(Bloomberg) — Saudi Aramco’s $12 billion share sale sold out shortly after the deal opened on Sunday, in a boon for the government seeking funds to help pay for a massive economic transformation plan.

Most read from Bloomberg

Under the terms of the deal, seen by Bloomberg News, all of the shares on offer were in demand within hours of the books opening. Books fell within the price range of 26.70 riyals to 29 riyals.

While it was not immediately clear exactly how much of the demand came from abroad, the order book reflected a mix of local and foreign investors, said three people familiar with the matter, declining to be identified because the information is private.

The extent of foreign participation will be closely watched as an indicator of interest in Saudi assets. During Aramco’s 2019 IPO, foreign investors had largely rejected valuation expectations and left the government dependent on local buyers. The $29.4 billion listing attracted orders worth $106 billion, and about 23% of the shares were allocated to foreign buyers.

One of the key selling points of the latest offering is the chance to reap one of the oil industry’s biggest dividends. Investors willing to look past a steep valuation and lack of buybacks could cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a 6.6% dividend yield.

Shares of Aramco fell as much as 2.9% to 28.30 riyals on Sunday, valuing the company at about $1.8 trillion. The stock has fallen about 14% since early this year, when Bloomberg News first reported the government’s intention to divest a stake, and is currently trading at its lowest level in more than a year.

The Saudi government owns about 82% of Aramco, while the kingdom’s wealth fund owns another 16% of the shares. The kingdom will remain the main shareholder even after the announcement, which has been in the works for years.

Crown Prince Mohammed bin Salman said in 2021 that the government wants to sell more Aramco shares in the future. Those plans gained momentum a year ago, when the kingdom started working with advisors to investigate the feasibility of a follow-up offer.

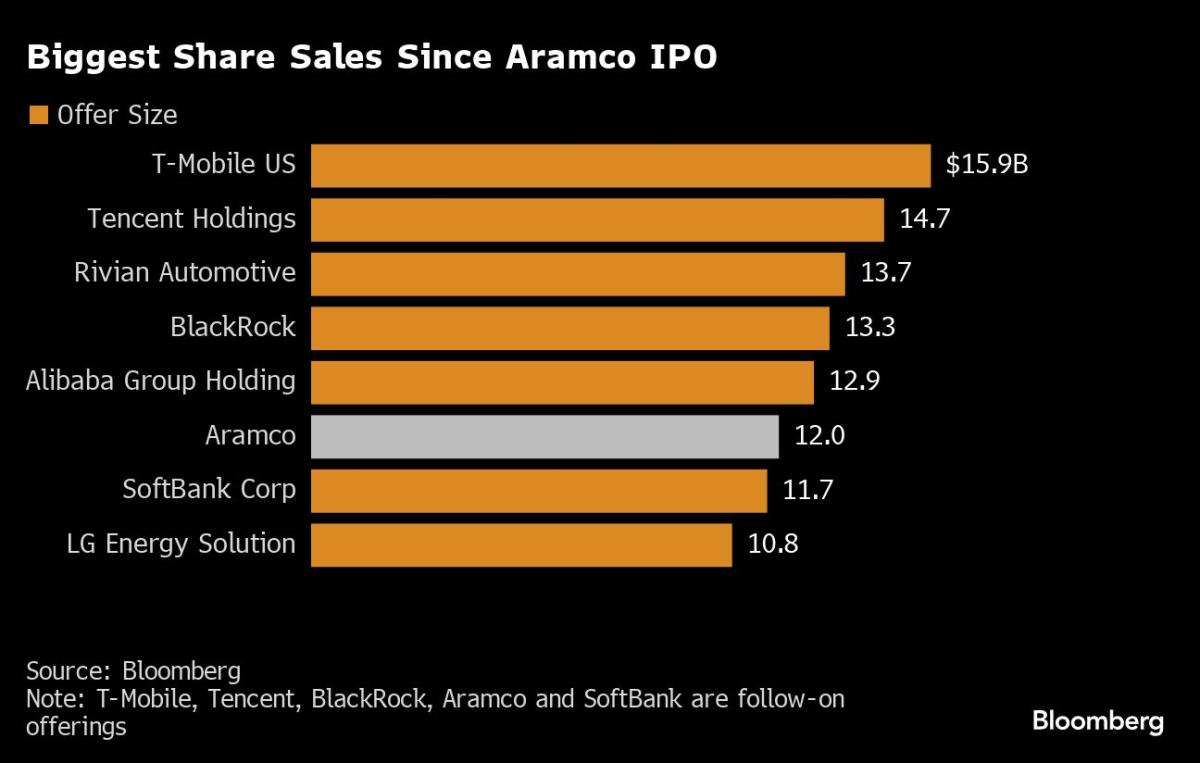

The deal is among the largest share sales worldwide since Aramco’s IPO. Proceeds will help fund initiatives to diversify the economy as the kingdom moves into artificial intelligence, sports, tourism and projects such as Neom.

The offer adds to Saudi Arabia’s efforts to raise money to fill a budget gap. International debt sales have raised $17 billion this year, more than any other emerging market country, Bloomberg data shows. The government also sold $25.5 billion worth of riyal notes domestically, compared to just under $20 billion in the same period a year ago.

The government kicked off the deal just before an OPEC+ meeting to discuss oil production policy. The group is planning a deal to extend supply cuts until the end of the year, which would leave Saudi Arabia’s output at its lowest level in about three years, according to delegates.

Follow our live blog from Sunday’s OPEC+ meeting here

The deal coincides with a period of strong demand for new share sales in Saudi Arabia. In recent weeks, four companies have attracted a total of $176 billion in orders for their initial public offerings, as fund managers flocked to deals that have delivered almost guaranteed returns over the past two years.

The government is working with a range of banks on the sale. M. Klein & Co. serves as an independent financial advisor alongside Moelis & Co.

Read more: Michael Klein makes Wall Street return with a bumper stock sale

SNB Capital acts as lead manager. It is also a joint global coordinator, together with Citigroup Inc., Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co., Bank of America Corp. and Morgan Stanley. Al Rajhi Capital, BOC International, BNP Paribas SA, China International Capital Corp., EFG Hermes, Riyad Capital, Saudi Fransi Capital and UBS are bookrunners for the deal.

Some of these banks also worked on Aramco’s IPO, when they paid just over $100 million for their work. These relatively small fees are common in the region. By comparison, banks including Goldman and JPMorgan split about $60 million from helping Peloton Interactive Inc. to raise just $1.2 billion in 2019.

The government has not yet specified how much the banks will receive from the latest deal. Instead, the prospectus said the kingdom will pay fees to the bookrunners based on the total value of the offering and costs associated with the share sale.

In total, Saudi Arabia plans to sell 1.545 billion shares, representing a 0.64% stake. The government could raise another $1.2 billion if it exercises an option to sell more shares as part of the offering.

(Updates with details on foreign demand from 3rd paragraph)

Most read from Bloomberg Businessweek

©2024 BloombergLP