While it’s perfectly normal for a hot trend to capture the attention of Wall Street and investors, two buzzy trends at the same time are quite rare. In addition to investors flocking to stocks associated with the artificial intelligence (AI) revolution, they can’t seem to get enough of companies announcing stock splits.

A stock split is a tool on the proverbial utility belt for publicly traded companies that allows them to adjust their stock price and the number of outstanding shares by the same amount. Despite these nominal changes, stock splits are purely cosmetic and have no effect on a company’s market capitalization or operating performance.

Although stock splits can go both ways — reverse stock splits increase a company’s stock price, while forward stock splits decrease it — a majority of investors favor companies that do forward splits. Companies that do forward splits typically outperform their competitors in all areas, which drives up their underlying stocks.

In 2024, 13 major companies will have announced or completed a stock split, all but one of which will be a forward stock split. Today just so happens to be the day that one of these phenomenal companies will trade at its post-split price for the first time.

This nearly 125,000% winner just completed its sixth split since going public

Earlier this week, satellite radio operator Sirius XM Holdings enjoyed its time in the sun as the only prominent reverse stock split of 2024. But today, September 12, it’s all about recognizing the corporate identity and the business services provider Cintas (NASDAQ: CTAS).

On May 2, the company’s board of directors announced plans to execute a 4-for-1 split after the close of trading on September 11. With the company’s shares closing at just over $816 on September 10, the largest split in the company’s history will drop the stock price to just over $200.

Since its initial public offering (IPO) in 1983, Cintas has achieved a total return (that is, taking into account dividend payments and the cumulative return of its shares) of nearly 125,000% and has completed half a dozen stock splits:

The catalyst that fuels this growth is primarily the growth of the U.S. economy. While recessions are a perfectly normal and inevitable part of the economic cycle, history shows that they are typically short-lived. Only three of the twelve U.S. recessions since the end of World War II lasted at least twelve months.

On the other hand, most growth periods last for several years. A growing economy usually leads to increased demand for workwear and the various products and services that Cintas provides, such as towels, floor mats and safety kits.

In addition to macroeconomic catalysts, Cintas has also benefited from a steady stream of bolt-on acquisitions. The purchases of Zee Medical and G&K Services are perfect examples of Cintas expanding its product and service ecosystem, dangling a carrot in front of new customers and giving itself the opportunity to sell more of its products to existing customers.

Innovation is another important piece of the puzzle for Cintas. Continuous product development for the rental uniform line, as well as the various business product lines, generally ensures customer loyalty.

Last but not least, Cintas has over 1 million corporate clients. This level of diversification virtually ensures that no single company is critical to its success or capable of sinking the proverbial ship.

Despite Cintas’ long-term success, further gains in the short term could be a tough task

While Cintas has a fairly clear path to long-term growth, thanks in large part to its close ties to the U.S. economy, it could be difficult to grow the company’s shares much further in the coming years.

First, there are growing concerns that a recession is on the way in the US. A number of data points and predictive statistics, including the first notable decline in US M2 money supply since the Great Depression and the longest yield curve inversion in history, suggest that the economy and the stock market will soon become weak.

While stocks don’t move in lockstep with the U.S. economy, Cintas is undeniably cyclical. Most of its customers are likely to feel some pain if economic growth slows or contracts, which in turn would be expected to slow its own growth rate.

To build on this, both the broader market and Cintas are historically expensive.

