(Bloomberg) — Asian stocks fell by the most since the Aug. 5 crash, following a selloff among U.S. rivals sparked by a nosedive by Nvidia Corp.

Most read from Bloomberg

Shares of Asian chipmakers tumbled on renewed concerns about the artificial intelligence frenzy, sending a regional stock benchmark down more than 2%. Chip giants Taiwan Semiconductor Manufacturing Co. and SK Hynix Inc. each fell at least 4%. U.S. futures also fell in Asian trading after the S&P 500 lost more than 2%.

The broad risk-off mood came as a closely watched U.S. manufacturing gauge again missed forecasts, shifting investors’ focus to the likelihood of a slowdown in the world’s largest economy. That added to already weak sentiment in Asia, where a string of disappointing Chinese data had hurt risky assets.

“The magnitude of that August 5 move probably burned more than a few people and it’s hard to get past those memories, especially as the hard landing versus soft landing confusion still hasn’t been resolved,” said Charu Chanana, head of FX strategy at Saxo Markets in Singapore. “I would be cautious here,” as soft data will fuel recession concerns while positive data will ease expectations of rate cuts, she added.

Treasury yields stabilized after a dip on Tuesday. A dollar gauge snapped a five-day winning streak, the longest since April. The yen rose slightly. Oil fell after a nearly 5% drop on Tuesday amid weak demand and concerns about oversupply.

Elsewhere in Asia, the Australian dollar suffered losses as data showed Australian economic weakness continued in the three months to June.

Chinese stocks fell after a private survey showed the services sector grew less than expected, in the latest sign of the economy’s fragility.

The S&P 500 and Nasdaq 100 saw their worst starts to September since 2015 and 2002, respectively. With inflation expectations now anchored, attention has shifted to the health of the economy, as signs of weakness could accelerate policy easing. While rate cuts are typically good news for stocks, that’s not usually the case when the Fed is rushing to prevent a recession.

Wall Street’s “fear meter,” the VIX, soared.

“The sharp sell-off on Wall Street was a stark reminder that September has a bad track record of shaky risk appetite,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank in Singapore, adding that the situation could be exacerbated by recession risks in the U.S. and the unwinding of the yen carry trade.

Traders expect the Federal Reserve to cut interest rates by more than two percentage points over the next 12 months, the largest non-recessionary drop since the 1980s.

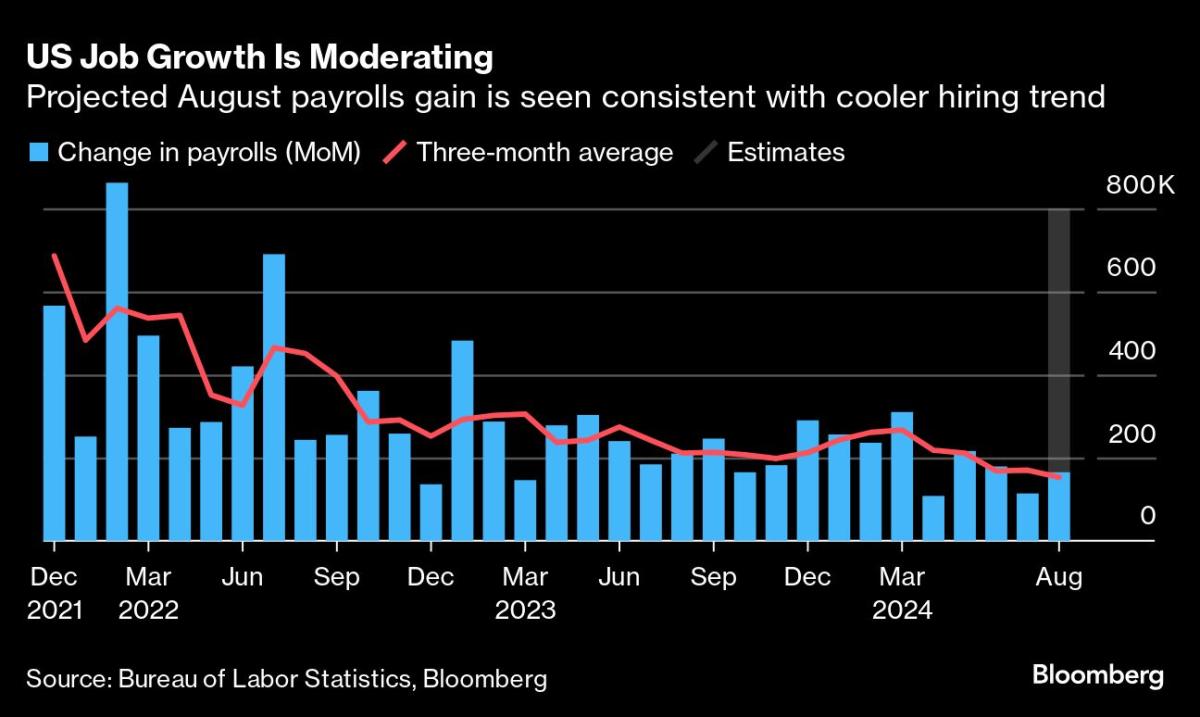

A report kicks off a busy week for economic data, showing that U.S. manufacturing activity shrank for a fifth month in August. The focus will be on the key U.S. jobs report due later this week. The data is expected to show payrolls in the world’s largest economy rose by about 165,000, based on the median estimate in a Bloomberg survey of economists.

“This week’s jobs report, while not the only determining factor, will likely be a major factor in the Fed’s decision between a 25- or 50-basis-point cut,” said Jason Pride and Michael Reynolds at Glenmede. “Even modest signals in this week’s jobs report could be a key deciding factor in whether the Fed takes a more cautious or aggressive approach.”

The S&P 500 fell to around 5,530, while the Nasdaq 100 lost more than 3%, while Nvidia fell 9.5% — wiping out $279 billion in a record one-day erasure for a U.S. stock. The U.S. Justice Department sent subpoenas to Nvidia and other companies, seeking evidence the chipmaker had violated antitrust laws.

Important events this week:

-

Eurozone HCOB Services PMI, PPI, Wednesday

-

Canada Tariff Decision, Wednesday

-

US Jobs, Factory Orders, Beige Book, Wednesday

-

Eurozone retail sales, Thursday

-

US Initial Jobless Claims, ADP Employment, ISM Services Index, Thursday

-

Eurozone GDP, Friday

-

US Non-Farm Payrolls, Friday

-

Fed’s John Williams to speak Friday

Some of the major moves in the markets:

Shares

-

S&P 500 futures were down 0.4% at 11:12 a.m. Tokyo time

-

Japan’s Topix fell 3%

-

Australia’s S&P/ASX 200 fell 1.8%

-

Hong Kong’s Hang Seng fell 1.7%

-

The Shanghai Composite fell 0.7%

-

Euro Stoxx 50 futures fell 0.9%

-

Nasdaq 100 futures fell 0.6%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro remained virtually unchanged at $1.1053

-

The Japanese yen rose 0.1% to 145.27 per dollar

-

The offshore yuan rose 0.1% to 7.1134 per dollar

-

The Australian dollar fell 0.2% to $0.6698

Cryptocurrency

-

Bitcoin fell 2.7% to $56,669.73

-

Ether fell 4% to $2,365.42

Bonds

-

The yield on 10-year government bonds remained virtually unchanged at 3.83%

-

Japan’s 10-year yield fell 3.5 basis points to 0.885%

-

The Australian 10-year yield fell six basis points to 3.94%

Raw materials

This story was produced with the help of Bloomberg Automation.

–With assistance from Rob Verdonck and Joanna Ossinger.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP