Stock splits are quite common among companies associated with artificial intelligence (AI). This is because they have performed so well over the past year and a half that their stock prices have reached a level where a split is a good idea.

One company that recently joined this club is Supermicrocomputer (NASDAQ: SMCI)better known as Supermicro. It announced a 10-for-1 stock split effective Oct. 1, taking its stock price from about $630 to $63 per share.

While the stock split is exciting news, I think there’s an even better reason to buy the stock now, before the split happens.

There is a huge demand for the data center products

While Nvidia may be making headlines because of the AI infrastructure being built, but many more companies are benefiting from the same tailwind. Supermicro is one of them, as its products, ranging from data center hardware to complete racks, are in high demand.

While many companies offer similar products to Supermicro, they stand out from the competition for two reasons. First, Supermicro servers are highly configurable and can be scaled to any size workload. Second, Supermicro servers are more energy efficient than the competition, which is an important consideration because the cost of energy input is significant over the life of the server.

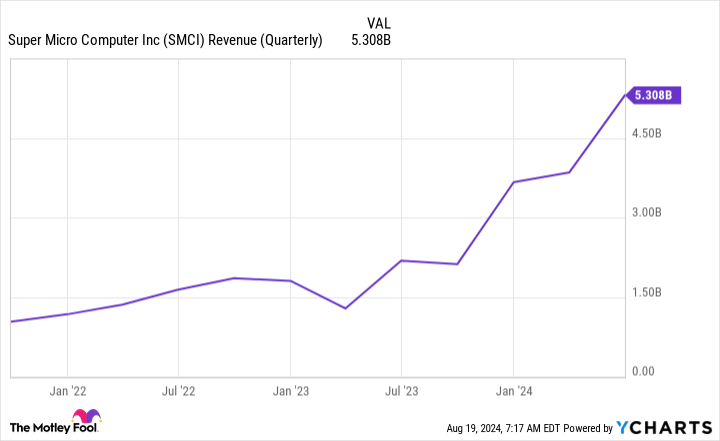

These benefits have led to Supermicro’s revenues skyrocketing over the past year, and further growth is expected.

Looking ahead to the first quarter of fiscal 2025 (which ends Sept. 30), management expects $6 billion to $7 billion in revenue, ranging from 183% to 230% growth. For fiscal 2025, it expects $26 billion to $30 billion in revenue, which would be year-over-year growth of 74% to 101%.

That’s significant progress and a big reason to invest in the stock now. At the end of fiscal 2023, Supermicro had a long-term annual revenue target of $20 billion. And at the end of the second quarter of fiscal 2023, that target was just $10 billion.

It is clear that this market is growing rapidly and demand for Supermicro’s products is growing accordingly. However, this target has been raised again in the most recent results to a staggering $50 billion in annual revenue. That is a huge advantage over current projections and I think it is a phenomenal reason to own the stock, as Supermicro has consistently achieved its long-term goals.

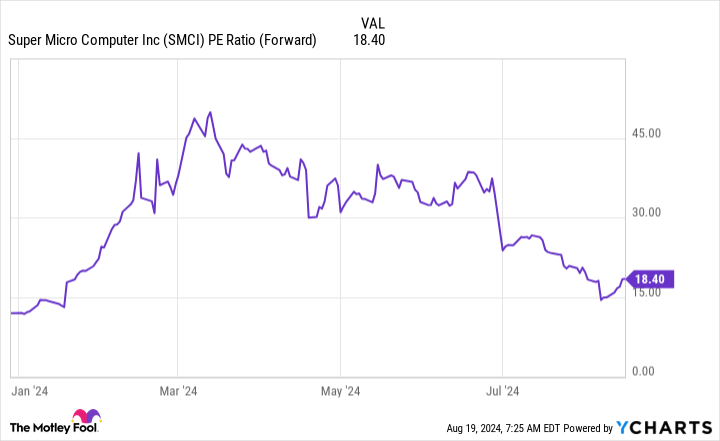

However, following the announcement of Q4 2024 earnings, the stock fell 20%. This seems like an odd reaction, but that’s because another key metric showed some weakness.

The stock is priced fairly cheaply compared to similar companies

While revenue growth is important and makes headlines, investors also need to see earnings growth. Supermicro’s margins declined in Q4 due to new product launches, and that weakness is expected to persist through most of fiscal 2025. However, this decline is short-sighted because if Supermicro can recover its margins by the end of fiscal 2025, it will represent a huge value opportunity.

The stock is currently trading at 18.4 times forward earnings. Compared to most stocks on the market, this figure is quite cheap. It also indicates 72% earnings growth for the coming year.

Supermicro management has already forecast revenue growth of 74%, which is on the low side, so earnings would have to remain this low all year to justify the current valuation.

This discrepancy presents a good buying opportunity for the stock and a patient investor can expect a satisfying return on his investment if Supermicro’s margins recover over the coming year.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy Super Micro Computer stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $792,725!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Super Micro Computer Announced a Stock Split. But There’s an Even Better Reason to Buy Now. was originally published by The Motley Fool