Stock indexes rose Monday as Donald Trump’s media company rebounded after a Supreme Court ruling. The rally was helped by Nvidia (NVDA), who fought back while other Magnificent Seven names Tesla (TSLA) rose on AI news. And Tough (CHWY) tumbled on the stock market today after meme trader Roaring Kitty took a major stake in the pet food maker.

↑

X

Want triple-digit returns? Here’s how to find surprising stocks with big returns.

Indexes closed mostly higher as the second half of 2024 got underway. The Dow Jones Industrial Average closed the session up nearly 51 points, or 0.1%.

The Nasdaq technology index rose 0.8%. MongoDB (MDB) fared well here, rising 5.4%. However, the maker of database software remains stuck below its 200-day and 50-day moving averages.

Meanwhile, the S&P 500 rose 0.3% Constellation energy (CEG) helped the index gain 2.4%. But cruise stocks were watered down, with Carnival (CCL) and Norwegian Cruise Line (NCLH) each fell more than 5%, falling as Category 4 Hurricane Beryl made landfall in Grenada, a popular Caribbean cruise destination.

A slight majority of S&P 500 sectors ended the session lower. Technology, which lagged early, and consumer discretionary were the strongest sectors, while materials and industrials were the worst performers in the stock market today.

Small caps struggled, with the Russell 2000 down 0.9%. The Innovator IBD 50 (FFTY) exchange traded fund squeezed out a small gain after rallying from negative territory.

Treasury yields played a role in small caps having a tough session. The 10-year Treasury note rose 14 basis points to 4.47% while the two-year rose 5 basis points to 4.77%.

Magnificent 7: Nvidia Fights Back; Elon Musk Lets AI Brag

The so-called Magnificent Seven were mostly higher on Monday. Nvidia shares turned higher, gaining 0.6% and emerging from the red amid a price target hike at Morgan Stanley. Analyst Joseph Moore maintained an overweight rating and raised his price target to 144 from 116.

It was outpaced today by Tesla shares, which rose more than 6%, retracing its 200-day moving average for the first time since January 10.

Tesla soared after Wells Fargo added the stock to its “tactical ideas” list, while maintaining an underweight rating on the stock. Wells Fargo sees “decelerating supply growth driven by lower demand and diminishing returns on price cuts.”

The increase also came after Tesla Chief Executive Elon Musk took to his social media platform X to boast about the potential of future artificial intelligence models. He made the comments as he apologized for the “delay” in the release of the company’s latest Full Self-Driving Capability Supervised version, which has now been rolled out to employees. Musk partly blamed “too much training in interventions and not enough in normal driving” for the slower rollout.

“Our next-generation AI model after this has a lot of promise: ~5X increase in parameter count, which is very hard to achieve without upgrading the vehicle inference computer,” he said. Musk said separately that “higher parameter count” shows how well the AI model understands nuances of reality.

Meanwhile, Tesla stock investors should also be on the lookout for the company’s second-quarter global vehicle delivery figures. The data is expected on Tuesday

Apple (AAPL) rose nearly 3% despite UBS reiterating a neutral rating on the stock, citing the iPhone’s declining market share in China. The stock has extended beyond a 5% buy range from a cup-base ideal buy point of 199.62.

Including Magnificent Seven players, Amazon.nl (AMZN) rose 2% and Microsoft (MSFT) rose 2.2%. Google parent company Alphabet (GOOGL) closed the day up 0.5% while Meta platforms (META) rose slightly on the stock market today.

Updated 12:22pm ET

Donald Trump Stocks Rise After Supreme Court Ruling

Trump Media & Technology (DJT) stocks rose after the Supreme Court ruled that former presidents are entitled to absolute immunity from prosecution for official acts performed in office. However, it also ruled that presidents do not have immunity for unofficial acts.

