MARSHALL – For the second consecutive year, Madison County’s budget will increase General Fund appropriations by 3%.

The Madison County Board of Commissioners approved the 2024-2025 budget on June 11. Madison’s $33.1 million budget is about $1 million higher than the 2023-2024 budget of $32.1 million.

County Manager Rod Honeycutt presented the proposed budget to county commissioners and outlined the tax rate at 36 cents per $100, down from 50 cents per $100 in 2023-2024.

Honeycutt thanked Chief Financial Officer Kary Ledford for her cooperation throughout the process,

“Developing the FY 2024-25 budget during a real estate revaluation year added complexity,” Honeycutt said, referring to the state’s General Statute 159.11, which requires a county budget officer to include a statement of the revenue-neutral real estate tax rate for the budget. The revenue-neutral property tax rate is the rate that is estimated to generate revenue for the next taxable year equal to the revenue that would have been generated at the current tax rate for the next taxable year if no revaluation had occurred.

“The revenue-neutral statement compares property tax revenues that would have been generated at the same milling rate and collection rate as the prior year,” Honeycutt said.

Honeycutt said the province issued 293 new construction permits in FY ’23.

Based on this figure and the projected tax revenue of 50 cents per $100, the county would have generated approximately $13.8 million. According to Honeycutt, this is an increase of more than $1 million over last year’s $12.7 million budget, based on the same valuation of 50 cents per $100 and a 96.7% collection rate.

Honeycutt said the 36 cents per $100 valuation in the new budget will generate $13.3 million in revenue, a decrease of nearly $474,000 from the revenue-neutral property tax rate of $13.8 million in the 2023-24 tax year.

“Most importantly, we are operating just over $400,000 less in property neutral, which will reduce the tax burden on taxpayers,” Honeycutt said.

According to the district manager, “incremental increases” were needed in some provincial departments. Public safety and transportation saw two of the largest increases between 2023 and 2024, as public safety appropriations will increase from $8.5 million to $9.1 million, and transportation appropriations will increase from $683,000 to just under 1 million dollars.

Two additional factors — the expansion of the state’s Medicaid program and the Wages and Fair Labor Standards Act that increases federal, state and local government minimum wages — also contributed to the increase, Honeycutt said, adding that the expansion from the state’s Medicaid program contributed $422,000 to the budget.

Internal factors for the increase included employee recruitment and retention, such as targeted wage increases and raising the minimum wage for county employees to $13 per hour.

Board discussion

Supervisory Board Chairman Matt Wechtel called the 36 cents per $100 valuation cut “a big cut.”

“I want to thank our department heads, our district staff and the colonel for all the work that went into this budget,” Wechtel said. “Kary, and Amanda, and Mandy and Brandy and Hannah, and everyone who played a role. I didn’t mean to leave anyone out, but I know all the people there at Elizabeth Lane had a lot to do with working on this budget and its composition.’

Wechtel said of his nine budget cycles: “This is by far the best organized and probably, from the Commissioner’s point of view, the easiest process that I have experienced, so I want to thank and commend the staff for that.”

Commissioner Bill Briggs said he appreciated the county’s work and estimated the county met 12 times during this budget cycle.

“Think about the time it takes, and if you have to try to distribute $33 million, that’s not a lot of money when you compare it to Buncombe County, which is over $600 million, and the city of Asheville. almost another $300, we’re comparing $33 million because we’re a bedroom county, so to speak, with Buncombe County, at $1 billion, with a ‘B,'” Briggs said.

“So you see what we’re dealing with. I just think they’ve done a great job with this budget. I have dealt with a few budgets, but as Mr President says, this is one of the best I have done. I’ve witnessed it. It was explained, and even I could understand it.”

Commissioner Jeremy Hensley said the 36 cents per $100 tax rate was the result of county commissioners’ struggle to “get as close to revenue neutral as possible.”

“We looked at it, and if you go to 35 cents, that pretty much means you’re not collecting as many taxes as last year on your property,” Hensley said.

“Then you factor in that your car taxes are going to go down, so we’re not collecting as much of the car taxes either. So when you get your tax bill, your taxes are probably going to go up, but it’s going to be as close to revenue neutral as we can. “

Hensley said the commissioners went from 30 cents to 36 cents after discovering the 35 cent figure would make the county revenue neutral.

