Artificial intelligence (AI) is the most popular investment theme at the moment. Much ink has been spilled about the technology’s awesome power and potential economic impact. Could it be as transformative as the evangelists would have you believe? PwC – one of the ‘big four’ accounting firms – believes AI could add $15.7 trillion to the global economy by 2030. If that turns out to be true, it will certainly live up to expectations.

While Nvidia was central, another AI company, Palantir (NYSE:PLTR)just passed a major milestone that could help boost its profile and share price. Founded in 2003, the company is certainly not new, but recent developments in AI are increasing the company’s ability to make profits. The company’s share price followed suit, rising 150% this year alone.

This made it eligible for inclusion in the S&P500and Palantir officially joined the index late last month. What does this mean for the company?

Joining the S&P 500 is a big deal and could impact Palantir’s stock price

The S&P 500 is an index consisting of the 500 largest companies in the US, measured by market capitalization. It’s also one of the best-known and most popular indexes out there – so popular that it’s often used as a benchmark for the stock market as a whole. This visibility usually translates into an increase in investments in the retail market. Some of these investors are hearing about the company for the first time, while others see its inclusion as a sign of legitimacy.

However, in addition to retail, the index is tracked by all kinds of funds, including the very popular ones SPDR S&P 500 ETF Trust or Vanguard 500 Index Fund. When a company joins the S&P, capital flows into its stocks because these funds align with the index.

All this leads to what is sometimes called the “S&P 500 effect”: a rise in the stock price after it is included in the index. Take Nvidia for example. The chipmaker was announced in November 2001 as the replacement for the crumbling Enron. In the month that followed, the share price rose by more than 30%. Will this happen to Palantir?

Correlation is not causation

Unfortunately, the effect may be more of a coincidence. A study commissioned by the Federal Reserve Bank of New York looked at the effect and concluded that there isn’t really much evidence for it, or that any direct effect is short-lived.

Stocks added to the index are usually already rising. They have earlier momentum. The study found that this momentum was the main driver of long-term performance post-inclusion. Essentially, the positive price movement would have occurred with or without addition. But whether it’s the cause or not, the fact remains that when a company is added to the S&P 500, it tends to perform well.

Palantir is promising, but beware of its valuation

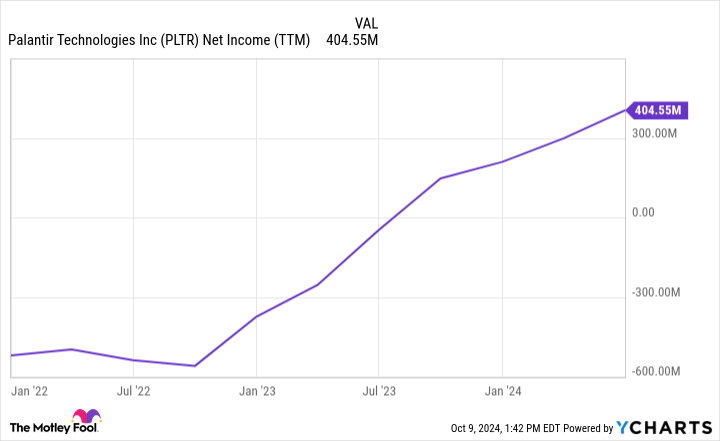

The company shows strong growth in sales and a huge reduction in operating costs. This means huge increases in net income. Take a look at the graph showing the start in 2022.

These are trends you want to see. The company continues to find success in the lucrative world of government contracts, announcing last month that it had secured another, this time from the US military, to help overhaul its AI capabilities. The new contract means the company now works with all five US armed forces.

Palantir’s looks great as a company. It appears that the country’s income growth will continue its rapid rise. However, the ability to make money is not the problem. Sometimes a great company can turn out to be a not-so-great investment if it is valued too highly. I think that’s the case here. While the valuation metrics can be shaky for a while when a company finally starts turning a profit, I can’t ignore how crazy the stock price seems to be.

It currently has a price-to-earnings (P/E) ratio of 103 and a price-to-sales (P/S) ratio of 41. Compare that to Nvidia, which is currently valued at quite a premium. with a forward price-to-earnings ratio of 46 and a price-to-earnings ratio of 26. Alphabet‘s stats are 21 and 6 respectively.

Given the current price, I cannot recommend the stock to most investors. I think there are better places to put your money. However, if you are younger, have a high risk tolerance and a very long time horizon, it can be an interesting game.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns October 7, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Johnny Rice holds positions in SPDR S&P 500 ETF Trust. The Motley Fool holds positions in and recommends Alphabet, Nvidia, Palantir Technologies and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Palantir just joined the S&P 500. History says artificial intelligence (AI) stocks will do this next. was originally published by The Motley Fool