Deciding when to buy a stock is perhaps the most challenging decision for an investor. This is especially true for new, unique companies in fast-growing industries Arm positions (NASDAQ:ARM). Arm Holdings shares have more than doubled since its initial public offering (IPO) about nine months ago, and many investors are eager to own the company. But is now a good time?

Several factors make timing purchases difficult:

-

Intellectually, we all assume that the best time to buy is when the market or stock is falling, but most people find it difficult to pull the trigger when the time comes because they fear further losses.

-

Newer companies and technology companies are notoriously difficult to value. Traditional metrics like price-to-earnings (P/E) ratios may be great for some established names, but are often of little value to today’s newcomers. Since the IPO AmazonThe stock’s average price-to-earnings ratio is well above 200 (and only this year has it dropped to a more reasonable 50), but the stock is up 6,700%.

-

You may not have money available when the opportunity arises. Life is expensive these days, and most people aren’t sitting on a pile of cash waiting for their favorite stocks to plummet.

Fortunately, there are strategies to help. First, let’s look at what makes Arm so attractive.

What does Arm do?

Semiconductors make computing possible. They are components of central processing units (CPUs) and graphics processing units (GPUs), which are deeply embedded in everyday life. An example of this is that Arm-based CPUs power 99% of the world’s smartphones NvidiaThe spectacular results are made possible by the advanced GPUs and components used by data centers.

However, there is an important distinction: Arm does not produce chips; it designs cutting-edge ‘architecture’ and receives royalties and licensing fees from the technology companies that use the technology in their products. For example, an Arm customer who sells smartphones pays Arm a royalty for each phone sold. This distinction is one of the things that makes Arm an attractive company and stock.

Is Arm stock a good buy now?

Because Arm does not produce chips, it saves a lot of costs and investments in real estate and equipment. Production facilities are expensive; just ask other semiconductor companies. To illustrate: the largest manufacturer in the world, Taiwanese semiconductor manufacturing, has a gross margin of about 50% and a free cash flow margin of almost 20%, while Arm’s margins are almost 95% and 30%, respectively. This makes Arm’s business model extremely attractive because a greater percentage of cash goes straight into the company’s pockets as sales grow. Revenue reached $928 million in the fourth quarter of fiscal 2024 ended March 31, growing 47% year over year. For the full fiscal year 2024, the company generated $3.2 billion in revenue and expects $3.8 billion to $4.1 billion in the coming fiscal year.

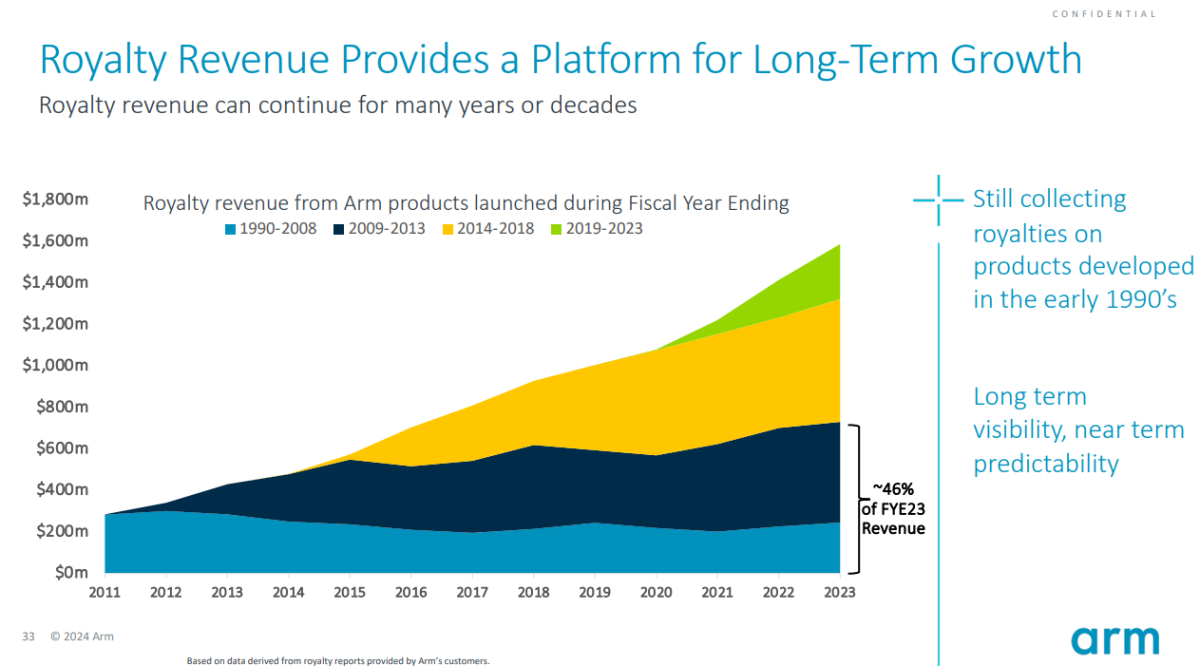

Another reason Arm’s model is attractive is because it still collects royalties on products produced more than 30 years ago, as shown below.

This means two things. First, the new advanced designs do not cannibalize sales of previous designs because they have different applications such as artificial intelligence (AI), cloud and advanced automotive systems. Second, royalties from decades-old designs are now almost all profit, because the research and development costs have already been incurred.

Arm is a great company to own for the long term. The big question is whether we should buy now or wait for a decline after the stock’s steep rise as shown below.

By most traditional measures, Arm stock appears overvalued. However, the company’s long-term potential and growth performance are critical, just like Amazon.

Here are three methods to buy stocks while minimizing the risk of overpaying.

-

Buy a little and wait for a drop to buy more. You make some money when the stock price rises and have only a small exposure when it falls. The decline provides an opportunity to reduce the average trading price. The disadvantage is that you only have a small position if it does not fall significantly.

-

Be patient. Buying the dip means that the investor waits patiently for a significant pullback and then strikes. The downside, of course, is that the shares may not cooperate. For example, if the stock rises another 40%, a 20% correction is still well above the current price.

-

Dollar-cost averaging (DCA) is a great risk mitigation strategy where the investor buys consistently over time, say $200 per month. DCA allows the investor to take advantage of ebbs in the stock price without a lot of guesswork and timing.

Arm Holdings is a great company with an enviable business model in an excellent sector. But these stocks aren’t cheap. Jumping head first is a risky strategy. Consider one of the more prudent ways to purchase above.

Should You Invest $1,000 in Arm Holdings Now?

Consider the following before purchasing shares in Arm Holdings:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon, Arm Holdings and Nvidia. The Motley Fool holds positions in and recommends Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Should you buy arm holdings now or wait for a pullback? was originally published by The Motley Fool