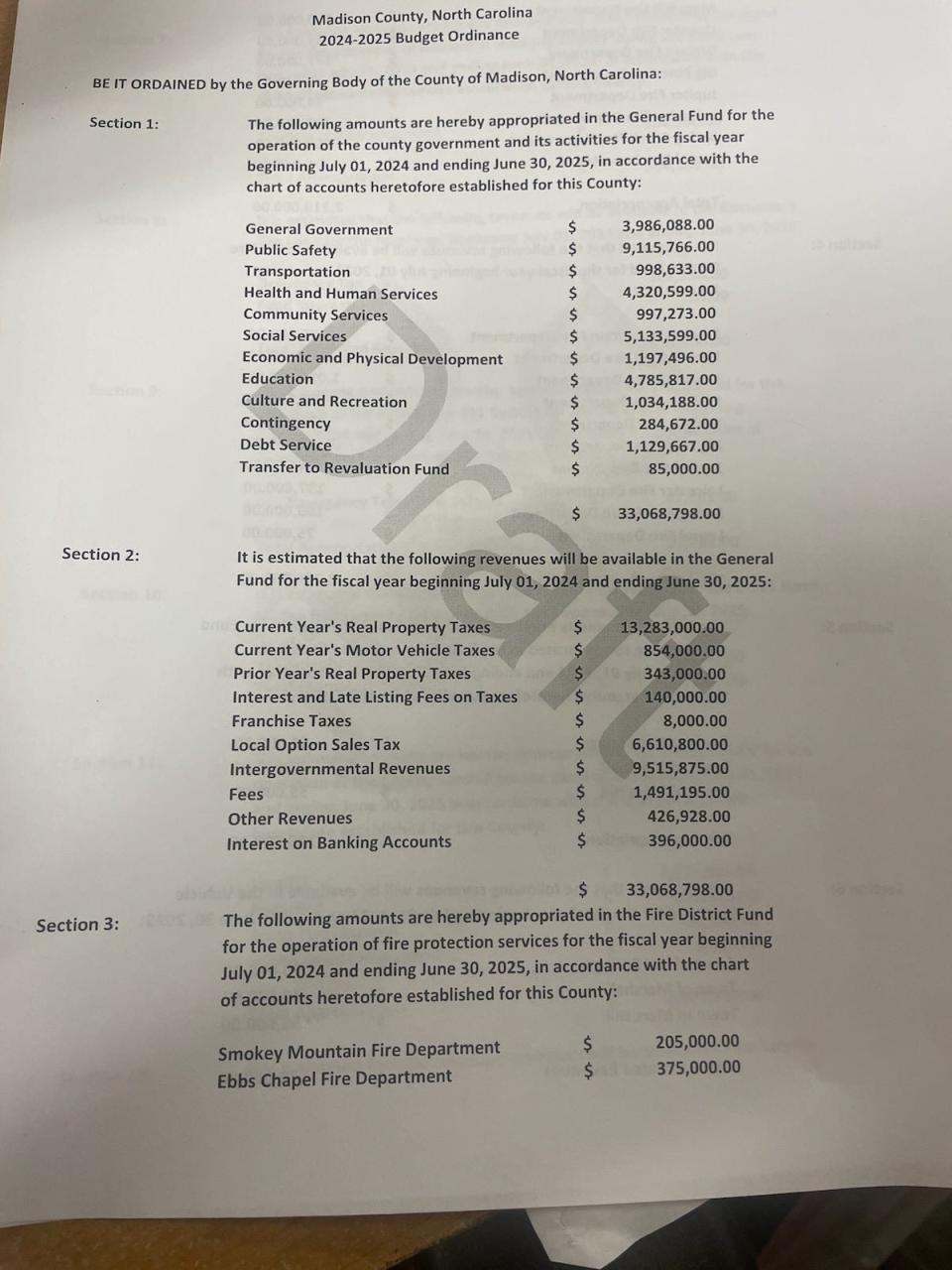

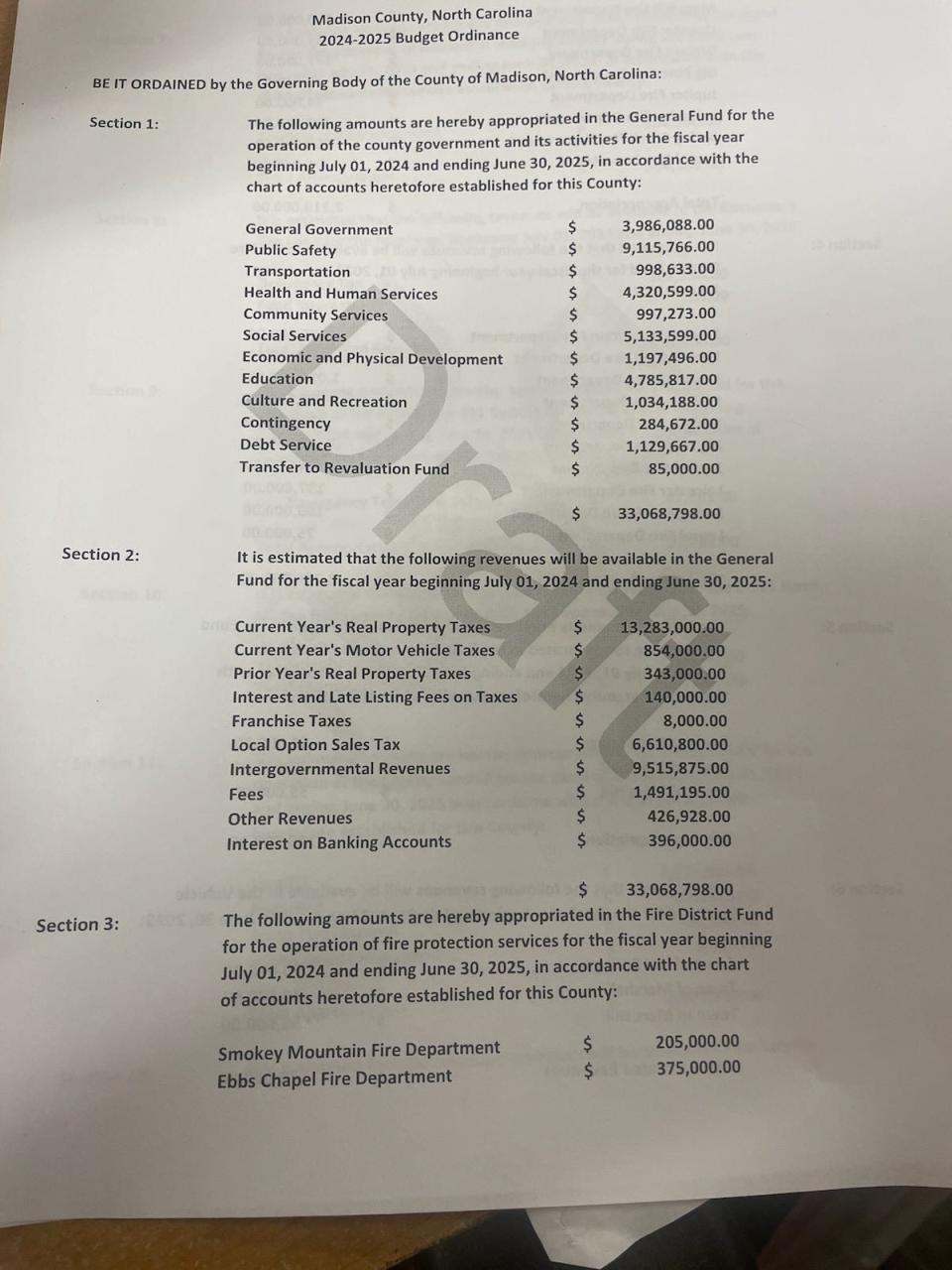

According to a copy of the budget regulation, the following revenues are estimated to be available in the General Fund for the fiscal year beginning July 1, 2024 and ending June 30, 2025.

-

This year’s property taxes: $13.3 million

-

Intergovernmental revenues: $9.5 million

-

Local option sales tax: $6.6 million

-

Cost: $1.5 million

-

Other income: $427,000

-

Interest on bank accounts: $396,000

-

This year’s vehicle tax: $854,000

-

Last year’s property taxes: $343,000

-

Interest and late filing fees on taxes: $140,000

-

Franchise taxes: $8,000

Commissioner Alan Wyatt reiterated that the revaluation year brought challenges for the county, but thanked his fellow commissioners for “their due diligence in really, really, really scrutinizing these numbers, and not just passing things along.”

Real estate reappraisals will be mailed out in the coming weeks, according to Wechtel.

“If you have any questions or concerns about these revaluations, I first and foremost encourage you to contact the tax authorities directly,” Wechtel said. “The Tax Authorities can possibly handle your problem by telephone with the appraisers who will remain with us for a while.

“The appraisers are the ones best placed to answer questions about their work. If you have any concerns or think a mistake has been made, the right time to do so right away is while the appraisers are still there because it is easier for If they want to find out whether a mistake has been made, then it is up to us to go back to the Board of Equalization and Assessment and try to determine whether a mistake has been made, or whether someone is just being unreasonable , or that someone just doesn’t like what they need to hear.”

More: Madison’s home revaluation process Madison County is hosting town halls to explain the first home revaluation process following the COVID-19 crisis

More: County proposes 3% increase in 23-24 Madison County is proposing a budget increase of more than 3%; to hold a public hearing at the end of the month

Wechtel reiterated the message he delivered in a series of town halls in February 2024, during which county commissioners met with county residents to inform them of the revaluation process, saying that the ratio of county home sales to real estate valuations subsequently skyrocketed. COVID strongly suggested to the state that the county would conduct a revaluation in 2024.

Johnny Casey has covered Madison County for The Citizen Times and The News-Record & Sentinel for nearly three years, including taking first place in beat reporting at the 2023 North Carolina Press Association awards. He can be reached at 828- 210-6071 or jcasey@citizentimes.com.

This article originally appeared on Asheville Citizen Times: Property tax rate cut in Madison County’s 2024-2025 budget