If you’re a dividend investor, you’ve probably considered buying tobacco stocks if you don’t already own them.

The tobacco sector has long been a ripe area for income investors. These stocks often generate wide profit margins, have a recession-proof business model, and require relatively little expenditure on capital expenditures or research and development, so they return most of their profits to investors.

Two of the largest and best-known tobacco stocks in the world are Philip Morris International (NYSE:PM) And British-American tobacco (NYSE:BTI). There are good arguments for including both in any dividend stock portfolio, especially one focused on high-yield stocks. But if you had to choose between the two, which is the better buy today?

Let’s see how these two tobacco titans stack up now.

Business Model: Philip Morris International vs. British American Tobacco

As tobacco stocks, both companies have similar business models, but there’s more to the tobacco industry today than just cigarettes. The industry is moving beyond combustibles to products like vapes and oral nicotine pouches that claim to be less harmful, and both Philip Morris and British American Tobacco (BAT) have established themselves as leaders in this transition.

Philip Morris is known for selling Marlboro and other cigarette brands in international markets, while its heat-not-burn product, IQOS, is at the forefront of its smoke-free efforts. IQOS uses real tobacco instead of the liquid commonly found in e-cigarettes. By 2023, smoke-free products accounted for 36.5% of the company’s revenue and a larger percentage of gross profit.

Historically, Philip Morris only operated outside the US as part of the company’s spin-off from Altria in 2007. However, it just bought the rights to sell IQOS in the US from Altria for $2.7 billion, indicating that the company is optimistic is about the product. It has also seen strong growth from Zyn, a branded oral nicotine pouch it acquired in its acquisition of Swedish Match.

British American Tobacco, which sells its products worldwide, is known for cigarette brands such as Camel, Newport and Lucky Strike, some of which it acquired almost a decade ago through its merger with RJ Reynolds. The company recently took a $31 billion writedown on the value of its U.S. cigarette business, showing that it likely overpaid for that acquisition and is focusing on the transition to smoke-free products.

In 2023, organic sales increased by 21%, driven by the growth of vape brand Vuse and oral nicotine pouch Velo, and achieved profitability two years ahead of BAT’s original target. New categories represented 12% of sales, and that share should continue to grow given 21% sales growth in 2023.

Financial figures: Philip Morris International vs. British American Tobacco

Philip delivered strong growth in the first quarter, with organic sales increasing 11% to $8.8 billion and total volume growth of 3.6% to 180.5 billion units. Cigarette shipments fell just 0.4% to 143.2 million, and the company posted strong growth in smoke-free products. The number of heated tobacco products increased 20.9% to 33.1 billion, and sales of oral smokeless products increased 35.8% to 4.2 billion.

Ultimately, the company’s margin grew, with organic gross profit rising 13.7% to $5.6 billion, while organic operating income rose 22.2% to $2 billion.

As a British company, British American Tobacco does not report quarterly results, but we can make comparisons with 2023 performance.

On an adjusted organic basis, BAT’s revenue rose 3.1% to 27.3 British pounds ($34.02), and adjusted operating profit rose 3.9% to 12.5 million pounds ($15.5 million), an operating margin of 45.7% was achieved. Organic sales from new categories rose 21% to £3.34 ($4.16). About half of that turnover comes from vapor, the rest from heated products and oral nicotine pouches.

Here the lead goes to Philip Morris because it is growing faster, increasing margins and has made more progress in next-generation products.

Dividend and Valuation: Philip Morris International vs. British American Tobacco

On metrics such as dividend yield and valuation, British American Tobacco gains an edge. BAT trades at a yield of 9.5% and has a price-to-earnings ratio of just 6.7. Philip Morris, on the other hand, offers a dividend yield of 5% and currently trades at a price-to-earnings ratio of 16.9.

British American Tobacco is clearly much cheaper than Philip Morris and offers a dividend yield that is almost double that of Philip Morris.

Past Performance: Philip Morris International vs. British American Tobacco

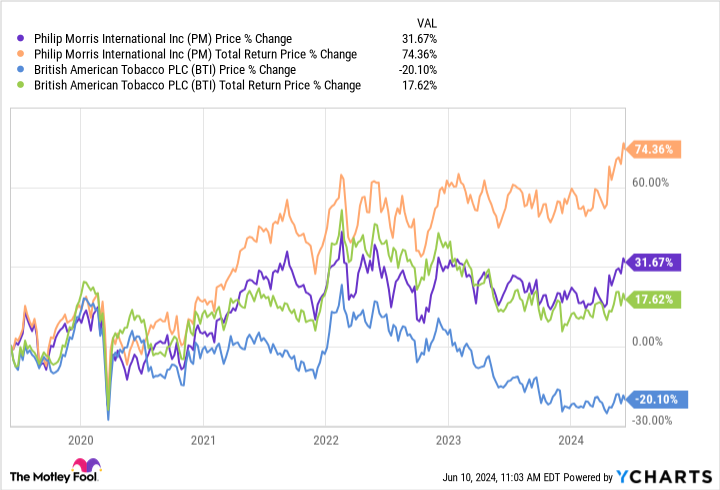

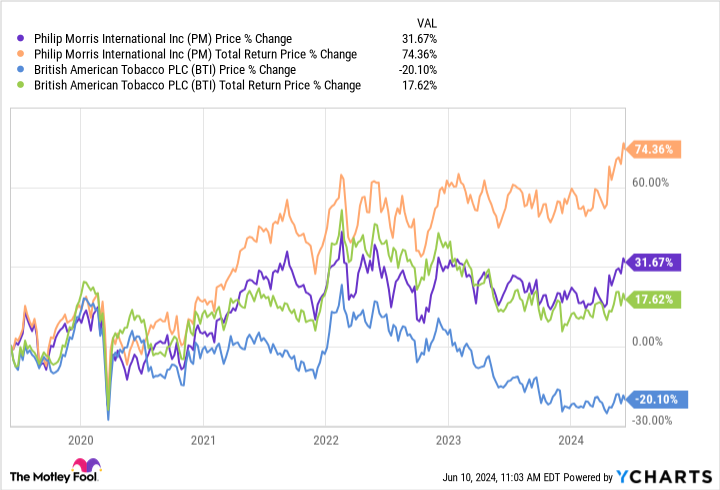

Finally, it’s worth considering how both stocks have performed in the recent past, as rising stocks tend to continue rising, and falling stocks may struggle to recover.

As you can see in the chart below, Philip Morris has a clear lead in both price appreciation and total returns.

Which is the better buy?

Dividend investors may prefer to buy shares of British American Tobacco for its high yield and lower valuation, but overall Philip Morris seems like the better stock to own. The company is active across its operations, outgrowing the competition and well ahead of its peers in the transition to smoke-free products.

Philip Morris seems a good choice to outperform BAT, even with the dividend difference.

Should You Invest $1,000 in Philip Morris International Now?

Before you buy shares in Philip Morris International, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco Plc and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Best Stocks to Buy Now: Philip Morris International vs. British American Tobacco was originally published by The Motley Fool