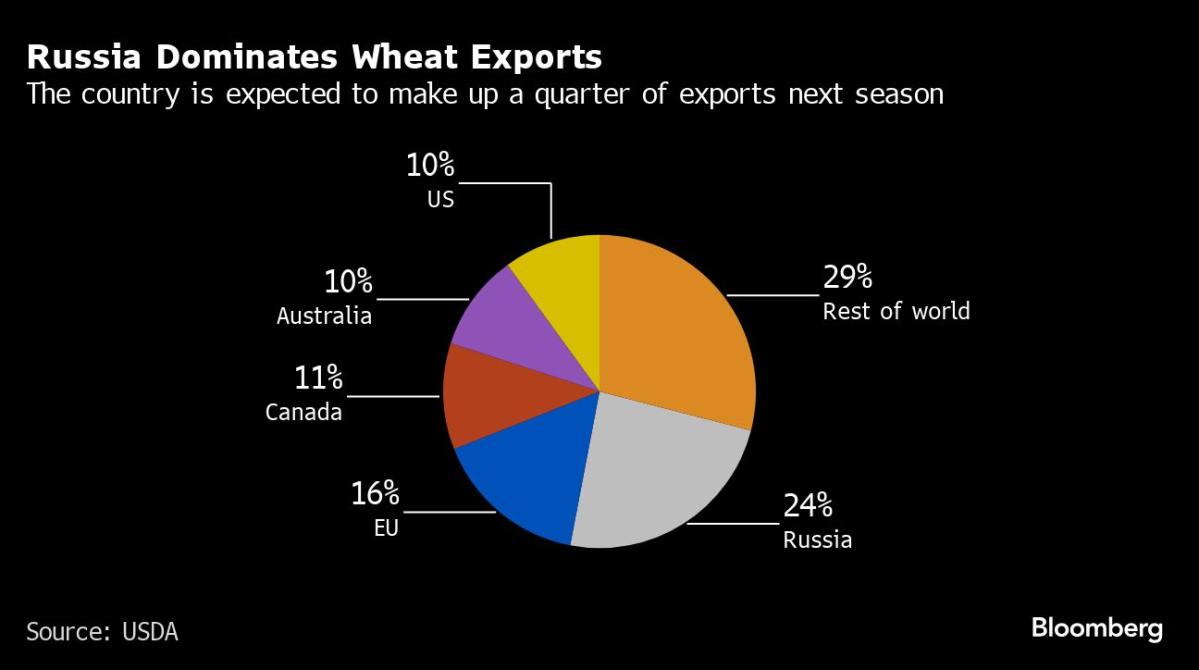

(Bloomberg) — Russia is stepping up its push to control even more of its crucial grain industry — potentially giving it more power over exports — just as concerns about global supply grow.

Most read from Bloomberg

Major Western traders, including Cargill Inc. and Viterra, withdrew from Russia last year after government pressure to make way for local companies. Now even the country’s largest private trader is finding it difficult to operate amid a row with the state. That puts the market in the hands of fewer companies, some of which have or had ties to the Kremlin.

Consolidation accelerated after President Vladimir Putin’s invasion of Ukraine and only four companies are now responsible for three-quarters of grain exports from Russia’s Black Sea terminals. That gives Moscow more leverage over wheat supplies, which have been crucial in curbing global food inflation. It also makes it harder for foreign traders to understand flows there – at a time when bad weather is hurting Russia’s wheat crop and spooking the market.

“Russia’s desire to control the commodity world is real, and their influence over grains is growing,” said Dan Basse, president of Chicago-based consultant AgResource.

Russia’s natural gas industry has always been government-dominated, with the state and Putin’s closest allies gaining control of much of oil production since he came to power. Now Russia is tightening its grip on grains.

Cargill, Viterra and Louis Dreyfus Co. stopped buying grain in Russia for export last year. They were previously among the top 10 exporters.

But a dispute with TD Rif shows how even private Russian exporters are coming under government pressure. The company, which recently changed its name to Rodnie Polya LLC, had helped Russia cement itself as an agricultural powerhouse but now sees its business under threat.

Former owner Petr Khodykin told Lenta.ru in March that the company’s cargo had been unfairly blocked by the agricultural regulator because it did not meet safety requirements, and that he was being pressured to sell the company.

Several people who used to buy from the company’s export partners said it had not been active in the market since March. The volume the company loaded for export in April fell about 40% from a year earlier, according to shipping data from Logistic OS. It can take anywhere from two weeks to a few months after an agreement is signed to load grain onto ships.

Spokespeople for Rodnie Polya and the Russian Agriculture Ministry did not respond to requests for comment.

Government objectives

Since the start of the war in Ukraine, Moscow has increasingly targeted assets owned by local tycoons and some units of overseas companies — from a pasta maker to the Russian subsidiary of French yogurt maker Danone SA — for nationalization or possible sale to a company favored by Ukraine. the Kremlin. It has also taken control of an agricultural holding company’s assets as it targets ‘unfriendly’ countries.

“The trend toward tougher policies and a more conservative ideology is inevitably accompanied by a strengthening of state intervention in the economy,” said Andrei Kolesnikov, a senior fellow at the Carnegie Endowment for International Peace in Moscow. “The state becomes politically untouchable and the most important player in the economy.”

Read more: Putin critic warns Kremlin will seize more assets to punish enemies

While Western traders still buy cargoes at Russian ports, it is harder to get information on things like harvest volumes and conditions, supplies and exports because they have restricted trade there. That could become a bigger concern as Russia may export less wheat due to crop setbacks.

Issues from drought to frost have prompted analysts to make major cuts to Russian production estimates, pushing wheat futures to their highest since July and rekindling concerns about rising food prices. The International Grains Council expects Russian wheat production to fall by about 6% this year.

Estimating things like the impact of frost is a challenge for the U.S. Department of Agriculture, which closely monitors global crop forecasts and no longer has staff on the ground in Russia. That means it’s more dependent on satellite images, which may not pick up damage.

The lack of people there “obviously adds a layer of uncertainty to what we’re doing,” said Mark Jekanowski, chairman of USDA’s World Agricultural Outlook Board.

The Russian government occasionally publishes crop forecasts, while independent local consultants such as IKAR conduct crop tours and regularly release production estimates that are closely watched by the market.

Read more: Bad weather and war are putting pressure on the world’s wheat supplies

Although benchmark wheat prices have risen in recent months, they are still about 50% below the record high set in 2022, when war disrupted flows in the Black Sea. Moreover, better prospects for U.S. crops could limit supply fears.

A key question is how Russian grain consolidation will affect the global market. The country is already trying to introduce an unofficial minimum price for its crops and stronger controls on the grain sector will make it easier for the government to influence deliveries.

There are no signs that Russia will significantly disrupt its own supplies – especially not in the way it did with gas when it cut supplies to Europe in the aftermath of the war, wreaking havoc on energy markets. And a large part of Russia’s grain exports goes to countries with which the country has good political ties.

The four largest Russian traders now control 75% of exports from Russia’s Black Sea terminals, up from 45% six years ago, said Dmitry Rylko, director of Moscow-based consultant IKAR.

“We have seen quite dramatic market consolidation in the hands of a very limited number of players,” he said at the GrainCom conference in Geneva this month.

–With help from Abdel Latif Wahba, Gina Turner and Michael Hirtzer.

Most read from Bloomberg Businessweek

©2024 BloombergLP