Homebuyers will be able to purchase a home without putting down any money thanks to a new program launched by United Wholesale Mortgage, one of the largest U.S. mortgage lenders.

The Pontiac, Michigan-based company’s new program will be available to first-time homebuyers and people earning at or below 80% of an area’s median income, the company said in a news release.

Most read from MarketWatch

UWM UWMC gives eligible buyers a second lien loan of up to $15,000, in the form of a down payment, for 3% of the home’s purchase price. The loan bears no interest and requires no monthly payment.

Buyers can also choose when and how often to make payments on that second loan, which is due in full at the end of the term if the first mortgage is paid off or if the borrower refinances the mortgage, according to UWM.

“Homeownership is something we are very passionate about,” Melinda Wilner, Chief Operating Officer at UWM, told MarketWatch.

The company had previously allowed buyers to put down just 1% on their homes, but it wanted to go further to help homebuyers, she said. The lender expects to see a larger number of borrowers with its new zero-down program, Wilner added.

Poor underwriting practices were a major driver of the U.S. subprime mortgage crisis, the International Monetary Fund wrote in 2008. But unlike the low- and no-down payment loans that proliferated at the time — when lenders made loans to people who could ultimately they didn’t pay them and they lost their homes — UWM’s program is different, Wilner said.

“It’s a very different time now than it was then,” she says. “The underwriting guidelines now are very, very different than they were in 2006 and 2008 … and last time we had a very large oversupply of houses. … Now the demand is much higher, compared to the supply that is available.”

Even the federal government recognizes the steep hurdle that down payments pose for aspiring homeowners. President Joe Biden called on Congress to provide up to $25,000 in down payment assistance to first-generation homebuyers during his State of the Union address.

What you need to know before taking out a ‘silent second mortgage’

UWM’s program is similar to down payment assistance programs at the state and local level, so “this is not a new concept,” Wilner said.

But it’s important that homebuyers fully understand the terms of the loan they’re taking out before signing any documents, an expert said.

“The aspect of this program that makes me nervous is the silent second mortgage,” Anneliese Lederer, senior policy advisor at the nonprofit Center for Responsible Lending, told MarketWatch in an interview. “It’s great that there’s no interest on it, but it’s a balloon payment and borrowers need to understand what a balloon payment is.”

A balloon payment refers to a larger-than-normal one-time payment that the lender requires at the end of the loan term, according to the Consumer Financial Protection Bureau.

On its website, UWM states in the fine print at the bottom of the page that the second loan “has no minimum monthly payment requirements, has a term of 360 months and is due in full as a balloon payment upon the occurrence of a refinancing of the [first mortgage], [or] payment of the [first mortgage] or the final payment.”

“So there are three points in time [when] This payment is due,” Lederer noted: When someone refinances, pays off the mortgage or sells the house. If a homeowner is prepared for these circumstances, there won’t be a problem, but “if you don’t have a plan, it could lead to the home being foreclosed on,” she warned.

One way borrowers can avoid this scenario is to talk to a housing counselor before applying for such a mortgage, Lederer said.

Gaining a ‘foothold’ in home ownership

The average first-time home buyer loses 8%, according to the National Association of Realtors. In the first quarter of 2024, the average home buyer put down $26,000, Realtor.com said in a recent report.

(Realtor.com is operated by Move Inc., a subsidiary of News Corp. MarketWatch publisher Dow Jones is also a subsidiary of News Corp.)

To be fair, buyers today can only put down 0% through their local government programs. For example, first-generation homebuyers in New Jersey can get up to $22,000 in home purchase assistance through the New Jersey Housing and Mortgage Finance Agency. The second loan is interest-free and payable after five years, with no monthly repayments, but also has income and purchase limits and other requirements.

UWM does not specify in the terms whether the loan, like government assistance programs, will ultimately be forgiven, CRL’s Lederer noted.

Other financial institutions, such as Bank of America BAC, also offer a zero-down plan for homebuyers in certain communities.

“The concept of getting help with a down payment is not new,” Wilner said, but “this program really simplifies it for everyone – for the agent and for the consumer.” Different entities providing assistance have their own products, lenders, guidelines and requirements, she added.

And the array of down payment tools and their guidelines can be tricky to keep track of. Freddie Mac recognized that challenge last year by launching a program to help lenders and homebuyers more easily navigate such programs.

The UWM program comes at a time when the housing market remains stuck due to high interest rates, which are undermining housing demand and keeping housing inventory in check. With mortgage rates above 7%, current homeowners – many of whom have interest rates below 4% – have little incentive to sell their home and enter a bidding war to purchase another home.

