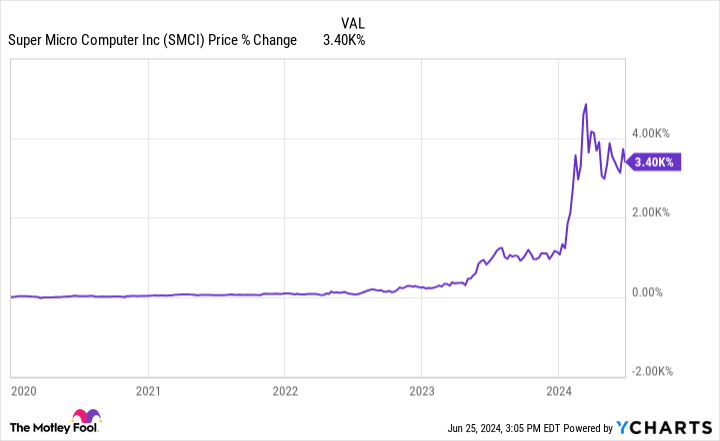

Supermicrocomputer (NASDAQ:SMCI) has become one of the most dramatic and surprising companies on the stock market over the past year. The company existed in obscurity for decades, and its shares gained little traction for years after its initial public offering (IPO) in 2007.

However, an important partnership with Nvidia has changed the game for Supermicro (as the company is commonly known). As a result, the share price has risen 190% in the first half of this year. With the huge gains, investors are rightly wondering whether that momentum can continue into the second half of 2024.

The State of Supermicro

Supermicro is a technology hardware company known for producing energy-saving, environmentally friendly tech products for the cloud, metaverse, and other applications. The servers have received the most attention, especially those equipped with Nvidia’s artificial intelligence (AI) chips. Thanks to this partnership, profits and stock price have grown exponentially.

Just four years ago, the stock was trading for about $24 per share. This year, the recent growth has been so dramatic that analysts are predicting nearly $24 per share for Supermicro’s net income! Not surprisingly, such improvements have led to a 3,400% increase in the price of tech stocks since 2020.

A study from Market.us seems to confirm this trend. It predicts that the AI server industry will grow at a compound annual growth rate (CAGR) of 30% through 2033, transforming what was a $31 billion industry last year into a $430 billion industry by 2033.

Can growth continue?

Even the most dedicated Supermicro bulls shouldn’t expect another 3,400% gain in the next four and a half years. While an additional 190% gain in six months is far from guaranteed, it’s not out of the question when you look at the financials. For the nine months of fiscal 2024 (ending March 31), net sales of $9.6 billion increased 95% from the year-ago level. Cost of sales increased slightly faster at 102%.

As a result, net income of $855 million grew 92% over the same period. Moreover, with consensus estimates pointing to a 102% increase in net income for the fiscal year, earnings are rising fast enough to allow the stock to maintain a high growth rate.

Furthermore, despite rising profits and massive share price growth, the price-to-earnings (P/E) ratio is 47 and the forward P/E ratio is 36. This is less than some of the faster growing tech giants such as Nvidia and AmazonThis indicates that it could support the many expansions needed to take the stock price much higher, possibly enough to maintain the current growth rate for another six months.

Supermicro in the second half of 2024

Given the business and financial environment, a 190% gain for the second half of this year is a plausible scenario. Granted, the market offers no guarantees, and ultimately investors should not expect a 190% increase by the end of 2024.

However, demand for the company’s servers is likely to continue to rise, possibly enough to warrant near-triple-digit revenue and profit growth in the near future.

At its current valuation, a 190% increase in its share price would give it an expensive, but not record-breaking, P/E ratio. So even if it falls short of that ambitious target, Supermicro could still deliver significant returns for the rest of the year.

Should You Invest $1,000 In Super Micro Computer Now?

Before you buy Super Micro Computer stock, you should consider the following:

The Motley Fool Stock Advisor analyst team just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the performance of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns from June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

Super Micro Computer Stock Is Up 190% Year To Date. Can Growth Continue Into Second Half Of 2024? was originally published by The Motley Fool