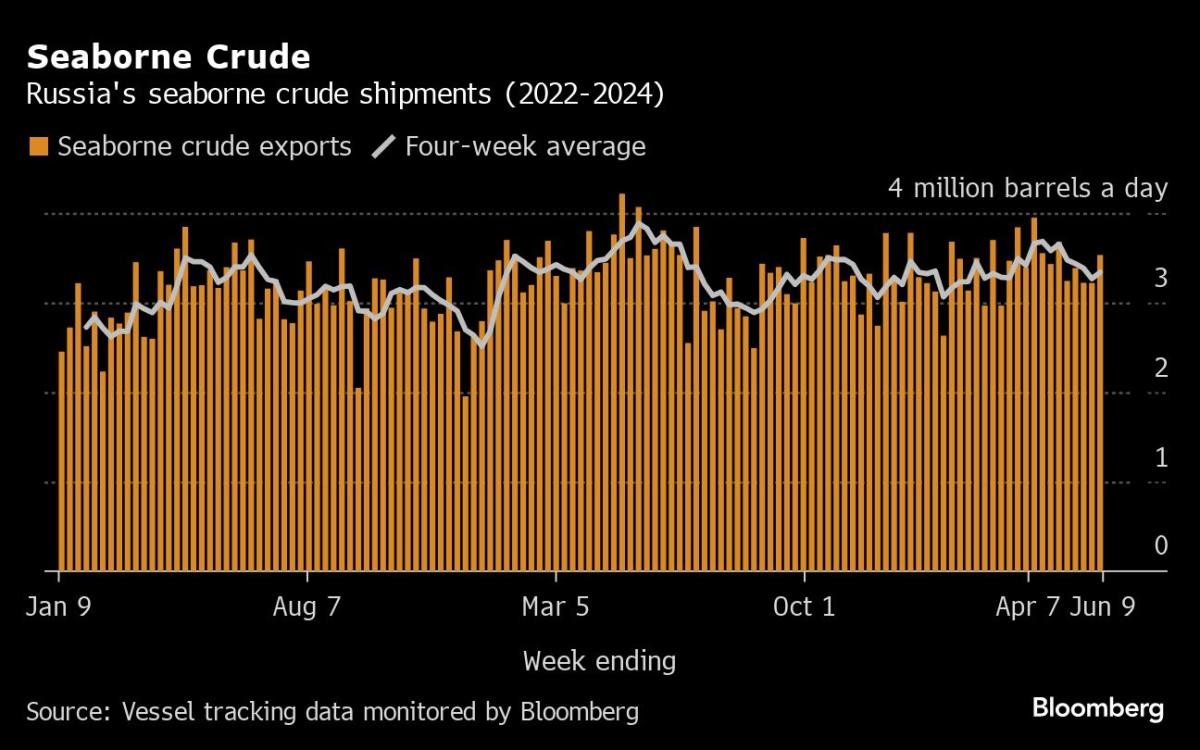

(Bloomberg) — Russia’s four-week average crude oil exports rose in the period to June 9, ending a string of declines.

Most read from Bloomberg

By this measure, exports had fallen each year for the past four weeks, resulting in a cumulative reduction of 390,000 barrels per day, or 11%. That was the biggest turnaround since November. The gain of 70,000 barrels per day in the latest tally was driven by a jump in weekly shipments to a five-week high.

Overseas crude oil flows have been below year-earlier levels since late April, with the gap widening to as much as half a million barrels per day before the latest rebound. This could be due to Russia’s more diligent adherence to a production target that is part of an effort by OPEC+ producers to support the market, or it could reflect pressure from international sanctions.

Moscow has pledged to make up for the overshoot of its April production target, blaming “technical aspects” of making significant cuts. But despite making the deepest cuts in more than a year, Russia still exceeded its promised level last month. Despite the increase in weekly export volumes, a sharp decline in oil prices from week to week, which followed the announcement of a gradual The easing of some OPEC+ production cuts from October limited the increase in the gross value of Russian shipments to just 4% in the seven days to June 9.

The Kremlin continues to test US-led restrictions on its oil shipments.

A third sanctioned Russian tanker loaded crude oil in Novorossiysk in the week to June 9. The Belgorod, until recently called the NS Bravo, seized about 1 million barrels of Ural crude on June 7 and is now in the eastern Mediterranean en route to the Suez. Channel. The first sanctioned ship to be loaded, the SCF Primorye, transferred its cargo in concealment to another ship east of Singapore. The second, the Bratsk, is located in the Indian Ocean, en route to Singapore.

If the cargo is eventually delivered to oil refineries, it could pave the way for more sanctioned tankers owned by state-controlled Sovcomflot PJSC to return to work. The company has now renamed at least 11 of 21 ships listed by the US Treasury Department for violating a G7-led price ceiling on Russian oil. All 21 now fly the Russian flag.

