Palantir Technologies (NYSE:PLTR) is taking its expertise in analytical and artificial intelligence (AI) to space after forming a strategic partnership with Starlab Space.

Let’s take a look at the deal and whether it could help send the stock to the moon and beyond.

Starlab space partnership

Palantir is already a mission-critical partner for the US and other governments around the world, as well as the public sector, and wants to conquer space. The company struck a deal with Starlab to become the exclusive provider of enterprise-wide software data management solutions for its commercial space station.

Starlab is a joint venture (JV) between Voyager Space, Airbus, MitsubishiAnd MDA space that is working to build and operate a commercial space station. The JV’s purpose is to maintain a human presence in low Earth orbit and transfer research and science from the International Space Station, operated by five separate government space agencies, to commercial space stations.

Starlab aims to get its space station into orbit in 2028, just ahead of the International Space Station’s decommissioning in 2030. The JV said Palantir’s technology will help identify potential problems and predict maintenance, extending the life of critical components is extended. It added that they will “use data modeling through digital twins and AI technologies to improve Starlab’s operations across the enterprise.”

This isn’t Palantir’s first space-related contract. Since 2021, the company has been working with the US Space Force, a branch of the US armed forces, by providing cloud and analytics services for the Warp Core project. Last year, the company renewed three contracts with the Space Force and the U.S. Air Force, worth a combined $110 million.

While the terms of Palantir’s Starlab partnership were not disclosed, it is yet another example of how the company’s technology is selected when advanced mission-critical solutions are needed.

Could the Stocks Go to the Stars?

Palantir’s win in Starlab is another example of the company’s breakthrough into the commercial space, which has seen strong growth recently. The segment saw revenue growth of 27% to $299 million in the first quarter, while commercial growth in the US was 40% to $150 million.

The company is seeing more types of industries adopt analytics and AIP (AI platform) solutions, as evidenced by the 69% growth in the number of U.S. commercial customers in the quarter. To help attract commercial customers, the company hosts boot camps to quickly teach them the skills they need to deploy AIP and solve their own complex problems.

The problem Palantir has run into is that government revenue growth has slowed, especially in the US government. Government revenues rose 16% to $335 million in the quarter, while U.S. government revenues grew 12% to $257 million.

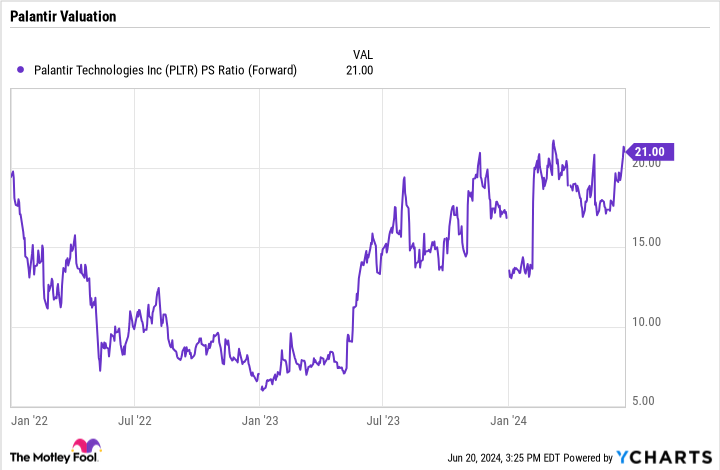

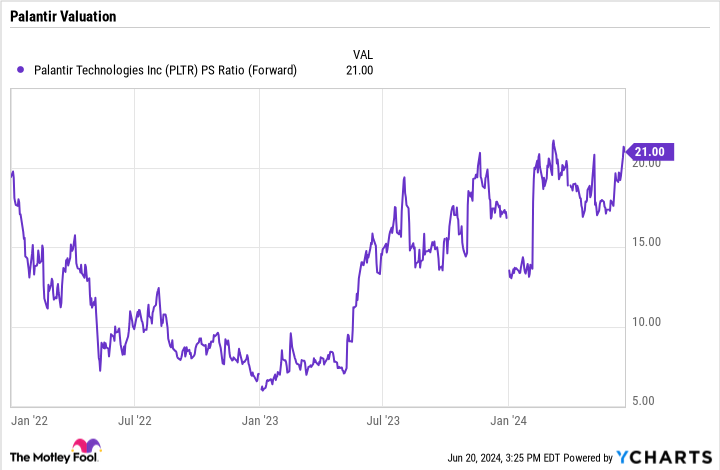

That growth isn’t bad, but for a company valued at a price-to-sales (P/S) multiple of 21 times, total revenue growth of 21% isn’t enough to justify that valuation.

Going forward, Palantir will need to win more commercial as well as government contracts to justify its valuation. The Spacelab deal helps on the commercial side, while a $480 million contract in late May with the US Army for a Maven Smart System prototype certainly helps on the government side.

Its technology is considered top-notch, and its use in critical tasks such as tracking terrorists and COVID-19 shows its importance. That said, there’s a lot of expectations priced into the stock right now.

While Palantir’s stock could go to the stars, it could remain grounded until revenue growth starts to accelerate. Therefore, it is best to rank these high-risk, high-potential growth stocks accordingly.

Should You Invest $1,000 in Palantir Technologies Now?

Before you buy shares in Palantir Technologies, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Palantir ink deal with Starlab. Is the stock ready to go to the stars? was originally published by The Motley Fool