Long term Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) Investors are incredibly happy. For decades, this one stock has been beating the market. Since inception, the average annual return has been about 20% — about double the performance of the S&P 500.

But is Berkshire stock still a bargain today? If you want to make your portfolio successful, read on.

Are Berkshire Stock Overpriced at $450 Per Share for One Share Class?

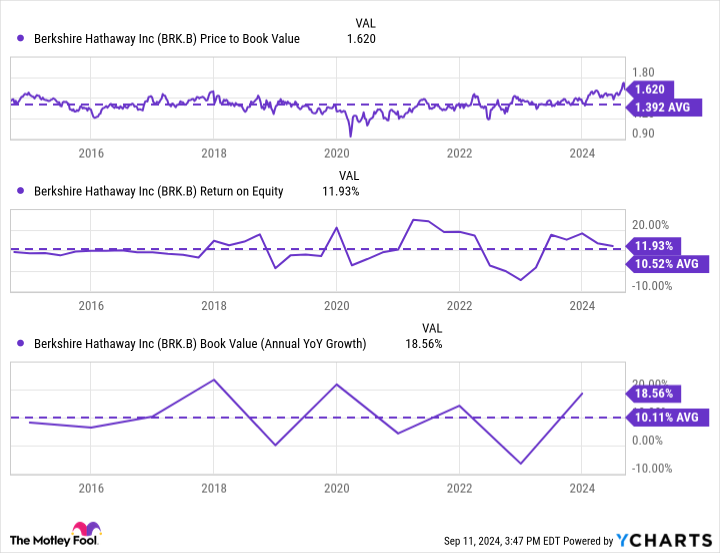

For years, Berkshire’s CEO, legendary investor Warren Buffett, described book value as a reasonable way to value the company. After all, the company was essentially a large, complex conglomerate of disparate assets. By looking at the company’s price-to-book ratio, you could see how the market was valuing those assets, in a very crude way.

In the past, Buffett believed that Berkshire’s assets were worth at least 1.1 times book value, or the value of its assets as recorded on its balance sheet. So he initiated share buybacks whenever valuations fell this low, arguing that buying back shares at a discount (or a minuscule premium) to book value was a great way to increase shareholder value. He later raised the buyback threshold to 1.2 times book value — meaning that Berkshire would buy back shares whenever the market valued its shares at less than 1.2 times the stated book value of its assets.

Buffett, however, recently dropped the price-to-book threshold. That seems convenient, given that shares are trading at a multi-year high of 1.6 times book value. But there’s a good reason for the shift. Berkshire buys back billions of dollars of stock each quarter. These moves, while they increase shareholder value, tend to suppress the company’s reported book value. So it’s a smart move for shareholders, but it artificially depresses book value. The result, all other things being equal, is that Berkshire’s price-to-book ratio will rise even though the shares won’t necessarily become more expensive.

The Best Way to Value Berkshire Hathaway Stock

So how do we value Berkshire stock today? To do this, investors need to ask a different question: How long will Berkshire’s business model continue to outperform the market?

It’s true that Berkshire looks expensive on a price-to-book basis right now. Although, as we’ve discussed, some of that premium has been inflated by massive share buybacks. But what investors really need to pay attention to is how much cash Buffett and his team are actually generating for shareholders. There’s been some volatility, but over the past few years, both return on equity and annual book value growth have hovered around 10%. And keep in mind that those numbers have been somewhat understated as share buybacks have reduced the stated book value. But despite those accounting headwinds, returns still average at or above 10%.

BRK.B Price-to-book value data from YCharts

If Berkshire can maintain returns above 10% per year despite share buybacks — a feat that is entirely possible given that the company enjoys several structural competitive advantages — then the shares are probably a bargain, even if the current price multiple suggests that shares are overvalued relative to historical averages. Consider this: There is never was a bad time to buy Berkshire stock in the past. Even if you had bought just before the financial crisis, the dotcom bubble burst, or the pandemic flash crash, your portfolio would still have performed very well over the long term. Paying a premium for a blue-chip stock like this is a no-brainer if you have the patience. That upfront premium, spread out over a decade or more, quickly gets diluted.

Is Berkshire stock expensive now that it’s hovering around $450 a share? Many would say yes. But is it so expensive that long-term shareholders should ditch the stock? Absolutely not. Whether you already own the stock or are looking to get in, don’t let its current valuation deter you from taking a long-term position.

Should You Invest $1,000 in Berkshire Hathaway Now?

Before you buy Berkshire Hathaway stock, consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $730,103!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Should You Buy Berkshire Hathaway Now That It’s Below $450? was originally published by The Motley Fool