E-commerce and cloud giant Amazon (NASDAQ:AMZN) is poised for the next decade of growth, having returned around 1,000% over the past decade. Thanks to the recent earnings increase, the stock price recently reached a new all-time high. Despite these gains, Amazon’s re-accelerated AWS growth powered by AI, strong momentum in retail, and expansion of margin and cash flow due to optimization initiatives make me bullish on the stock. That’s why I’m buying the stock at current levels.

Amazon releases another quarterly beat, powered by AWS

On April 30, Amazon reported impressive first-quarter results for the fifth consecutive quarter, driven by positive performance across all segments, including cloud, advertising and e-commerce. Adjusted earnings of $0.98 per share easily exceeded analyst expectations of $0.84 per share. Additionally, earnings more than tripled (+216%) year-over-year, compared to earnings of $0.31 per share in the prior-year period.

Furthermore, net revenue increased 13% year over year to $143.3 billion, and revenue for Amazon’s cloud business segment, Amazon Web Services (AWS), grew 17% year over year to $25 billion, which exceeded expectations. The segment’s growth was helped by renewed demand and investments in generative AI, which boosted AWS’s performance, in addition to a near halt to the cost optimizations customers resorted to last year.

Of particular note, AWS operating income rose 84.3% year over year to $9.4 billion. Furthermore, there was a significant increase in operating margin in the segment, from 24% in last year’s quarter to 37.6% currently.

Regionally, North America sales grew 12% year-on-year, while the International segment sales growth was 11% (in constant currency). In addition, operating income for all segments of the company combined increased 219% year over year to $15.3 billion.

Based on robust first-quarter performance, Amazon provided an optimistic outlook for the second quarter, above expectations. Net sales in the second quarter are expected to grow 7 to 11% to between $144 and $149 billion. Notably, expected operating revenues of $10 billion to $14 billion ($12 billion at the midpoint) are also much higher compared to the $7.7 billion generated in the first quarter of 2023.

AWS sees record growth and margins in Q1 due to AI impact

AWS, Amazon’s cloud company, has been the market leader and the company’s profit engine for years. However, after years of impressive growth, the segment experienced a slowdown, with growth slowing to 13% in 2023, compared to 29% in 2022 and 37% in 2021.

That downward trend is now a thing of the past. In the first quarter, AWS revenue grew 17%, helping AWS reach its long-awaited $100 billion revenue milestone. Furthermore, operating income for the segment saw a remarkable growth of 84%.

Artificial Intelligence (AI) is the catalyst behind this astonishing growth that AWS has experienced this quarter. In fact, the tech titans of the world, like Microsoft (NASDAQ:MSFT) and alphabet (NASDAQ: GOOGL) (NASDAQ:GOOG) have invested heavily in AI technology.

For example, Microsoft’s Azure has been gaining market share in the cloud space and now has a 25% share, up from 19% in 2021. The addition of AI tools has contributed to Azure’s rapid growth over the years. Like its peers, Amazon is making meaningful investments in AI, developing its own large language models and investing billions in AI products like Anthropic (which competes with OpenAI’s ChatGPT).

Amazon’s investments in AI are now paying off and visible in the financials. The company stated that most of its CapEx (capital expenditure) for fiscal year 2024 will be spent on strengthening AWS infrastructure and AI efforts. As a cloud leader, AWS can make significant money from the growing demand for AI with its wide variety of cloud offerings.

It’s not just the margin expansion that impressed investors in the first quarter. It was a huge jump in cash flows, despite substantial capital investments in AI and cloud infrastructure. This reassured investors that Amazon’s fundamentals remain intact. Free cash flows in the first quarter grew to $50.1 billion (Q4: $36.8 billion), compared to cash outflows of $3.3 billion a year ago. Margin expansion, coupled with robust free cash flows, implies strong returns for investors in the coming years.

Earlier this week there was news that AWS is looking to invest billions in Italy to strengthen its cloud infrastructure and data center operations in the country. Similarly, AWS will invest billions in Spain (€15.7 billion) and Germany (€7.8 billion) with the aim of expanding its cloud business to European countries.

Amazon has taken major initiatives to streamline the company’s operations and reduce costs. These steps include transforming the U.S. fulfillment model from a national to a regional model and synchronizing inventory with regional consumers.

On a separate note, Amazon recently announced the departure of its AWS head, Adam Selipsky. He will be replaced by Matt Garman, an AWS veteran, to become CEO of AWS. This leadership change could further strengthen Amazon’s AI growth initiatives.

Amazon’s valuation is not expensive

Since Amazon has several companies under its radar, I believe the EV/EBITDA ratio is the best metric to evaluate the stock’s valuation. As a market leader, the company has historically traded at high prices. However, currently, Amazon shares trade at an EV/EBITDA of around 14.3x (term) compared to its own five-year historical average of 20.6x. This implies a huge discount of 31%.

For comparison, let’s also look at the P/S ratio. Amazon trades at a price-to-sales (P/S) ratio of 3.0x. In contrast, cloud computing and technology giant Microsoft trades at a price-to-earnings ratio of 13.1x, while social networking company Meta Platforms (NASDAQ: META) trades at a price-to-earnings ratio of 7.7x.

Therefore, I believe the stock is trading at an attractive valuation and presents a great buying opportunity given the strong growth potential across several business sectors.

Is Amazon Stock a Buy According to Analysts?

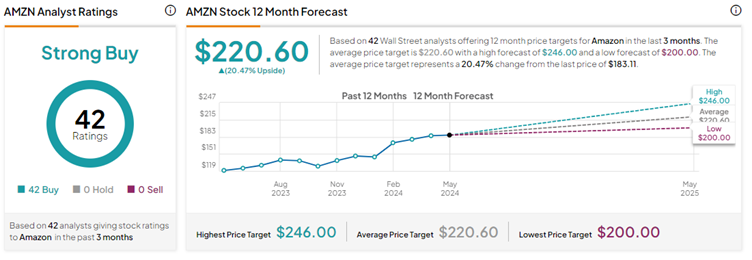

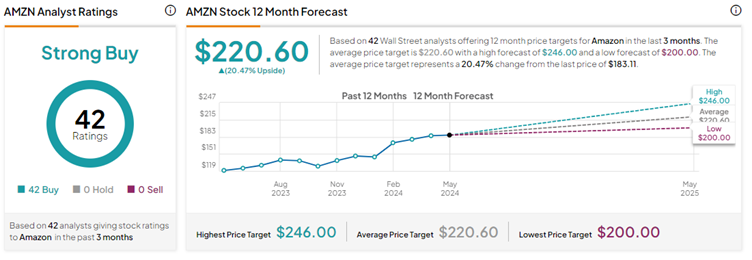

Wall Street analysts remain bullish on Amazon stock, with a majority of them raising their price targets following the impressive earnings results. Overall, the stock has a Strong Buy consensus rating, based on 42 unanimous Buys. Amazon stock’s average price target of $220.60 implies 20.5% upside potential from current levels.

Conclusion: Consider AMZN stock for its long-term growth

Amazon may have been a little late to the AI growth story, but it’s important to remember that AWS remains the leader in cloud infrastructure. The substantial investments and recent leadership changes should yield significant benefits. The foundation has been laid and I believe there is no way back for Amazon.

With multiple growth drivers, including AWS’s growth trajectory fueled by generative AI initiatives, a well-diversified business portfolio, strong retail performance, and impressive margin and cash flow expansion, Amazon appears well positioned for the next phase of growth. Therefore, I feel confident buying the stock at current levels.

Revelation