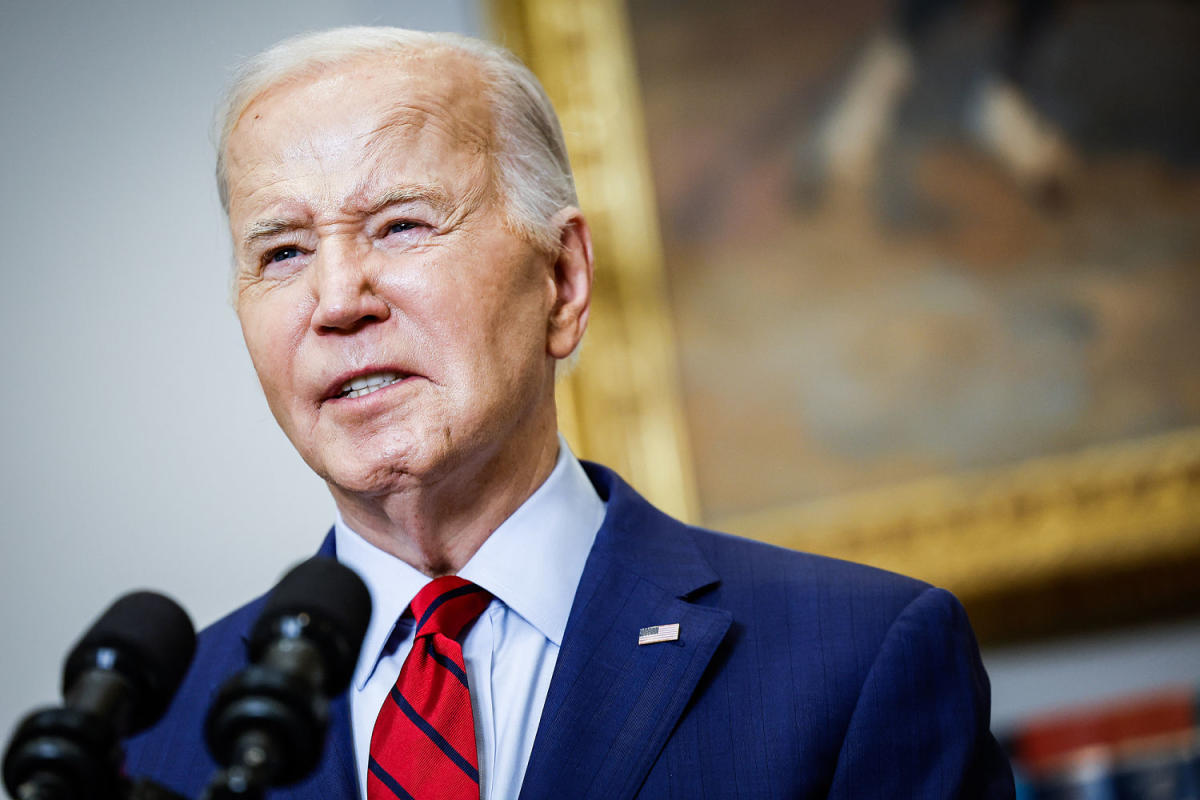

The ruling means it is unlikely that the federal election interference case against Donald Trump will be heard before the November election, when he looks set to face President Joe Biden.

The Supreme Court ruled 6-3, with the split along ideological lines. Chief Justice John Roberts wrote that a president “may not be prosecuted for exercising his core constitutional powers, and that he is entitled to, at a minimum, a presumptive immunity from prosecution for all of his official acts.”

Justice Sonia Sotomayor wrote in her dissent that the decision “parodies the principle” that “no one is above the law.”

Trump himself called the decision on his social media platform Truth Social, which is owned by Trump Media & Technology, a “great victory for our Constitution.”

The outcome sends the federal election interference case back to U.S. District Court for the District of Columbia Judge Tanya Chutkan, who will decide the timing of the trial and which charges, if any, should be dismissed.

Trump Media shares rose nearly 3% today in the stock market. It is supported by its 200-day moving average but remains below its 50-day line. It is down just under 58% from its March high of 79.38.

Updated 12:01pm ET

Stock Market Today: These Stocks Are Test Entry

A number of stocks tested their entry into the stock market today, although their breakout attempts failed.

Energy transport game Kinetics (KNTK) tested a flat base entry of 41.77, according to analysis from MarketSurge.

This is a first-stage base, meaning there is a greater chance of good profits. Overall performance is solid, with an IBD Composite Rating of 92 out of 99. The company, which operates in the Permian Basin, has segments including midstream logistics and pipelines.

Fellow energy stocks MPLX (MPLX) fell after testing a flat buy point of 42.90.

The stock is a strong performer overall, with good earnings performance. This is reflected in the EPS rating of 93 out of 99. However, funds only own 28% of MPLX shares, which is not ideal.

S&P 500 component Waste management (WM) also saw early gains disappear after initially breaking above a 214.58 entry. It previously recovered after hitting consolidation lows. The relative strength line is also gaining strength after a dip.

Roaring Kitty jumps up, Chewy falls 34%

Chewy shares initially rose before being pummeled by hungry bears in the stock market. Pet goods activity initially surged after news broke that meme stock trader Keith Gill, known on social media as Roaring Kitty, had acquired a large stake in the retailer.

However, it seems that the bulls were not eager to protect the stock as the initial gains disappeared. It has fallen almost 6% and has undermined the 10-day moving average. It is down more than 34% from last week’s peak of 39.10.

Gill owned 9,001,000 shares of the company’s stock, according to a June 24 SEC filing. That represents a 6.6% stake in the company. The holdings are worth $245.18 million based on Friday’s closing price of 27.24. The stock was down 6% as of midday.

The investor previously gave his followers a hint about his latest move by posting a photo of a cartoon dog on X on June 27.

Among the meme stocks, GameStop (GME) fell nearly 7% while AMC Entertainment (AMC) was flat.

Updated 10:37 a.m. ET

Stock Market Today: Boeing Closes Spirit AeroSystems Deal

The big news among Dow Jones stocks was the airline giant Boeing (BA) has finally closed a deal for Spirit AeroSystems (SPR).

Boeing has agreed to buy supplier Spirit in a $4.7 billion all-stock deal as the company seeks to tighten scrutiny of its supply chain amid recent safety lapses.

It comes amid reports that the Justice Department has told Boeing it will be sued for fraud, accusing it of violating a 2021 settlement reached after the deadly 737 Max crashes in 2018-2019

Under a proposed plea agreement, Boeing would be fined and have an independent oversight body for Boeing’s safety and compliance practices. The Virginia-based company has until the end of the week to respond.

Boeing shares rose more than 2% on the stock market today, while Spirit AeroSystems shares rose more than 3%.

In the meantime, Merck (MRK) was the best performer on the Dow Jones today, as it rose almost 4%, while Caterpillar (CAT) lagged, falling more than 2%.

Follow Michael Larkin on X, formerly known as Twitter, at @IBD_MLarkin for more growth stock analysis.

YOU MAY ALSO LIKE:

These 7 stocks’ earnings growth will be greater than Nvidia’s this quarter

Stock Market Forecast: AI Investing and Four More Predictions

These are the five best stocks to buy and watch now

Join IBD Live every morning for pre-open stock tips

This is the ultimate Warren Buffett stock, but should you buy it?