(Bloomberg) — Foreign investors were allocated about 60% of the shares offered in Saudi Aramco’s $11.2 billion share sale, people familiar with the matter said, marking a reversal from the listing of the oil giant in 2019, which ultimately became a largely local affair.

Most read from Bloomberg

The deal generated strong demand from the U.S. and Europe, according to the people, who declined to be identified because the information is private. Funds from Britain, Hong Kong and Japan also backed the share sale, which totaled orders worth more than $65 billion, the people said.

During the oil giant’s listing, foreign investors had largely resisted valuation expectations, leaving the government dependent on local buyers. The $29.4 billion IPO attracted orders worth $106 billion, and only 23% of the shares were allocated to foreign buyers.

Aramco shares initially fell as much as 1.4% in Riyadh on Sunday, the first trading day after the completion of the secondary offering, before paring all losses and rising about 2%.

The secondary offering attracted about 450 funds and more than 125 new international investors, people familiar with the matter said.

Aramco confirmed that a majority of its shares had been allocated to foreign funds. International institutional investors now own about 0.73% of the company, the company said in a statement on Sunday.

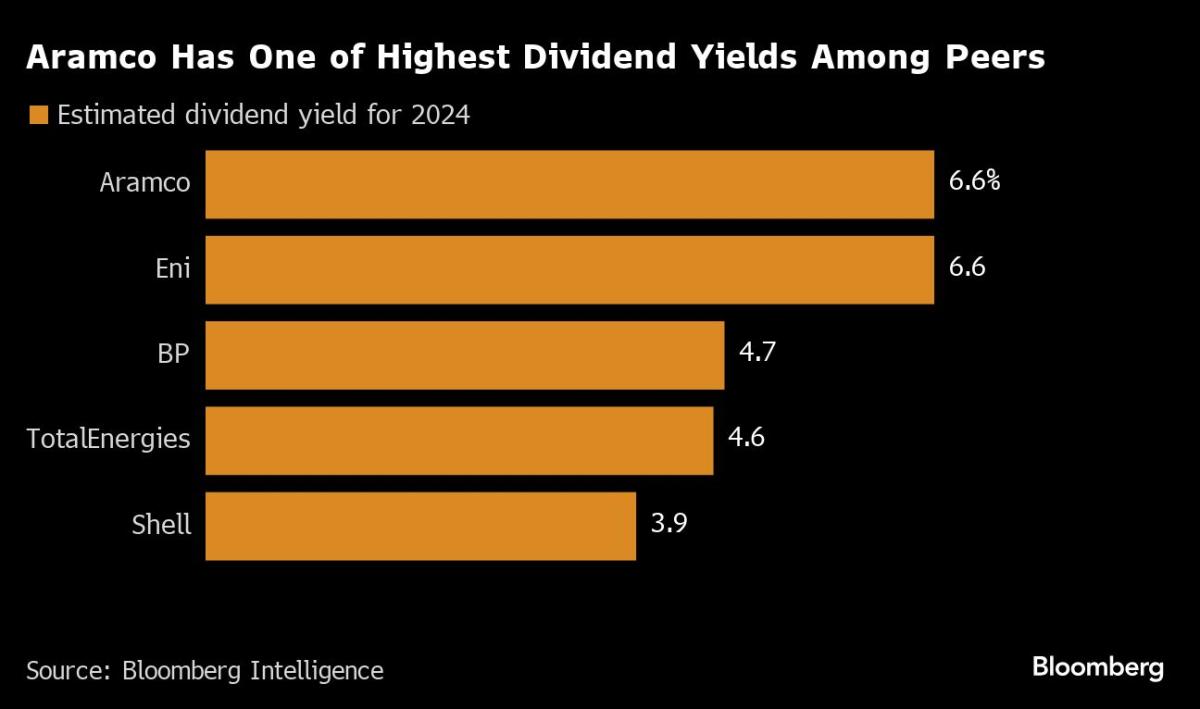

A major draw this time around is the company’s dividend, which is one of the largest in the world. Investors willing to look past a steep valuation and lack of buybacks could cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a 6.6% yield.

Saudi Arabia attracted enough bids to cover all shares within hours of the start of the deal. The offering closed on Thursday and the kingdom is expected to bring in at least $11.2 billion in proceeds, excluding over-allotments – cash that will help finance a multi-trillion dollar boost to transform the economy.

The final price was near the lower half of a proposed range of 26.70 riyals to 29 riyals, although Aramco shares have been trading below the upper end since the deal was announced and closed at 28.30 riyals on Thursday.

The scale of foreign participation was closely monitored, with Aramco’s top executives organizing a series of events in London and the US to boost demand.

The Saudi government owns about 82% of Aramco, while the Public Investment Fund owns another 16% of the shares. The kingdom will remain the main shareholder even after the issue.

(Share price updated in fourth paragraph)

Most read from Bloomberg Businessweek

©2024 BloombergLP