Raw shipments

A total of 32 tankers loaded 24.72 million barrels of Russian crude in the week to June 9, ship data and port agent reports show. That was an increase from 22.53 million barrels the week before.

Russian crude oil flows by sea rose 10% to 3.53 million barrels per day in the week to June 9. The less volatile four-week average also rose, rising about 70,000 barrels per day to 3.34 million, the first increase in five weeks.

A week-on-week increase in shipments from the Black Sea port of Novorossiysk and the Pacific ports of Kozmino and De Kastri was partially offset by fewer departures from the Baltic Sea, the Arctic terminals in Murmansk and the Sakhalin Island terminal in Prigorodnoye.

Two shuttle tankers used to transport crude oil from Russia’s Sakhalin-2 project have failed to move cargoes since April, putting the entire burden of shipments on one ship. Unless at least one of them is returned to service soon, the Sakhalin-2 project will struggle to continue delivering the normal pace of three to four cargoes per month.

Crude oil shipments so far this year are about 10,000 barrels per day, above the 2023 average.

Russia ended its export targets at the end of May and opted to limit production, in line with its partners in the OPEC+ oil producer group. The country’s production target is set at 8.978 million barrels per day until the end of September, after which it will increase by 39,000 barrels per day monthly until September 2025, as long as market conditions allow.

One shipment of KEBCO from Kazakhstan was loaded in Ust-Luga during the week.

Flows by destination

-

Asia

Most read from Bloomberg

Observed shipments to Russian Asian customers, including those without a final destination, recovered from 2.93 million in the four weeks to June 2 to 3 million barrels per day in the four weeks to June 9.

About 1.24 million barrels of crude oil per day were loaded onto tankers bound for China. The Asian country’s seaborne imports are boosted by about 800,000 barrels of crude oil per day, delivered by pipeline from Russia, either directly or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.43 million barrels per day, compared with a revised 1.63 million barrels per day in the period to June 2.

Both the Chinese and Indian figures are likely to rise as discharge ports become clear for ships that currently do not show final destinations.

The equivalent of about 285,000 barrels per day was on ships signaling Port Said or Suez in Egypt. These voyages typically end at ports in India or China and appear as ‘Unknown Asia’ until a final destination becomes clear.

The ‘Other Unknown’ volumes, which amount to around 50,000 barrels per day in the four weeks to June 9, come from tankers that have no clear destination. Most come from Russia’s western ports and pass through the Suez Canal, but some could end up in Turkey. Others may be transferred from one ship to another, with most such transfers now taking place in the Mediterranean Sea, or more recently off the coast of Morocco.

Russian oil flows continue to be complicated by the Greek Navy conducting exercises in an area that has become synonymous with the transfer of the country’s crude oil. The activities, which ran until June 3, have now been extended until July 15.

-

Europe and Turkey

Most read from Bloomberg

Russian exports of crude oil by sea to European countries have stopped, while flows to Bulgaria stopped at the end of last year. Moscow also lost about 500,000 barrels per day in pipeline exports to Poland and Germany in early 2023, when those countries stopped purchasing.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows stable at around 340,000 barrels per day in the 28 days to June 9.

Export value

The gross value of Russia’s crude oil exports rose to a five-week high of $1.63 billion in the seven days to June 9, from around $1.56 billion in the period to June 2, despite a sharp fall in prices. Export values at Baltic and Black Sea ports fell by almost $4.50 per barrel week-on-week, while key Pacific grade ESPO fell by around $3.70 per barrel. Prices for delivered goods in India also fell, by about $4.60 per barrel, according to figures from Argus Media.

In contrast, four-week average income was little changed, rising about $8 million to $1.6 billion per week, just above a 15-week low. The four-week average peak of $2.17 billion per week was reached in the period to June 19, 2022.

During the first four weeks after the Group of Seven countries’ price ceiling on Russia’s crude oil exports came into effect in early December 2022, the value of ocean flows fell to a low of $930 million per week, but soon recovered.

COMMENTS

This story is part of a weekly series tracking crude oil shipments from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, June 18.

All figures exclude loads identified as Kazakhstan’s KEBCO grade. These are KazTransoil JSC shipments passing through Russia for export via Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are mixed with crude oil of Russian origin to create a uniform export flow. Since the Russian invasion of Ukraine, Kazakhstan has renamed its cargoes to distinguish them from those shipped by Russian companies.

Ship tracking data is compared with reports from port agents and with flows and ship movements reported by other information providers, including Kpler and Vortexa Ltd.

If you are reading this story on the Bloomberg Terminal, click here for a link to a PDF file showing four-week average flows from Russia to major destinations.

–With help from Sherry Su.

Most read from Bloomberg Businessweek

©2024 BloombergLP