the use case(s) and consumer/business adoption of a new technology or trend, ultimately leading to disappointment, fading euphoria, and a bubble-bursting event.

For example, we have seen this in the areas of the Internet, genome decoding, business-to-business trade and networking, the housing market, Chinese stocks, nanotechnology, 3D printing, cryptocurrencies, cannabis, blockchain technology, virtual/augmented reality, and the metaverse.

To further emphasize the point, you’ll notice that few of the companies building AI data centers have definitive plans for how they’ll use the technology to drive sales and profits. Meta Platforms, for example, is investing over $10 billion in Nvidia’s H100 GPUs, but has no immediate plans to profit from these investments in its AI data center.

The simple fact that most companies don’t have a clear plan when it comes to AI makes it clear that we’re dealing with the next in a long line of bubbles.

This is not to say that artificial intelligence cannot do this, possibly (keyword!), will dramatically change the growth curve for businesses in America — but there’s no doubt that the technology will take time to mature.

If the AI bubble bursts, as history suggests, no company will be hit harder than Nvidia. Adjusted gross margin numbers over the next week should confirm that the beginning of this bubble-bursting event is underway.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $758,227!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: On August 28, This Nvidia Figure Will Confirm An Artificial Intelligence (AI) Bubble Is In The Early Stages Of Bursting Originally published by The Motley Fool