Chevron (NYSE: CVX) has a lot to offer as an energy investment, not the least of which is its dividend. It has increased annually for 37 consecutive years and currently offers a high dividend yield of 4.4%. Should you buy Chevron with the stock down more than 20% from its most recent highs? Here are some key factors to consider before you make your final decision.

What is Chevron doing in the energy sector?

The headline is actually a trick question, because Chevron almost always does that. everythingand therefore it is classified as an integrated energy company. But to be more specific, it has operations in the upstream segment (energy production), the midstream arena (pipelines and other transportation and storage infrastructure) and the downstream niche (chemicals and refining). Each segment of the broader energy sector operates a little differently and has different market dynamics.

By bringing upstream, midstream and downstream businesses all under one roof, not only does it create a diversified company, further enhanced by Chevron’s global reach, but it also helps smooth the ups and downs of the energy cycle. Commodity prices are the primary driver of Chevron’s top and bottom lines, but the inherent fluctuations won’t be as material as if the company focused solely on upstream.

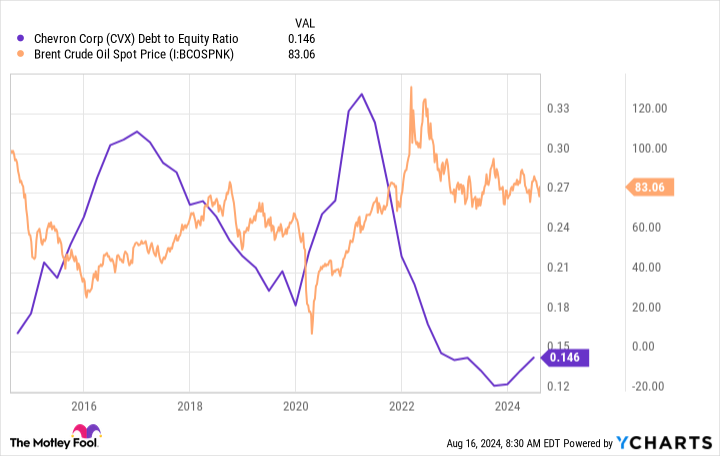

Chevron also focuses heavily on the strength of its balance sheet. To put a number on that, Chevron’s debt-to-equity ratio is a minuscule 0.15 today. That would be a low number for any company, but it’s also the lowest number compared to Chevron’s closest peers. This gives Chevron more room to use leverage to support its business and dividend during the inevitable oil downturns it will face. Simply put, Chevron is a conservative way to invest in the energy sector.

Is Chevron a bargain at under $150?

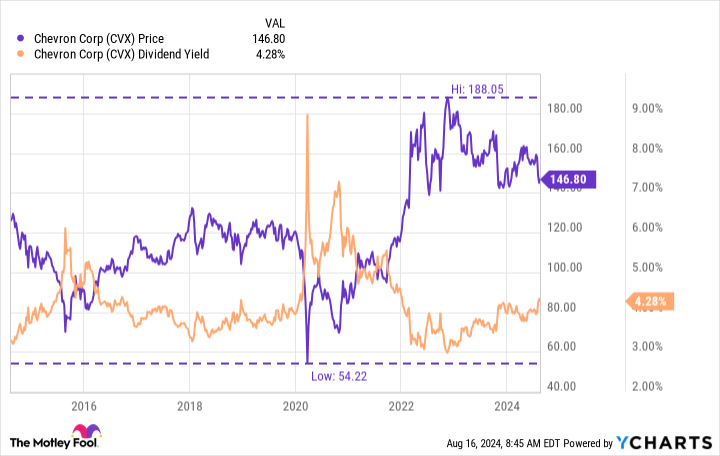

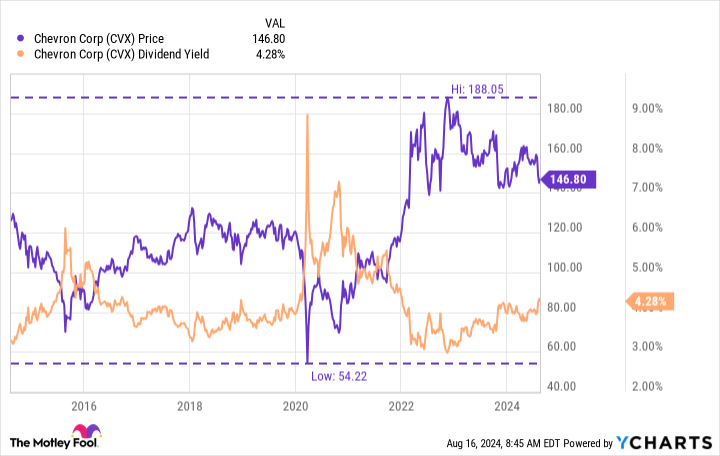

Chevron shares are trading below $150 today, down about 20% from their recent price peak of around $188 per share in late 2022. That could be seen as a solid entry point for dividend investors looking to add energy exposure to their portfolios, given the stock’s attractive 4.4% yield. S&P 500 index yields only about 1.2%, and the average energy stock, using Energy Select Sector SPDR ETF as a replacement, yields approximately 3.1%.

Add to that Chevron’s strong financials, diversified business, and long history of weathering energy downturns while rewarding investors with regular dividend increases, and you can see where a conservative type would make a smart choice to buy the stock if they were looking for an energy investment right now.

But there’s one problem: oil prices are pretty high right now. Sure, they’ve been higher, but they’ve also been a lot lower. Given the nature of the oil industry, it’s highly likely that Chevron will be faced with significantly lower energy prices at some point in the not-too-distant future.

Chevron is ready, noting that its debt-to-equity ratio is very low, but that doesn’t change the fact that revenue and profits will fall if energy prices fall. That, in turn, will cause investors to sell the stock.

In fact, Chevron’s stock has dipped below $80 a share three times in the past decade. Meanwhile, its dividend yield has risen to as high as 9% at one point. That was an extreme spike due to the coronavirus pandemic. But 6% is not unachievable, as it has been reached three times.

It wouldn’t be at all shocking to see a deep drop in oil prices lead to a deep drop in Chevron stock and push yields to materially more attractive levels. Or, to put it another way, if you want to buy Chevron at a bargain, you’d be better off waiting until the next big oil sell-off.

Chevron is a good company

Here’s the thing: For long-term investors with an income focus, Chevron is probably a good choice right now. You’re not getting the best possible price, but you’re probably buying at a fair level if you add the stock below $150.

However, if you’re willing to watch and wait, you can probably buy it at a much better price at some point in the future, given the inherent volatility of the energy sector. The only caveat here is that you need to get to know the company today and make a concrete plan for when you want to buy it (perhaps when the yield hits 6%).

The best time to buy Chevron is probably when the fear of owning it is at its highest. And if you don’t plan ahead, fear can cause you to miss the opportunity.

Should You Invest $1,000 in Chevron Now?

Before you buy Chevron stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $779,735!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Should You Buy Chevron Now That It’s Under $150? was originally published by The Motley Fool