Supermicrocomputer (NASDAQ: SMCI) was one of the best performing stocks this year, even outperforming NvidiaHowever, it has fallen on hard times after a poorly received earnings report and a short-seller announcement. The stock is now down more than 60% from its all-time high after the combination of these two factors and a general sell-off due to extreme valuation.

With the stock price at this low, many investors (myself included) may be wondering if stocks are a bargain at these levels. Let’s take a look, because there’s a lot to be excited and concerned about.

Supermicro products are in high demand

Super Micro Computer (often referred to as Supermicro) supplies components needed to build large-scale data centers and servers. Due to the high demand for extreme computing power to train artificial intelligence (AI) models, Supermicro is seeing a spike in demand similar to Nvidia for its products.

This space is quite commoditized, as there is not much to differentiate between vendors. But Supermicro’s highly customizable server products set it apart from the competition. Additionally, the company’s architecture is the most power-efficient offering available. This is crucial, as the power costs for these servers are incredibly high.

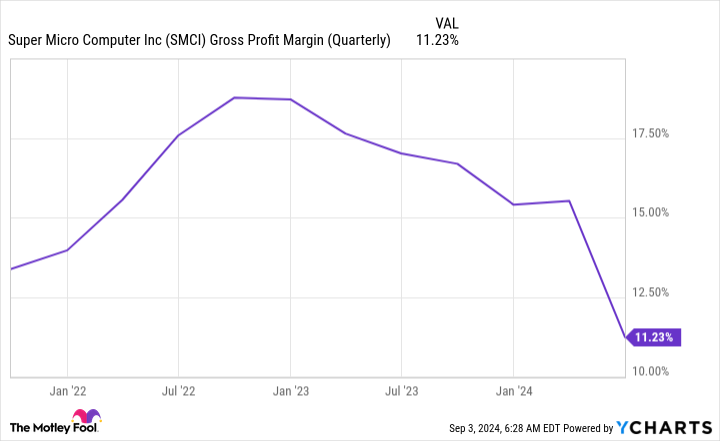

Supermicro’s business has exploded as demand for AI computing has increased. In the fourth quarter of fiscal year (FY) 2024 (ending June 30), revenue increased 143% year over year to $5.3 billion. It also forecast revenue of $26 billion to $30 billion for FY 2025, indicating growth of 74% to 101%. However, gross margin has declined significantly as the product mix has increasingly focused on its new liquid-cooling technology.

Management expects gross margin to improve in 2025 and beyond due to the relocation of manufacturing facilities, but these short-term headwinds are expected to put significant pressure on profit margins. This is as Supermicro’s accounting is accurate, given recent allegations about concerns over its internal controls.

Are there legitimate questions about Supermicro’s accounting practices?

Supermicro also announced that it would be late filing its year-end Form 10-K with the Securities and Exchange Commission (SEC) due to management’s review of internal controls over financial reporting. This announcement came at almost the same time that famed short-seller Hindenburg Research announced its short position in the company.

While Hindenburg cited several reasons in his announcement as to why the company is engaging in some level of irregularity, he primarily alleges that Supermicro’s quarter-end accounting techniques make it appear as if the company is doing better than it actually is. Of course, Hindenburg is a motivated short-seller and the validity of his claims remains to be proven.

Additionally, Supermicro was temporarily delisted from the Nasdaq stock exchange in 2018 for failing to file timely financial statements. The SEC fined the company in 2020 for improper accounting. While some people lost their jobs as a result, Hindenburg claims those people were rehired within three months of paying the fines.

Almost all investor actions are based on the financial data that the company reports to them. If that information is unreliable, it is almost impossible to adequately evaluate the stock.

The report sent the stock price plummeting nearly 30%, indicating that most investors wanted nothing to do with it.

But is this a legitimate reaction? While there are likely some accounting issues at Supermicro, there is also real demand for its products and services. While this may affect a few percentage points of revenue, it is unlikely to be worth billions of dollars. Furthermore, the stock is trading at just 13 times forward earnings after the sell-off.

That’s dirt cheap for a company benefiting from the huge demand for AI.

So, what should investors do? I think investors should be patient before taking a large position in the stock. There are a lot of unknowns at this point and it’s too early to say how the stock will react. However, it might not be a bad idea to take a small position (say less than 1% of the total portfolio weight) because there is a lot of potential here. And if Supermicro falls further, it won’t affect the overall portfolio much.

Supermicro is still a company with a huge demand for its product, but there are some allegations surrounding its finances and internal controls, so only time will tell.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy Super Micro Computer stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $650,810!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Stock Now That It’s Down 60% From All-Time Highs? was originally published by The Motley Fool