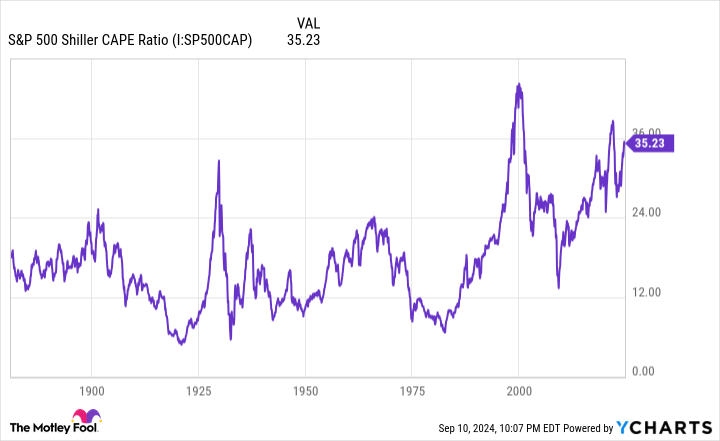

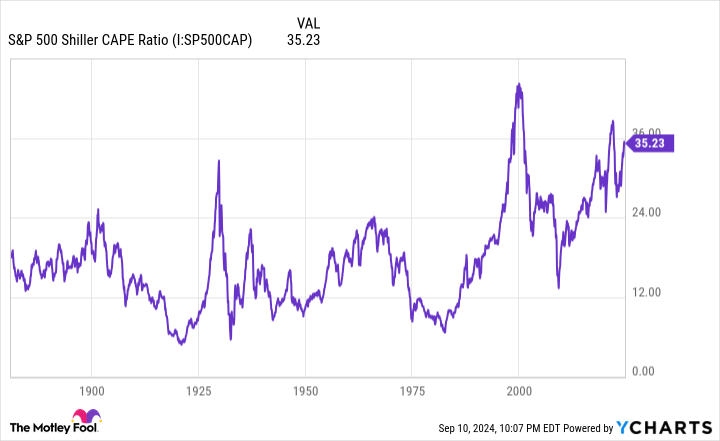

According to the S&P 500According to the 2006 Shiller price-earnings (P/E) ratio, also known as the cyclically adjusted price-earnings (CAPE) ratio, the stock market has been only twice as expensive as it is today when it was tested back to January 1871.

On September 10, the S&P 500’s Shiller P/E, which is based on the average inflation-adjusted earnings of the previous 10 years, closed at 35.33, or more than double the 153-year average of 17.16. More importantly, previous times when the S&P 500’s Shiller P/E exceeded 30 during a bull market rally include: possibly (keyword!), followed by drops of at least 20%.

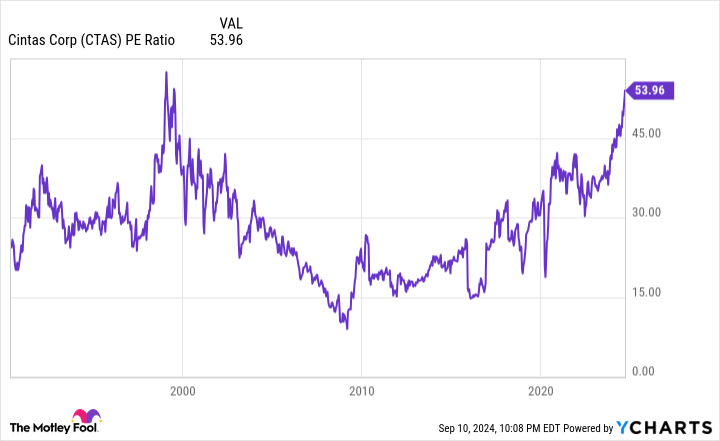

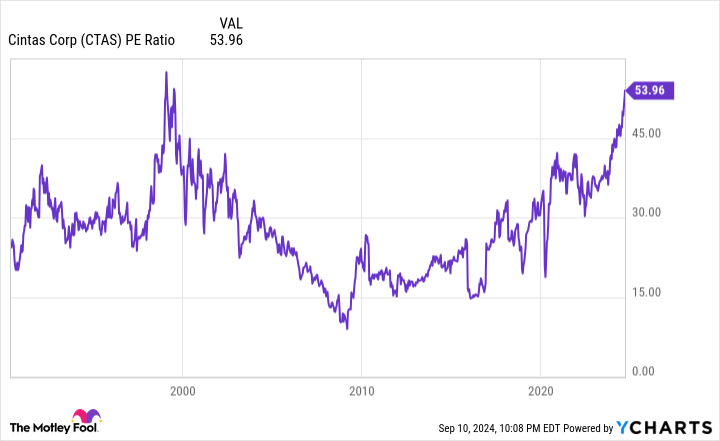

Cintas closed Sept. 10 at about 54 times trailing-12-month (TTM) earnings per share (EPS) and a nosebleed of 44 times next year’s EPS. You have to go back to the late 20th century to find the last time Cintas was valued at 54 times TTM earnings per share (EPS).

While expected revenue growth of 7% in the current and coming year is commendable for a company of this size, it does not come close to justifying a forward price/earnings ratio of 44.

This is a rare example of a rock-solid company whose shares simply aren’t worth buying right now.

Should You Invest $1,000 in Cintas Now?

Before you buy shares in Cintas, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Cintas wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $662,392!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Sean Williams has positions in Sirius XM. The Motley Fool recommends Cintas. The Motley Fool has a disclosure policy.

One of Wall Street’s biggest stocks, up nearly 125,000% since its IPO, has officially completed its latest stock split. This was originally published by The Motley Fool