Rivian Automobile (NASDAQ: RIVN) recently reported its second quarter earnings update, and there were no real surprises. But it’s likely the calm before the storm for Rivian, and investors should pay attention.

That’s because the electric vehicle (EV) startup is preparing to begin production of the R2 SUV next year, its first new model. The smaller, cheaper R3 will follow. If these new EVs launch successfully, they should be major catalysts for Rivian’s stock. Investors who believe in the Rivian brand and see the success of the R1 models translating into a growing customer base should look into the stock before these catalysts impact the share price.

Rivian has found its niche market

Rivian distinguished itself as market leader in electric vehicles Tesla from the start. It launched only a pickup truck and a large SUV model as its first consumer EV offerings, plunging it into a growing market that didn’t compete with Tesla’s popular Models 3 and Y.

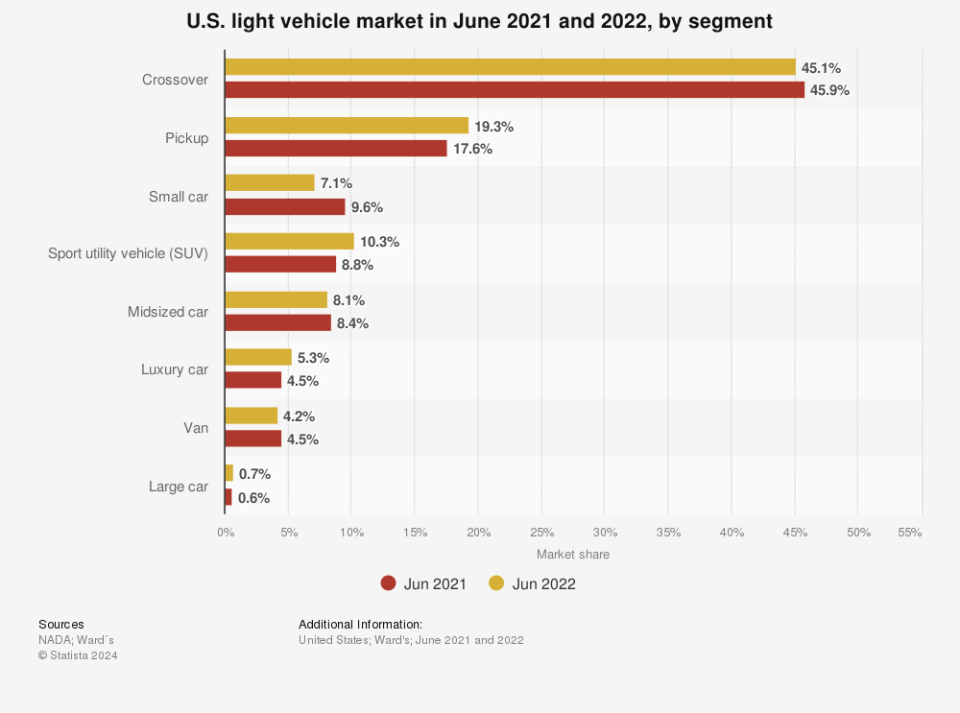

That business plan allowed the company to gain market share in vehicle markets that had yet to be penetrated by other all-electric offerings. At the same time, as seen below, pickup trucks and SUVs have been among the best-selling light-vehicle designs in the U.S. in recent years. And Rivian now has plans to enter an even larger consumer market.

Production of the next-generation R2 SUV starts next year, with deliveries scheduled for early 2026. That smaller, more affordable model should help expand Rivian’s addressable market. The company plans to enter the leading crossover segment next with its R3.

Those additional models will undoubtedly be catalysts that drive Rivian stock higher in the months ahead. A solid order book for the R2 will likely generate bullish views on the stock. Successful launches and reviews will only reinforce those opinions. But positive outcomes aren’t the only possibility. Any perceived slowdown in demand, or of the vehicles themselves, could drive the stock lower. Either way, investors should prepare for volatility in the EV maker’s stock for the foreseeable future.

Will Rivian’s next electric car be a success?

Rivian CEO RJ Scaringe is already touting the R2’s features, differentiating it from Tesla’s Model Y. He says the R3 will have even more unique features. The R2, which starts at around $45,000, will be “worlds different” from the Model Y, Scaringe said.

He wants to emphasize Rivian’s support for outdoor adventure applications for its vehicles as a significant and unique reason to want to own an R2 SUV. Scaringe recently said, “You can really go off-road with it, you can drive through a riverbed with it, you can do the things you expect an SUV to do.”

The R3, in turn, is promoted as a car that offers the driving experience of a rally car, but with an unusually high ground clearance for the crossover segment.

Investors must have a plan

If it launches successfully, the market should respond positively to Rivian’s expanded product offering. Investors who believe in the company and its brand may want to get ahead of these catalysts.

But investors also need to recognize the high risk and speculation. One way to hedge that risk is to simply invest an appropriate amount of money in a growth stock like Rivian. If it’s very successful, a small allocation is all you need. If it fails, that small investment is all you want.

Should You Invest $1,000 in Rivian Automotive Now?

Before you buy Rivian Automotive stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Howard Smith has positions in Rivian Automotive and Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Prediction: Rivian Shares To Rise On Emerging Catalysts was originally published by The Motley Fool