Shares of financial technology (fintech) pioneer PayPal (NASDAQ:PYPL) are down more than 40% in the past five years and are down 80% from their all-time highs. Before I explain the company’s recent announcement, which could finally help turn things around, let me explain some of the issues it faces.

First, PayPal is currently struggling to find revenue growth. The company’s revenue rose only 8% year over year in 2023. And the first quarter of 2024 was only marginally better with 9% growth. That is much lower than what investors are used to.

Second, this lackluster revenue growth for PayPal has come at the expense of profit margins. In addition to the fintech services that most consumers are used to, the company also offers unbranded checkout products behind the scenes. And prices for these products were lowered to gain market share.

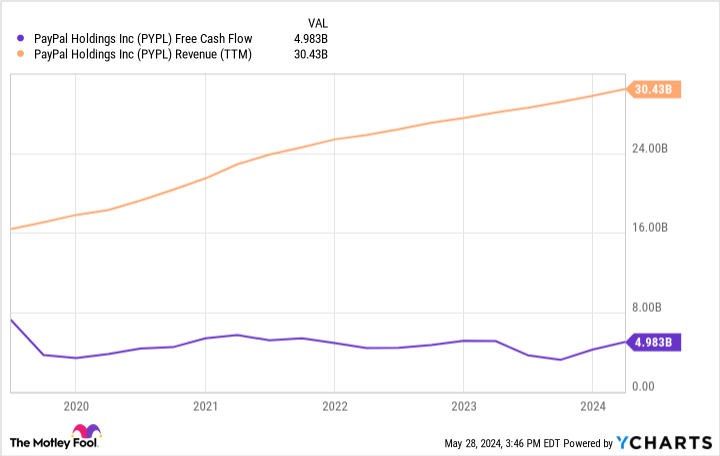

Looking at both factors together, PayPal has struggled to grow, and the little growth it has experienced recently has been a disaster from a profitability perspective. This is illustrated by the free cash flow in the five-year chart below.

If PayPal can solve this problem of profitable growth, the company will be well on its way to improving shareholder returns. And that’s where management’s recent announcement comes in.

Management’s big move

PayPal management just announced that it will be launching its own ad network, which could be quite valuable.

I’m not going to dig up the history of it all. But suffice to say, PayPal has long talked about its wealth of consumer spending data. And there’s no doubt that the company does indeed have something valuable. After all, it has 427 million active users and processes more than $1.5 trillion in payments annually. There are useful data points buried in here somewhere.

PayPal knows what people want to spend money on. And hundreds of millions of people are already active on the platform, giving the company the ability to serve relevant ads in abundance.

PayPal takes out Mark Grether Uber Technologies (NYSE:UBER) to lead its new advertising business. It’s important to note that Grether led Uber’s advertising operations from its inception in October 2022. Now, less than two years later, Uber’s advertising is already a billion-dollar business.

PayPal is certainly bringing in a seasoned veteran to build its advertising business. And Grether may be ready for even more success this time. Not only does he now have more experience running Uber, but PayPal’s user base is also larger. When Uber started advertising, it had 122 million monthly active users. By comparison, PayPal had 220 million monthly active users as of the first quarter.

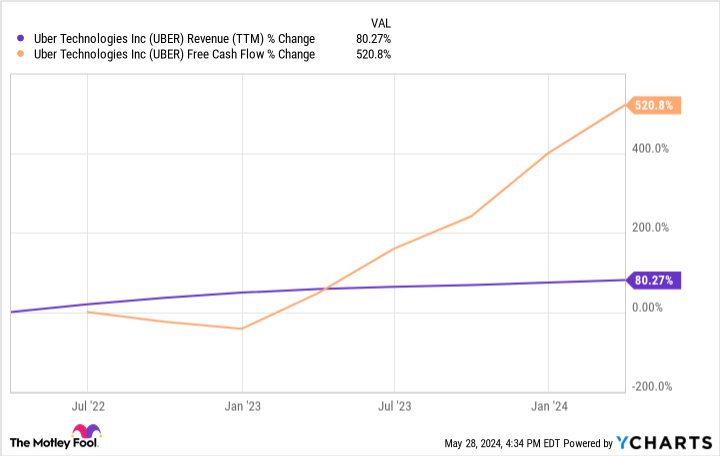

I’ll stop short of saying that ads were created all of the difference to Uber’s bottom line — there are a lot of moving parts at a company of this size. That said, free cash flow undeniably started to peak around the time ads launched.

I think this should be a good reason for cautious optimism among PayPal shareholders. I say ‘cautious’ because the company has been talking about better use of its data for a long time, while there appears to be little evidence for this. But perhaps now is finally the time under his relatively new leadership.

I say “optimism” because I’ve already established that the lack of earnings growth has been a major reason PayPal stock has gone down the drain. The company has a valuable consumer data set, a large active user base, and an experienced industry veteran tasked with capitalizing on it through advertising. That is indeed reason to be optimistic.

At the time of writing, PayPal shares trade at less than 14 times free cash flow – the cheapest valuation ever. This cheap valuation suggests many investors have given up on PayPal stock. Therefore, this could be a situation where earnings improve quickly and stocks start to rise before the majority of investors understand what is happening.

If PayPal succeeds with advertising, investors will regret not noticing this development sooner.

Should You Invest $1,000 in PayPal Now?

Before you buy shares in PayPal, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $677,040!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in PayPal and Uber Technologies. The Motley Fool recommends the following options: June 2024 short calls of $67.50 on PayPal. The Motley Fool has a disclosure policy.

Still down 80%, did PayPal management just make a big move that investors will regret if they didn’t notice it sooner? was originally published by The Motley Fool