Read more: ‘What’s the point’: As homes sell for $400,000 above asking price, bidding wars push buyers to breaking point

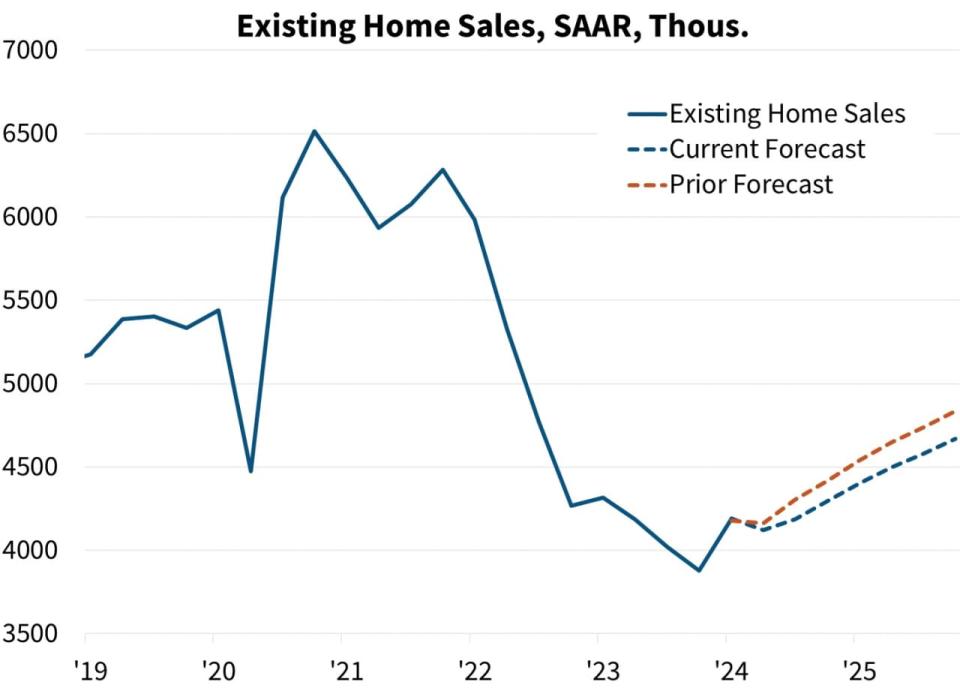

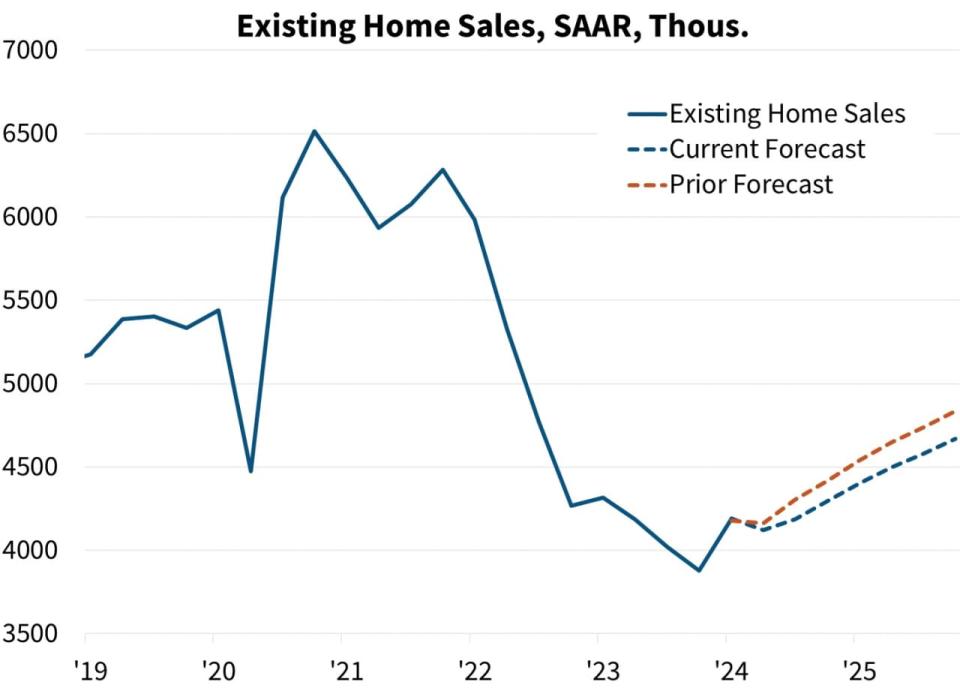

Homebuilding activity is expected to slow in 2024, Fannie Mae said in a forecast released in May, as mortgage rates are expected to end the year at an average of 7%. The government-sponsored company expects 30-year mortgage rates to average 6.7% by 2025. That would reduce existing home sales to 4.19 million, Fannie Mae said — which, as the chart below shows, is significantly lower than before and during the pandemic.

According to a recent CFPB report, UWM was the second-largest company in terms of the number of mortgages originated in 2022.

With UWM’s zero-down program, the first lien loan will still be resold to government-sponsored enterprises, while the second lien loan will be owned by UWM, Wilner said.

The program is ultimately “really good” for people who can exchange their rent for a mortgage and make those monthly payments comfortably, Lederer said, because “it can be the foundation you need to get into homeownership.”

While such programs “have the potential to really increase homeownership,” Lederer added, they can also be a big problem for homebuyers who don’t understand exactly what they’re getting into.